Penny Validation

Verify your users’ identity with penny validation

Validate your users' identity and bank account status. Reduce fraud, minimize chargebacks and increase the percentage of successful transactions.

Trusted by the leading financial innovators

More security and confidence for your company

Decreased fraud

Verify the existence and operability of the account, ensuring the destination account is correct and preventing fraudulent registrations.

Chargeback reduction

By guaranteeing the bank account is correct and the recipient is properly identified, it reduces errors and payment disputes.

Save time and costs

Streamline your internal processes and reduce transaction times with a fast, real-time system. Ensure the authenticity of your customers and deliver a frictionless experience.

Increased customer trust

Demonstrate your commitment to security, giving your customers peace of mind knowing their account has been validated before larger amounts are debited.

Tailored to your business needs

Payment processing

Avoid transaction errors by confirming the destination account is correct and active before processing any payment.

Onboarding and KYC

Verify bank details during registration, preventing errors or fraud and ensuring a safer process for businesses and users.

¿Cómo funciona?

The user enters the payment method.

$0.01 is deposited into the user’s account.

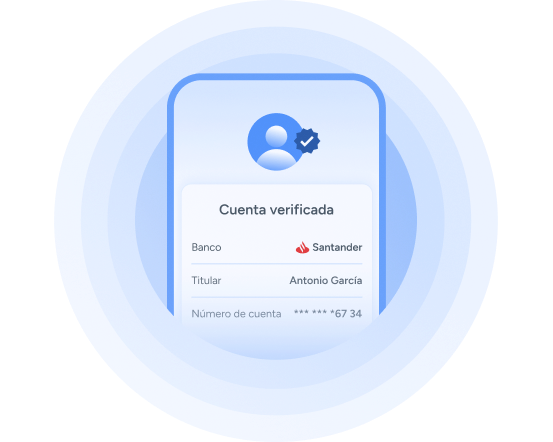

Belvo checks if the information matches the recipient's details.

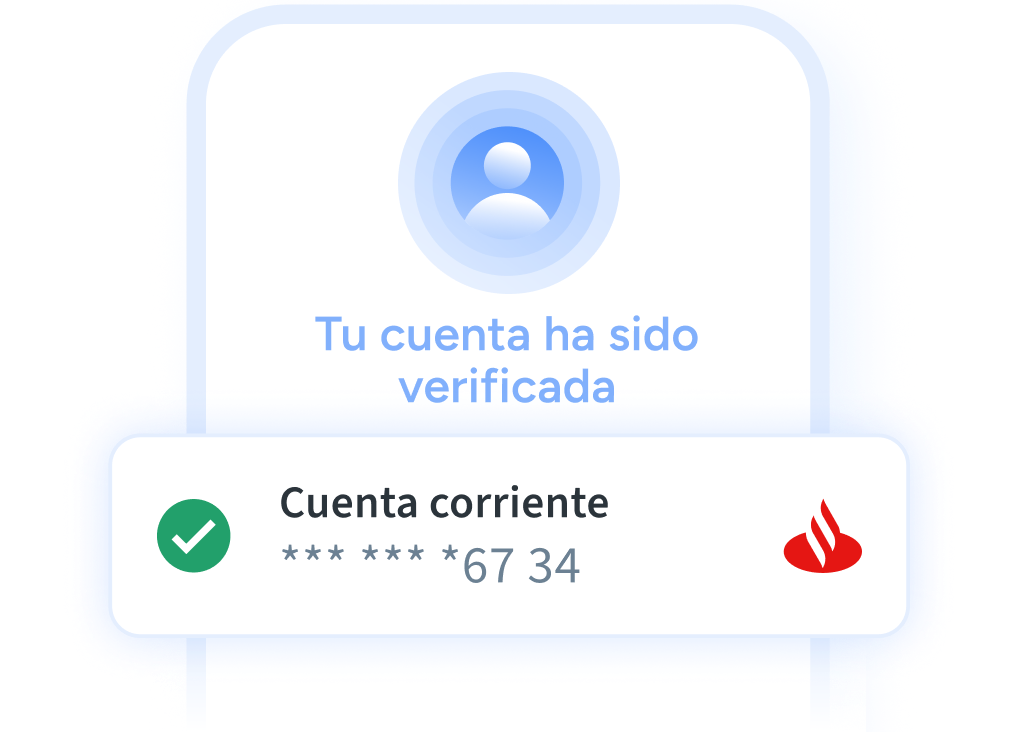

Done! Account verified.