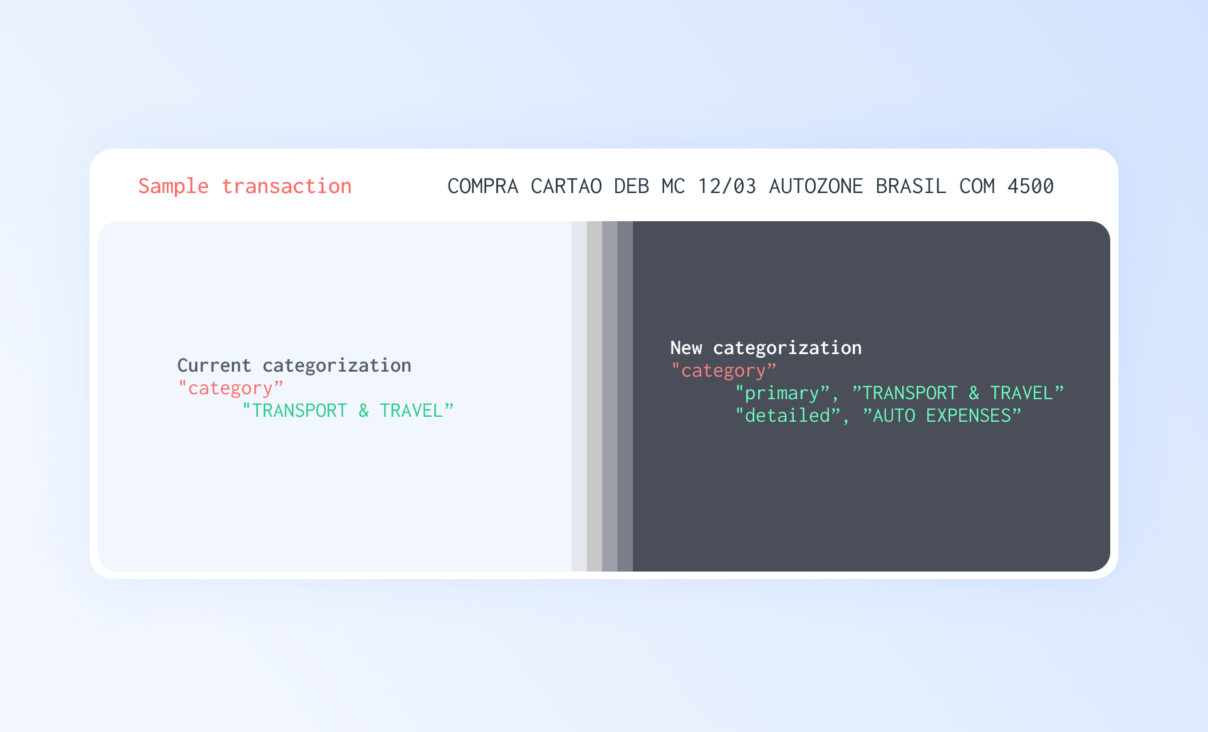

Our categorization engine now includes more categories and detailed subcategories to help lenders identify income, spending patterns and potentially risky financial behavior.

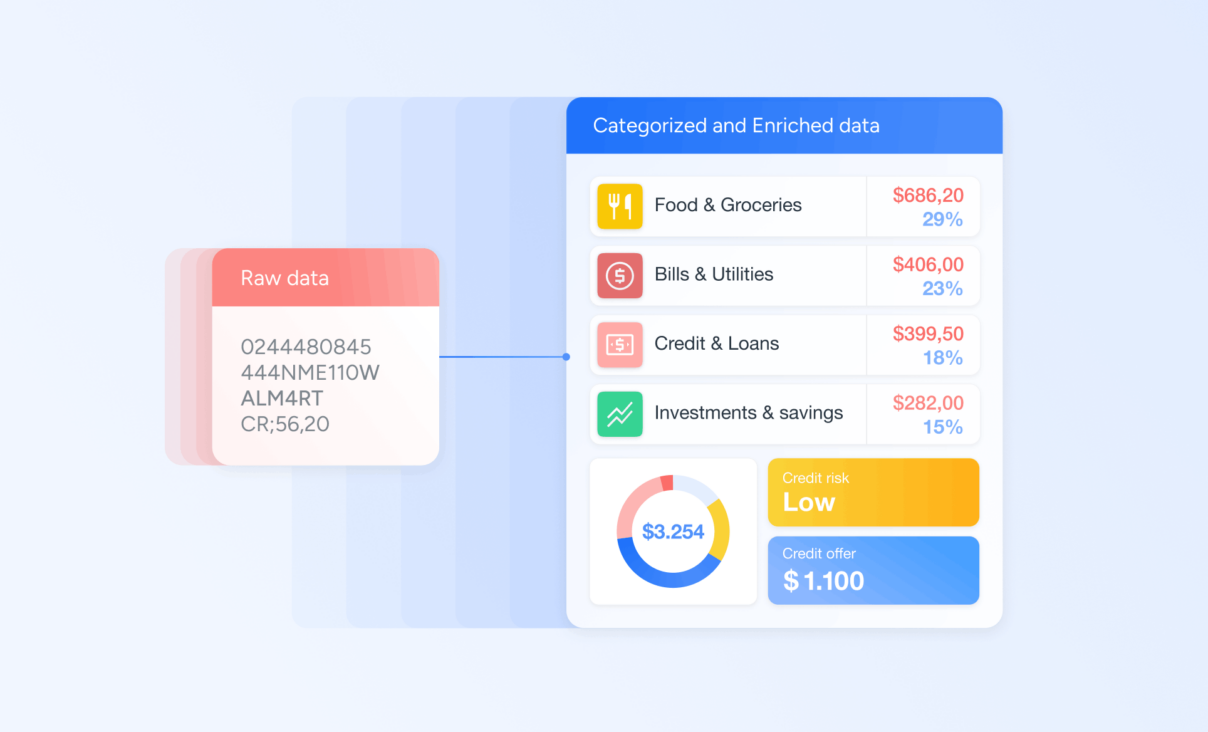

As financial technology advances, credit bureau data alone is insufficient to provide a complete overview of an individual’s financial well-being. In this context, open finance is key to expand visibility on users’ daily financial behavior thanks to access to transaction data.

This source of information includes data dismissed by credit bureaus –that focus solely on credit history–, such as recurring expenses, bills payments, and other day-to-day transactions. But processing and making sense of this new data and integrating it into current underwriting models is a challenge for lenders.

To address this, we have expanded our categorization engine and taxonomy powered by natural language processing, to encompass a wider range of credit and non-credit related data. By gaining more insights and clarity about users’ transactions, lenders can make better and more informed lending decisions.

What’s new

We now provide more categories and detailed sub-categories that help lenders to easily identify income, spending patterns of credit applicants and potential risky financial behavior (such as gambling) to create more effective credit risk models.

1. Tailored for credit and risk

Each category is carefully crafted to capture the unique nuances of the lending industry, providing lenders with the granularity they need to make data-driven decisions. We train our models to identify lending and repayment categories and potentially risky expenses. We currently support 15 main categories and 94 detailed sub-categories in Spanish and Portuguese.

2. Higher quality category predictions

A concise category list enables us to deliver a prediction for the category field with greater accuracy. Our models achieve 85% accuracy when identifying the correct category for each transaction and our engine properly recognizes and covers 90% of the transactions.

3. Enrich your own data

We can categorize and classify transaction data from any source. If you already have a data set, or currently access open finance data, you can plug your data into our engines and we’ll return the transactions properly categorized and enriched.

Below are the 15 primary categories of the new taxonomy. You can find the complete list of categories in our API documentation.

How does it work?

Let’s look at this example which we show what the original, raw transaction looks like, and what categories and subcategories are assigned thanks to our new model:

- Raw transaction → REMUNERACAO/SALARIO — 7761.87 BRL

- Category → Income & Payments

- Sub-category → Salary

In this example, in which “Income & Payments” is the principal category, we can choose from up to seven subcategories, which helps companies identify what type of income the transaction belongs to.

- Salary: Income received from employment.

- Freelance: Income earned from freelance work or self-employment, including gig economy platforms such as Rappi or Uber.

- Retirement: Income received from a retirement plan.

- Government: Income received from the government, such as Social Security or unemployment benefits (e.g Programa Bolsa Família in Brazil).

- Interest: Interest earned from bank accounts or investments.

- Rent: Income received from renting out properties.

- Other: Other sources of income that don’t fall under the previous sub-categories such as company’s reimbursement or rewards program.

In this way, lenders gain details and clarity about the transaction which can help them to better understand their users’ financial behavior and make more informed decisions.

In recent months, we have worked together with various Belvo customers to experiment and improve the product. According to Aritz Amasane, Belvo’s Credit Risk Manager:

“Categorization is one of the main pillars to extract value from open finance. Categories give meaning to transactions in order to correctly portray financial profiles of end users, a good analogy would be subtitles in a foreign language film.“

Our new taxonomy is the industry’s new default choice for optimizing the value of transaction data for lending. Try our new update today and revolutionize the way you manage risk.