Onboarding

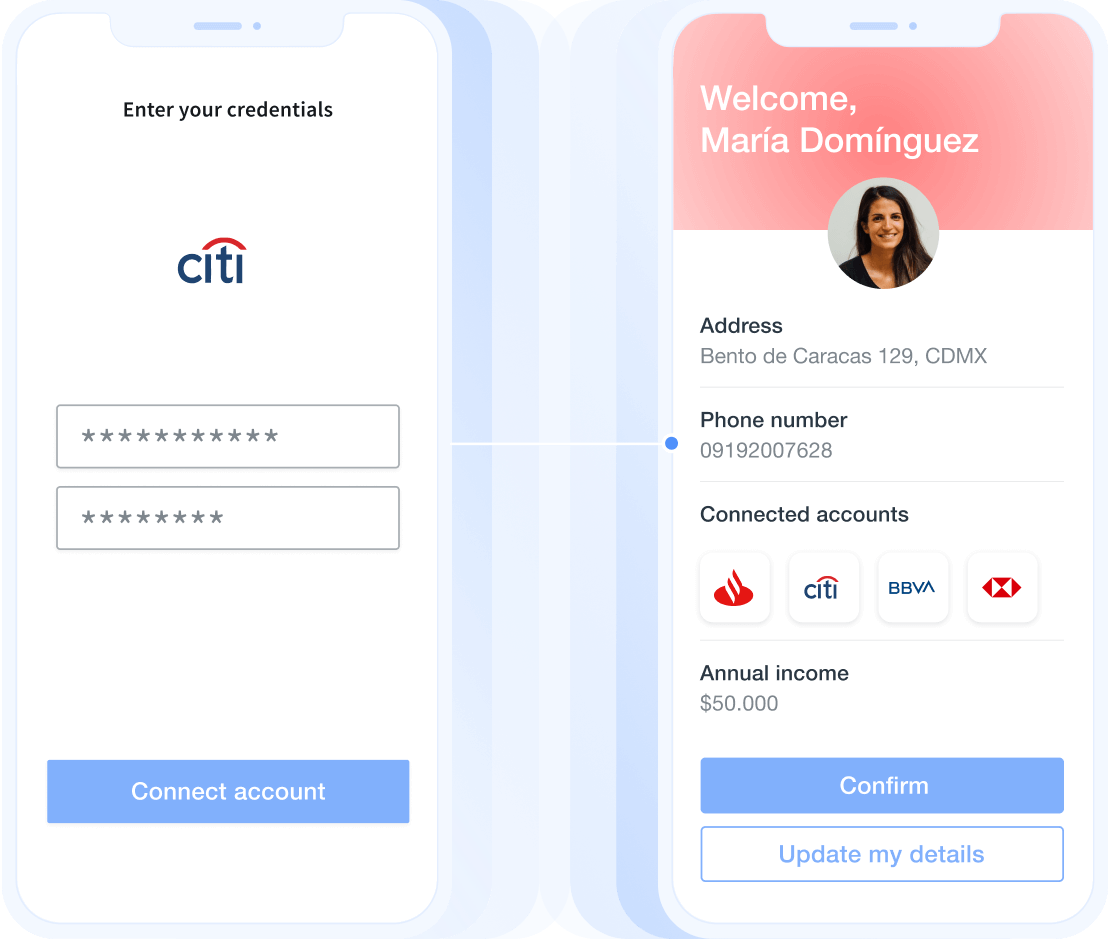

Speed up the onboarding experience with instant account verification

Connect your app with your users’ up-to-date financial data to instantly authenticate their identity. Reduce fraud risks, validate user balances and reduce failed payments.

Simplify verification flows with open finance

Instant account verification

Eliminate the need to wait for data validation by using verified information that comes directly from your users’ bank accounts.

Accurate payment information

Ensure that the payment details provided are valid. Reduce the likelihood of failed or rejected payments due to incorrect information or insufficient funds.

Enhanced security

Quickly and automatically identify account anomalies and block any suspicious activities and transactions to reduce fraud.

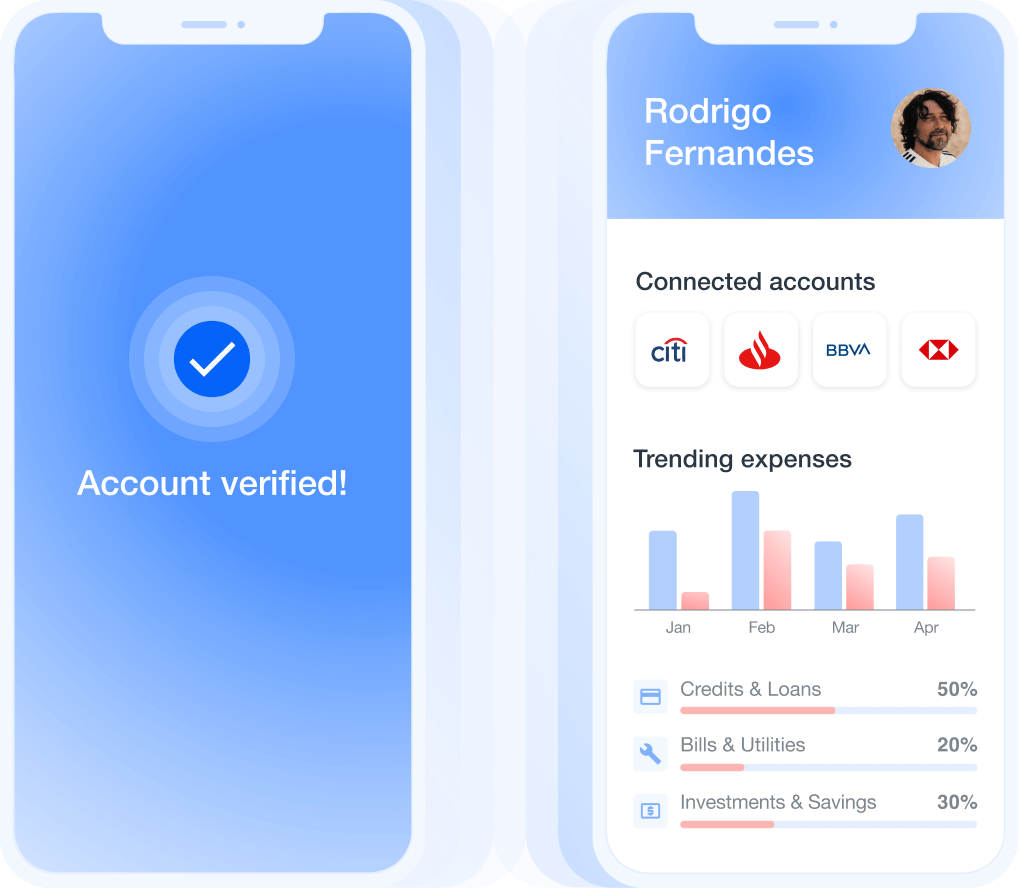

Frictionless KYC and account ownership verification

Improve KYC with identify verification

Complement KYC processes by verifying that users are who they claim to be. Verify users’ identities by cross-referencing KYC data previously gathered with the information retrieved from your users’ bank account such as national identifier and name.

Open finance for account ownership verification

Instantly confirm that the user is the account’s rightful owner by letting them connect one of their banking accounts. Remove micro-deposits or lengthy forms and offer a frictionless onboarding experience, free from human errors.

We can’t wait to hear

what you’re going

to build

Belvo does not grant loans or ask for deposits