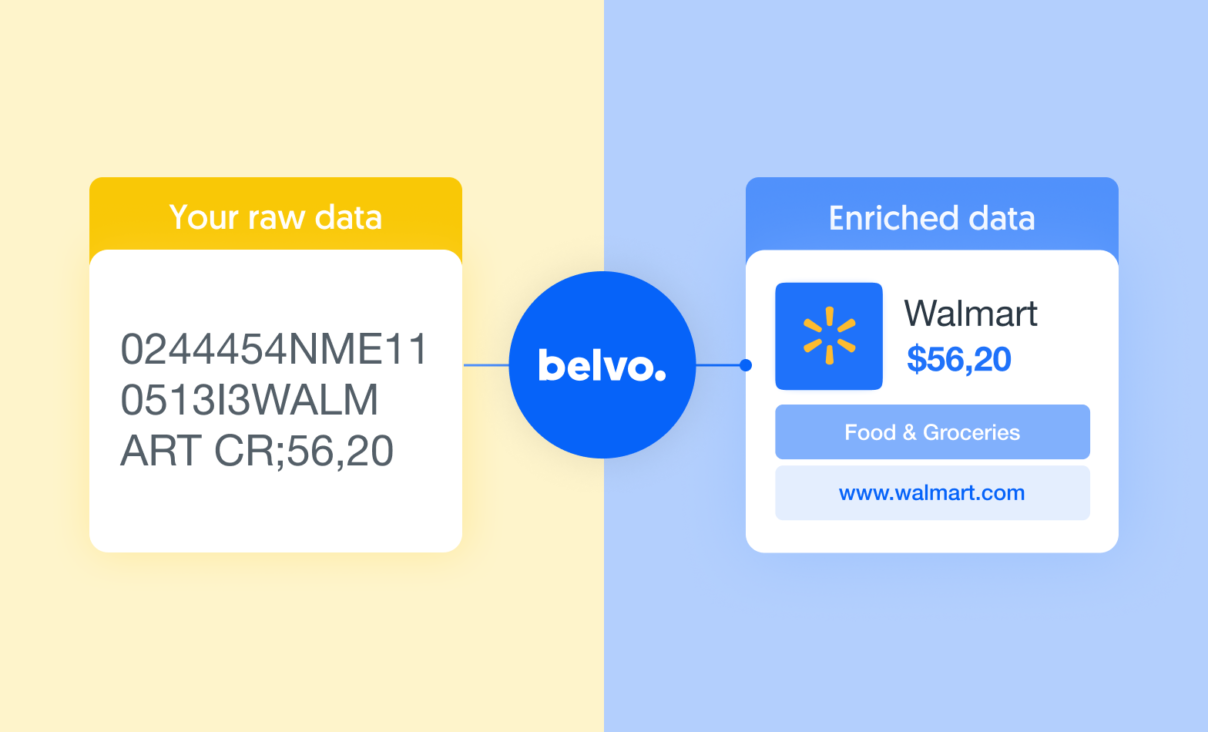

Financial innovators in Latin America can now automatically categorize their own transactional data at scale from any source using our enrichment engine, getting accurate results in just seconds.

Data scientists spend between 40% and 60% of their time turning messy and unstructured raw information into processable, clean, and categorized data that’s ready to use. This process is essential for financial innovators, like lenders or bankers, looking to better understand their customers’ behavior to make informed decisions and tailor services for them.

To make this process easier and faster we just introduced a new feature that allows companies to apply our powerful enrichment engine to their own data sets from any source, in order to obtain categorized transactions in seconds.

This means they can benefit from our enrichment capabilities not just for the data that we’re able to retrieve for them, but also for the core banking data or financial information these companies already gather from their users. No matter where their users’ financial data is, we’re able to properly categorize and enrich it with high accuracy.

What’s new

Our new categorization feature helps companies to streamline the process of labeling and cleaning data so they can focus on more value-added tasks, like analyzing and extracting insights, saving valuable time and resources.

We are the only solution in Latin America that currently categorizes transactional data at scale from any source using machine learning.

What can you expect from it:

- Input transactional data from any source into our platform and obtain detailed information on categories, merchant names, merchant logos, and URLs. Provide a more comprehensive understanding of your customer’s spending habits and financial well-being, no matter where their financial data is hosted.

- Automated categorization of large volumes of transactional data at scale, saving time and increasing efficiency. We can process up to 10K transactions in just 10 seconds.

- For Mexico and Colombia, we can categorize your internal core banking transaction data or any data set that you wish. In Brazil, we’re also able to categorize Open Finance data, retrieved from the Central Bank’s APIs.

- Powered by machine learning, our models achieve 85% accuracy when identifying the correct category for each transaction. They are trained with millions of data exchanges daily through Belvo-powered apps and by our data scientists team improving them every day.

How does it work?

To get started, you’ll need to prepare your transactional data by including the required fields as mentioned in the API documentation.

Once your data is ready, you can safely send your transactions to Belvo through our API and we’ll provide a response containing all the available enriched data for your transactions in a maximum of 10 seconds.

All financial data entering or leaving Belvo is always protected with up to three layers of encryption. Trust, safety, and security are core values of Belvo and our platform follows the highest security standards in the market for both data access and enrichment processes.

Our new categorization feature is already available and you can try it in our sandbox environment, check it out!