Banking data

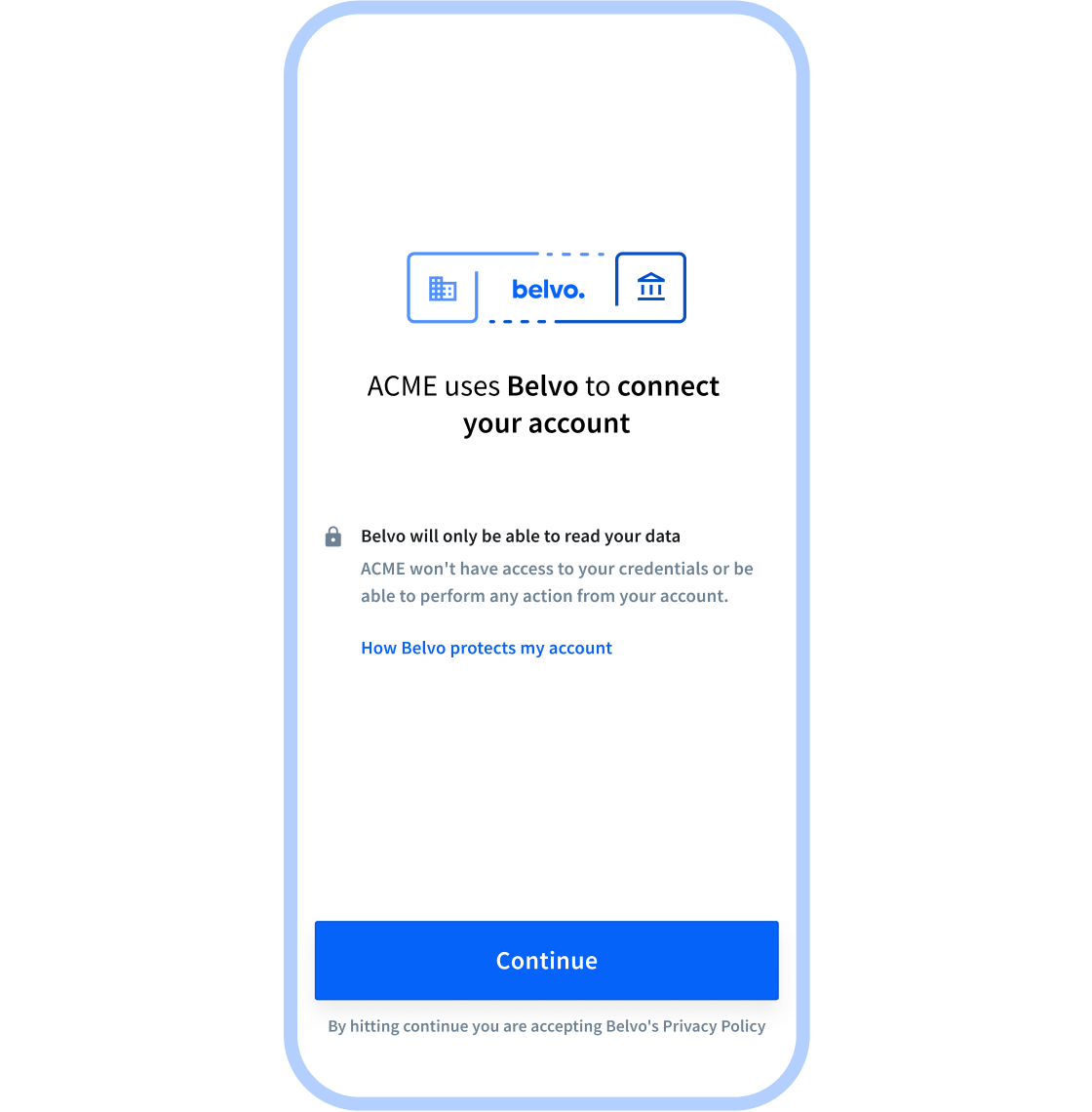

Safely connect to your customers’ banking data

Access real-time, up-to-date, and categorized banking data to get in-depth customer insights and build tailor-made financial solutions.

Trusted by the leading financial innovators

Access banking data to offer better financial services

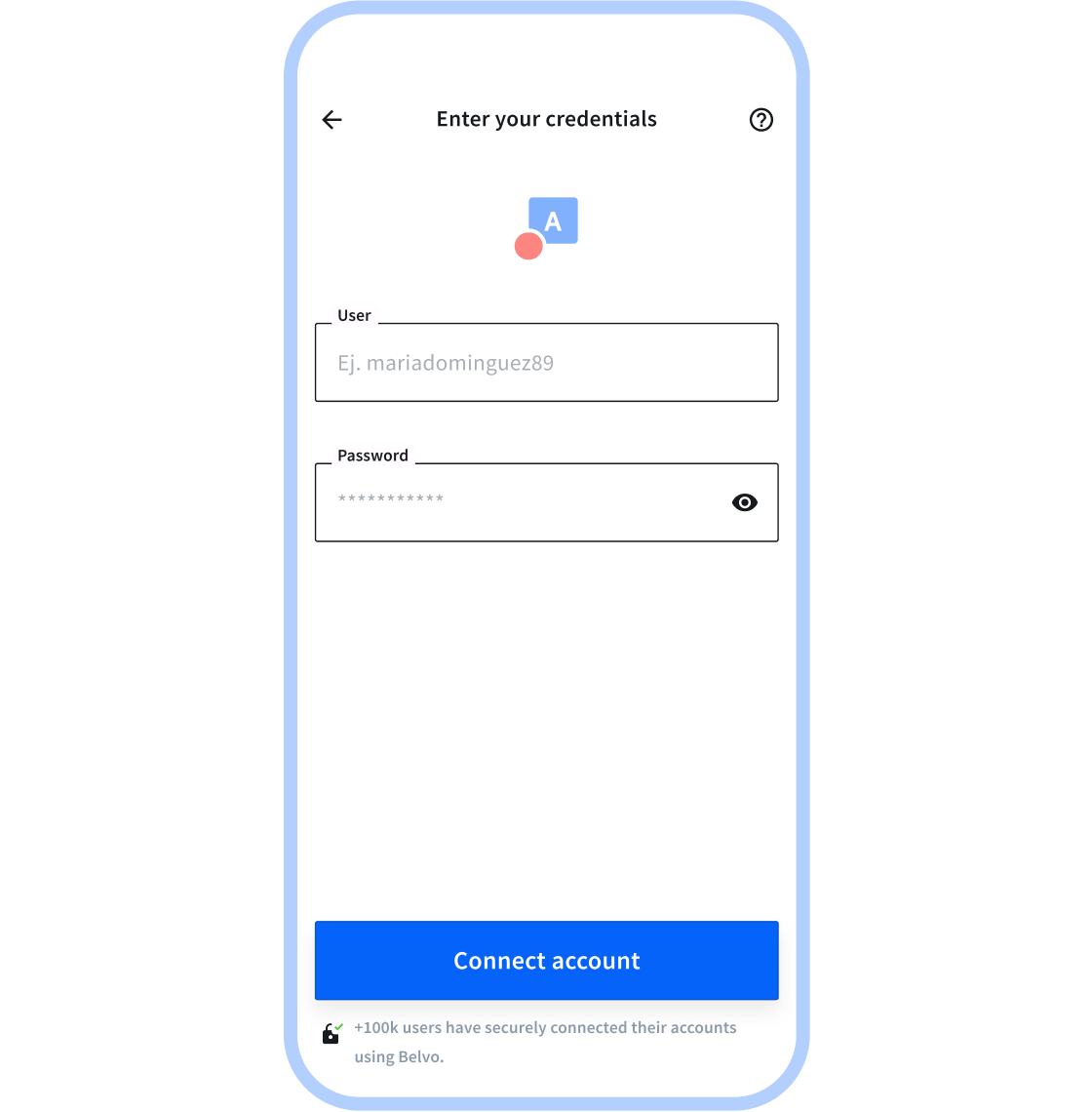

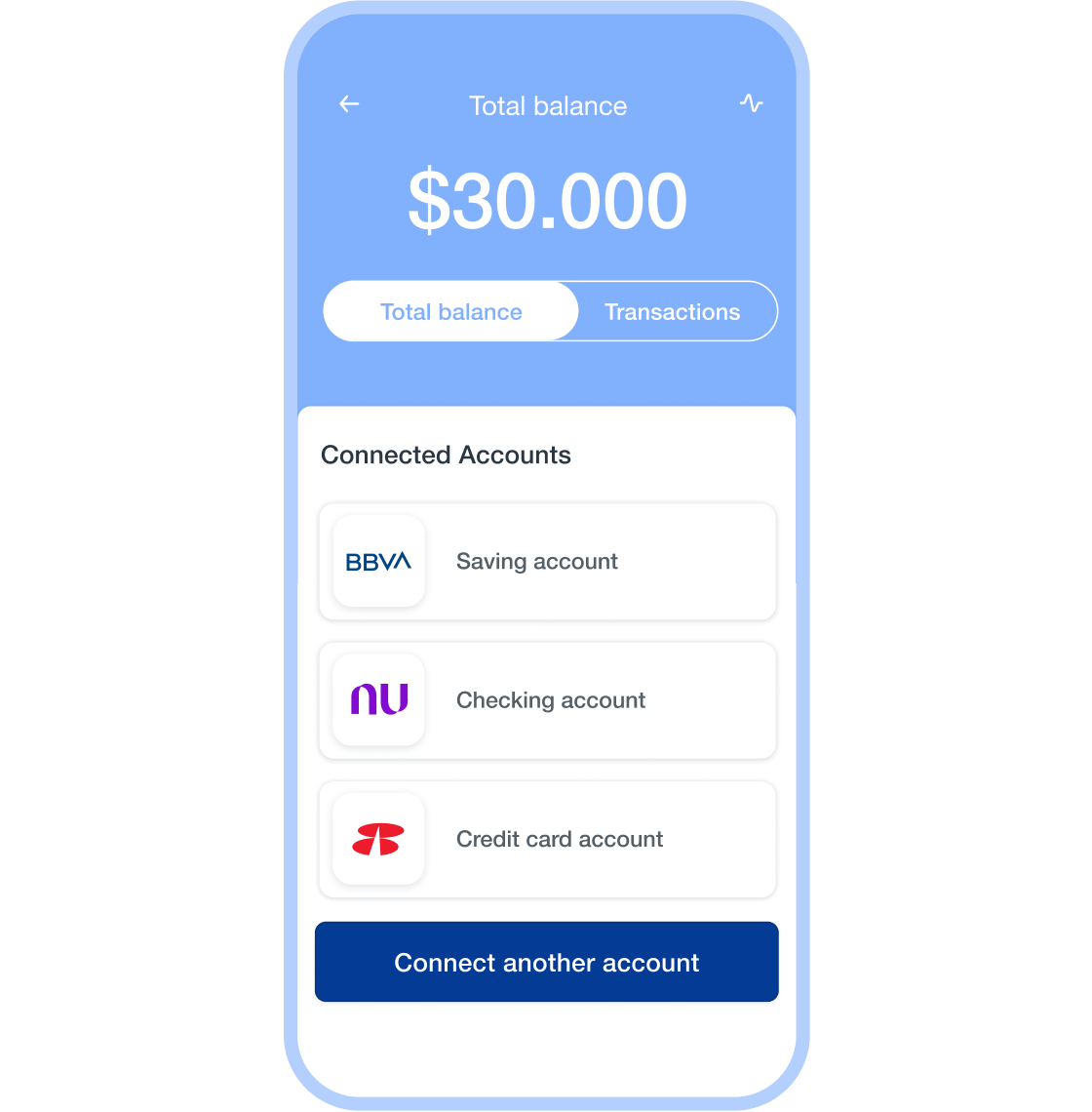

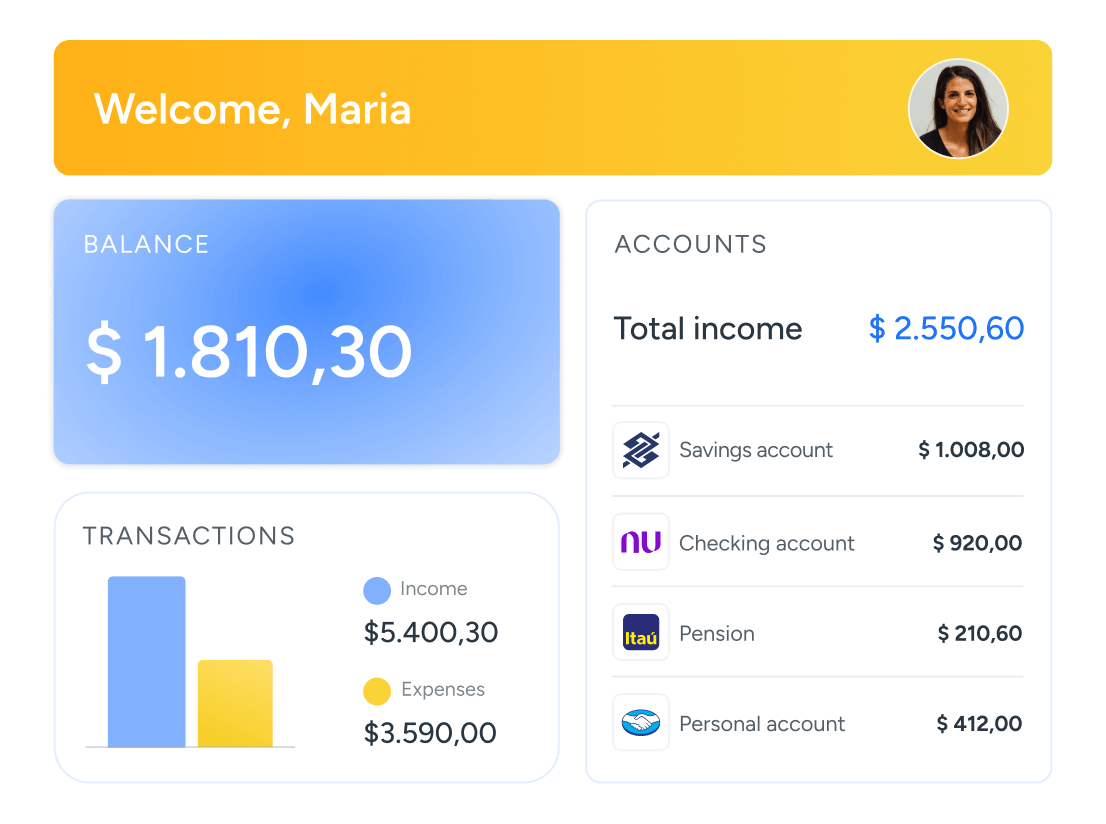

Connect all accounts in one place

Get an instant snapshot of all your customers’ banking information through a single platform and improve user experience.

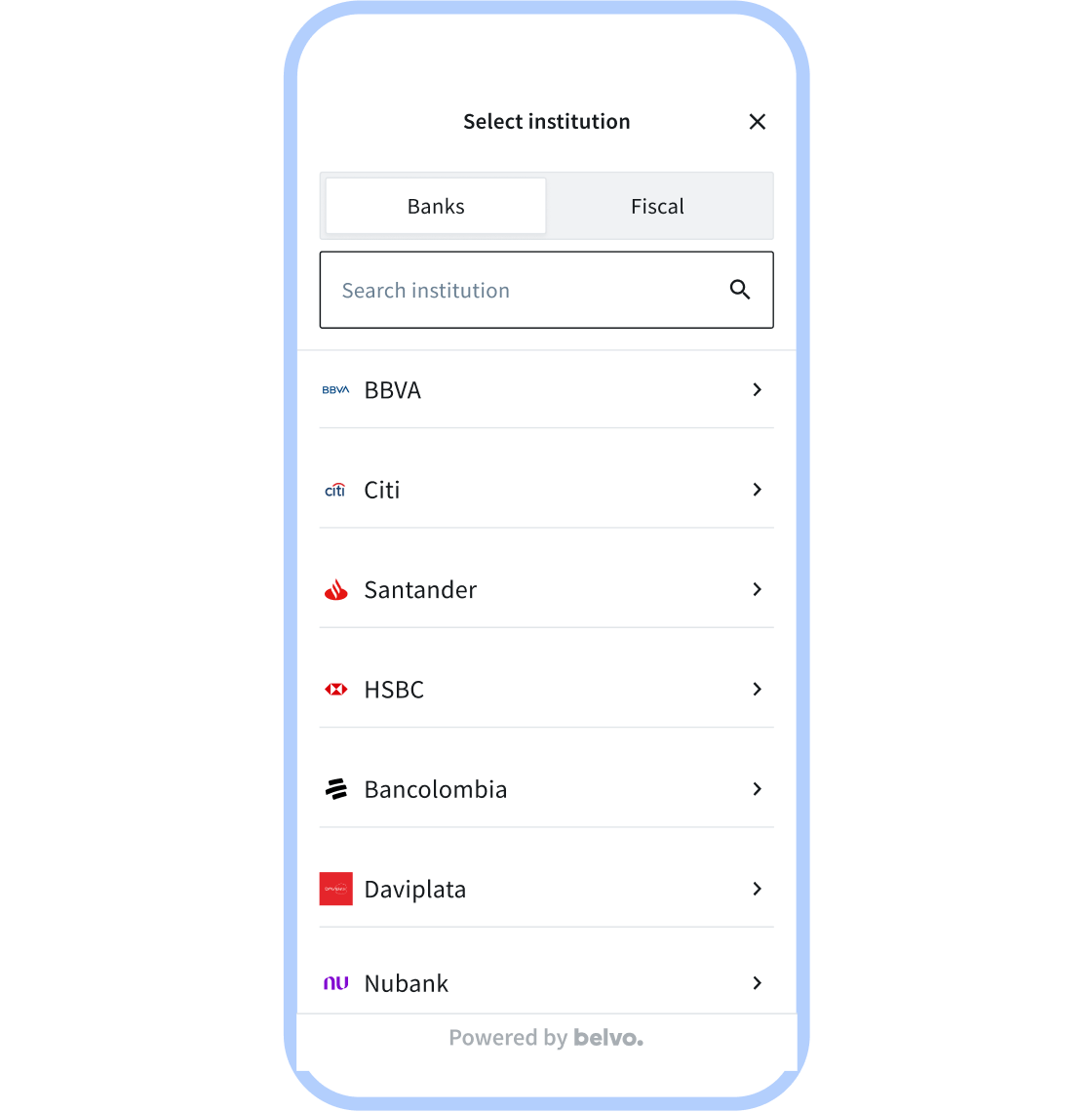

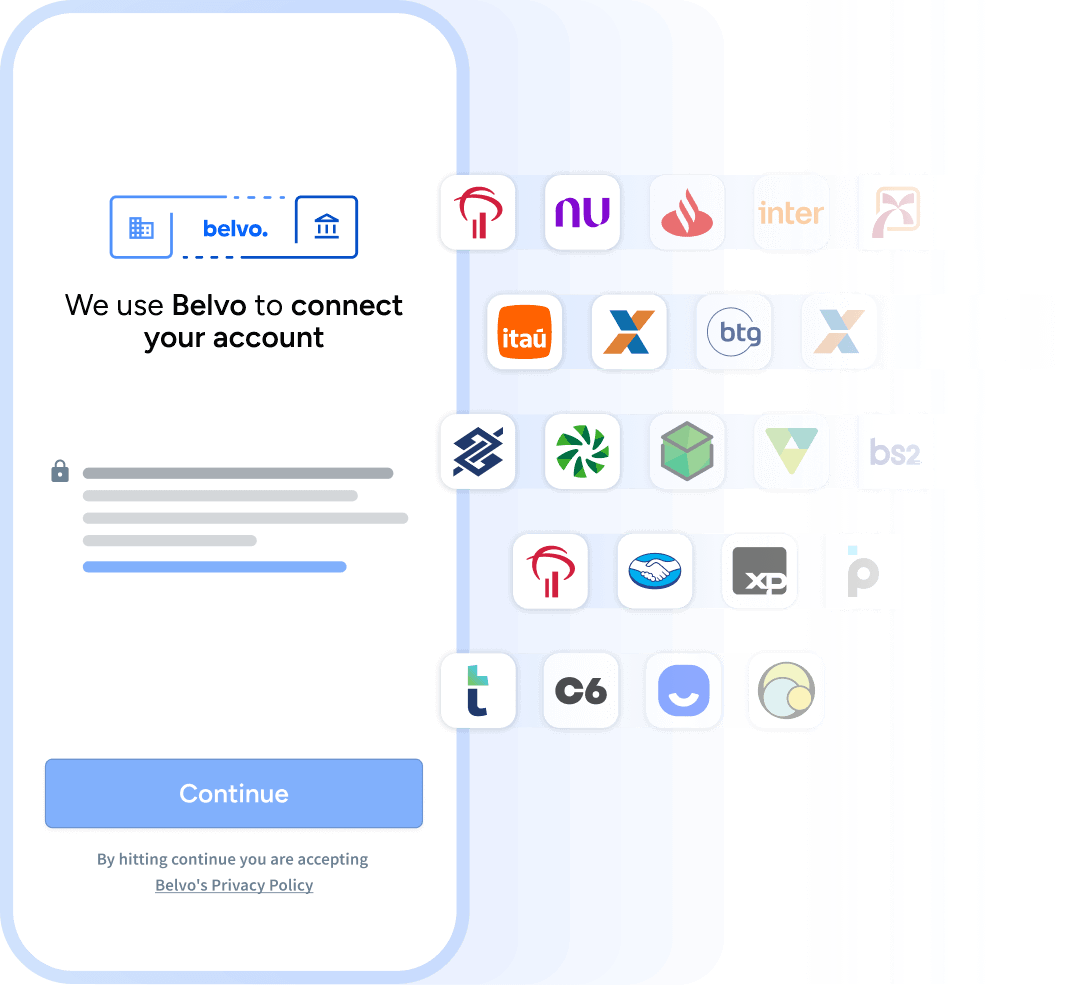

Scale your solution to other markets

Access more than 60 top retail and business banks in Latin America which represents more than 90% of market coverage.

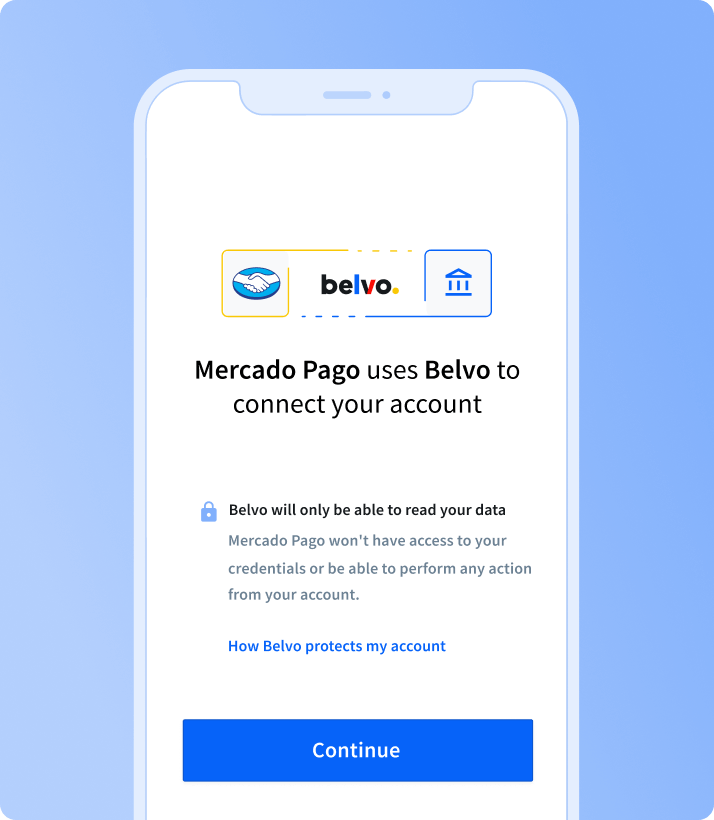

Data secure and private

Belvo is ISO 27001 certified and we use bank-grade security standards and comply with privacy, security, and regulatory best practices.

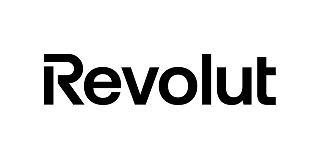

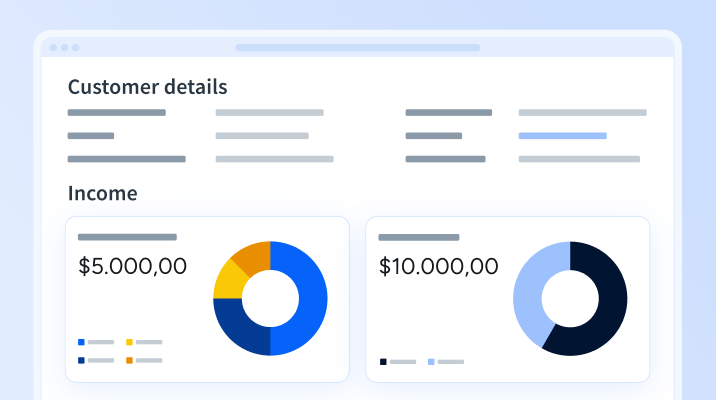

Build a 360° picture of your customer

Retrieve categorized and up-to-date financial data directly from its source to get behavioral financial insights about your customers.

Build better financial apps

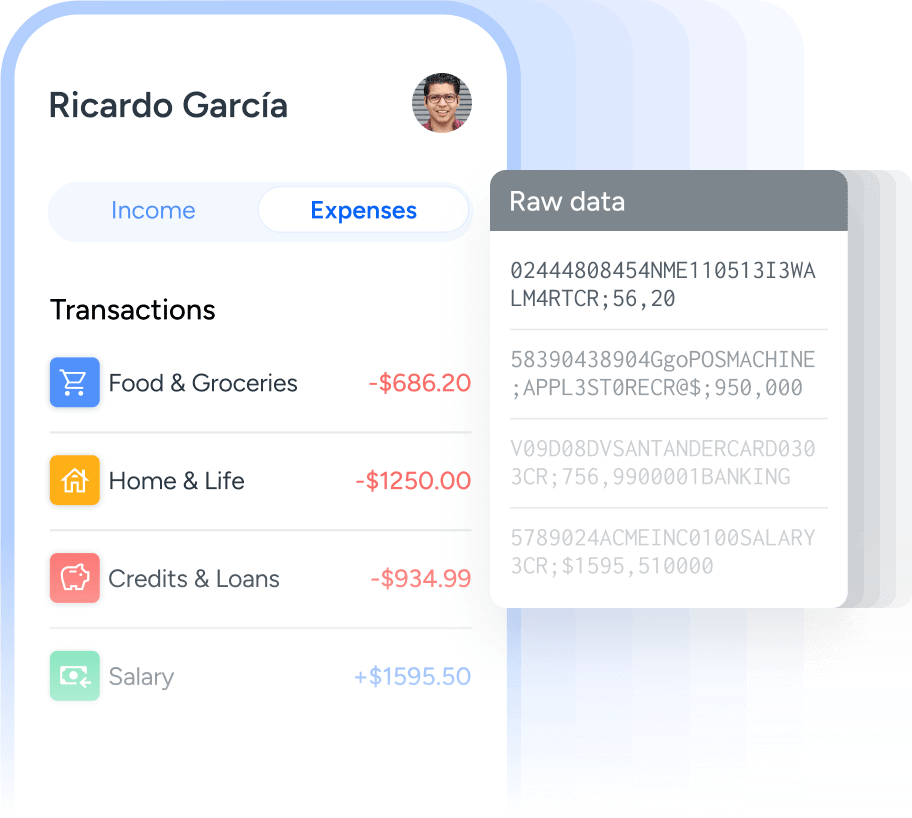

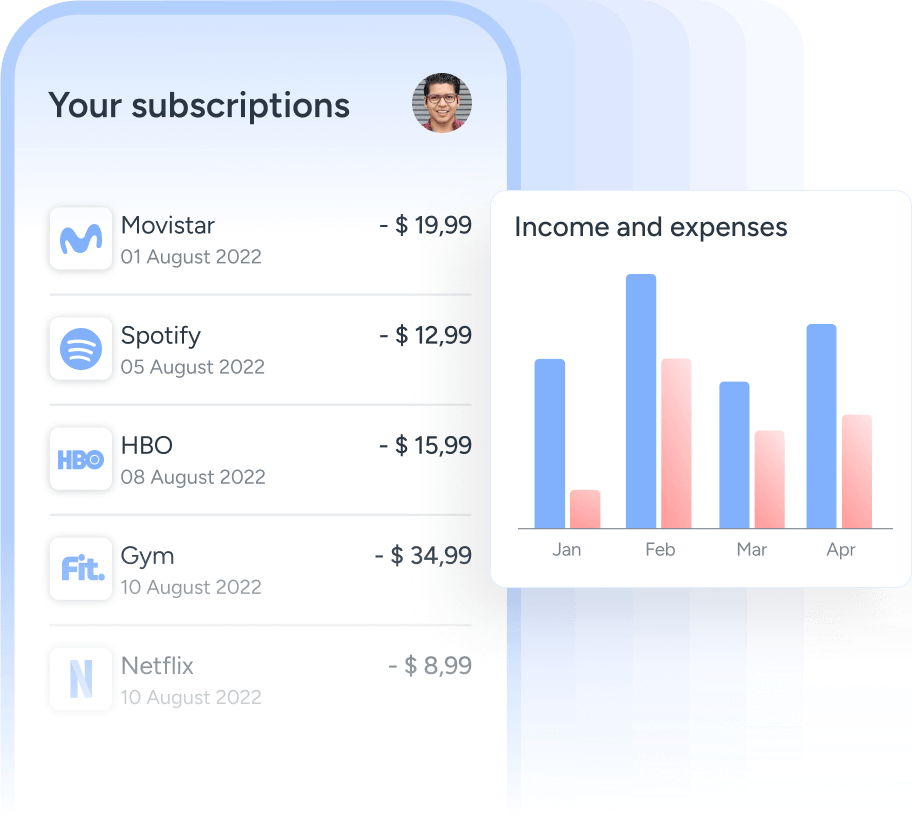

Boost your customers’ financial management

Access homogenized transactional data and insights about your users’ income and financial activities to build a 360° vision of their finances.

Correctly map customers’ spending categories, income, as well as their recurring expenses and subscriptions, to create personalized finance management tools and better guide them with their daily finances.

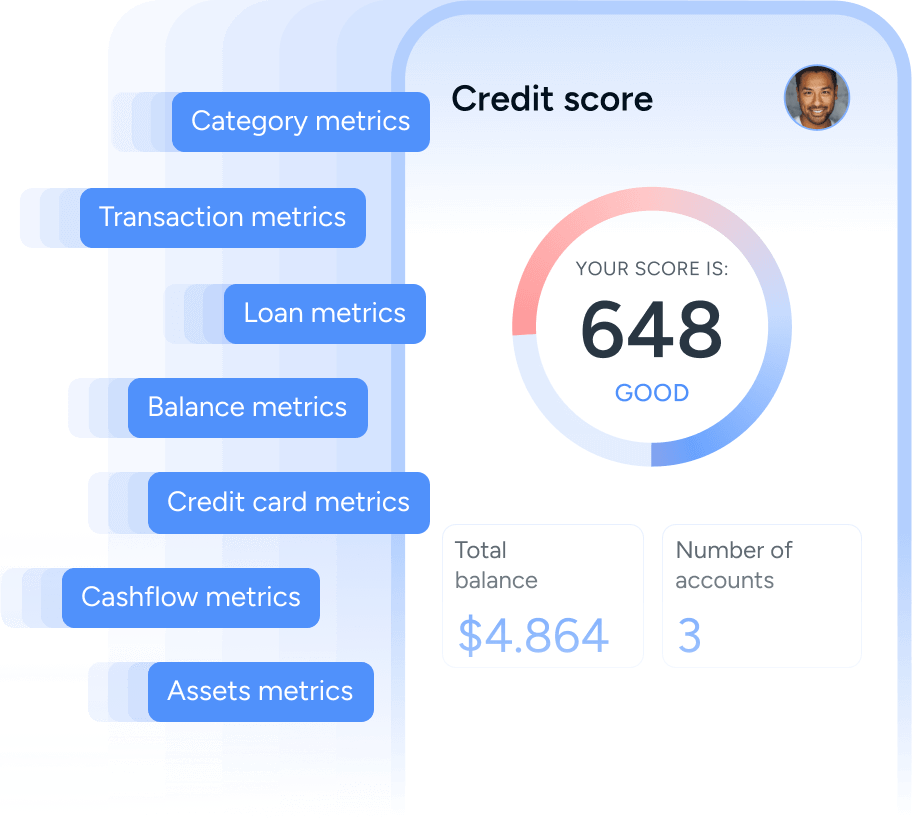

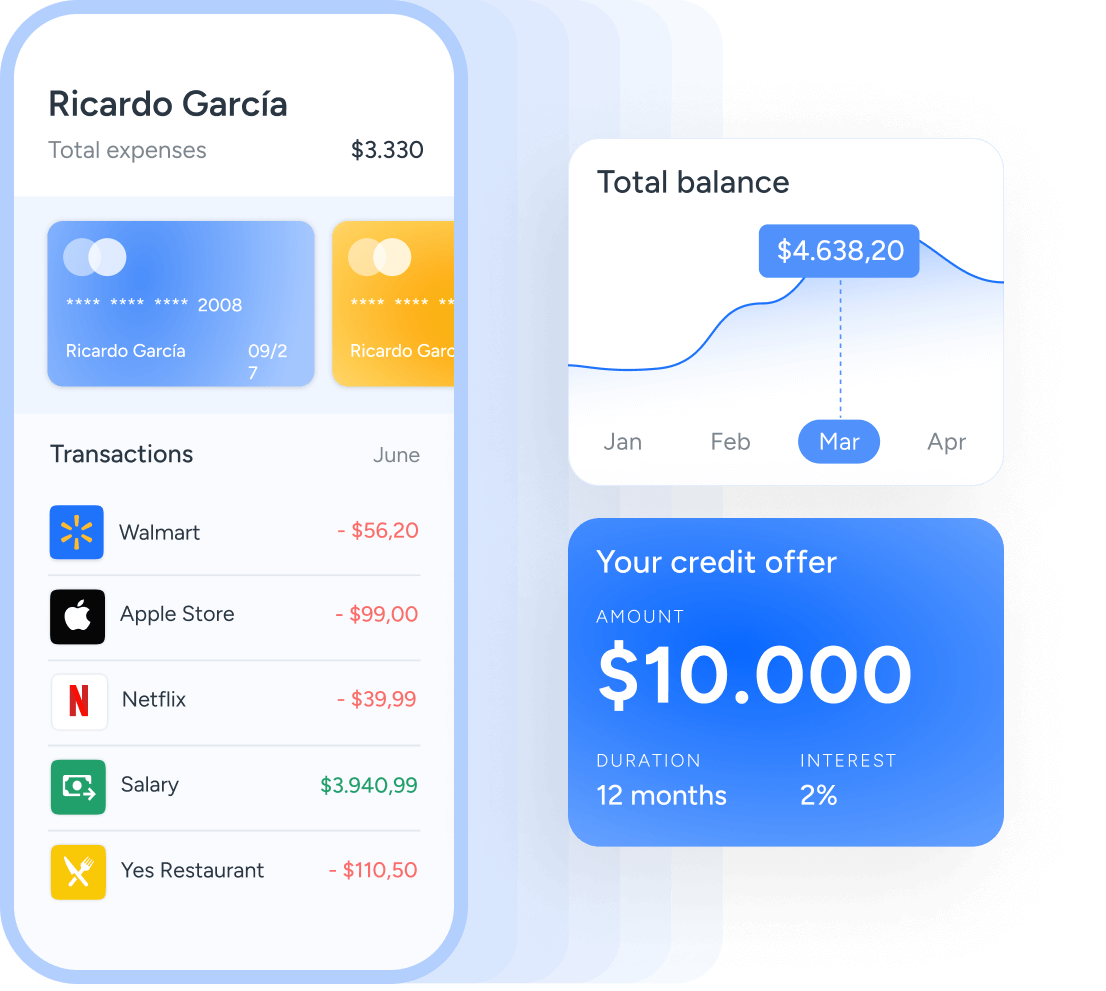

Optimize credit decisions and reduce risks

Thanks to banking data, you can easily determine your consumers’ consumption patterns and get a sharp picture of their financial behavior.

Better assess their affordability and offer them tailor-made repayment options. Decrease payment default risk while you increase loan acceptance rates.

Data aggregation

Access comprehensive and detailed banking data

Transactions

Access up to 24 months of standardized and categorized transactional data for personal and business bank accounts.

Accounts

Get users’ account information and complete details on business and personal financial products held within each bank.

Owners

Retrieve account holder critical information such as name, email, and phone numbers.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits