UX: The Engine Driving Open Finance Adoption in Brazil

Open Finance is no longer a distant promise but a reality in the Brazilian market, with over 60 million active consents demonstrating the revolutionary potential of customer data ownership and sharing. Despite this robust volume, full adoption still faces a critical challenge: User Experience (UX). Technical complexity and lack of clarity in the consent journey can lead to drop-offs, preventing companies from fully leveraging these data. In this article, we will show how user experience (UX) can drive Open Finance adoption in Brazil, highlighting best practices and strategies to increase conversion and generate real value for users.

Trust: The Bridge Between Innovation and Inclusion

Trust is the foundation of Open Finance, and it is built through experiences that are fluid, transparent, and intuitive.

When users can easily connect their accounts, understand which data they are sharing, and see clear benefits in return (such as faster credit approvals, smarter financial insights, or simplified onboarding processes), Open Finance moves beyond a technical concept to become a real value in everyday life.

Simplicity is the most powerful way to win over users.

In a context where financial inclusion is a priority and access to digital services is growing rapidly, complex or confusing solutions simply drive users away. Users expect interactions to be simple, intuitive, and fast, few steps, clear instructions, and immediate responses.

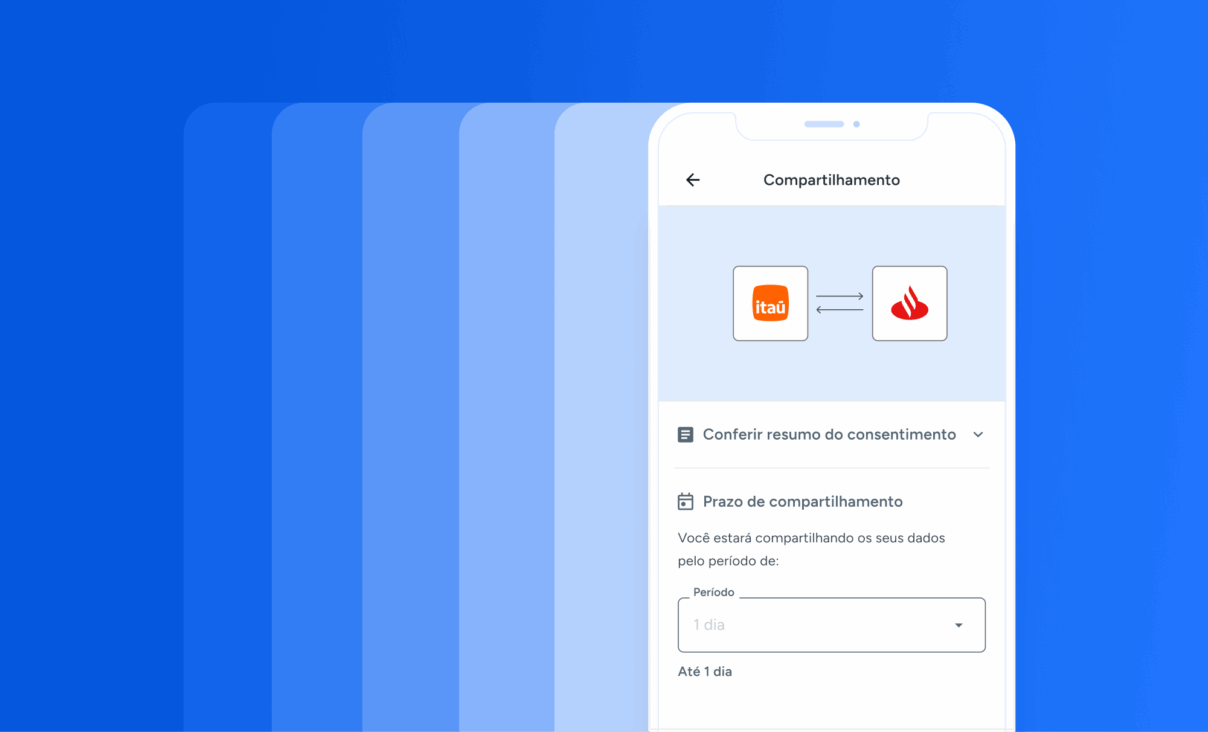

That’s why creating frictionless onboarding experiences, consent flows that remove legal jargon, and real-time updates is essential. A good UX not only increases adoption but also reduces drop-off rates during critical steps such as data connection or authentication.

Maximizing Adoption: Best UX Practices for Open Finance

The success of Open Finance depends on trust and simplicity in the user experience. Even with robust technology, a confusing UX can make customers abandon the connection before completing the process.

To gain more consents and increase conversion, it is essential to apply strong design and communication practices:

- Clarity is key: Use simple language, explain the benefits of connecting an account, and be transparent about which data will be used and for what purpose.

- Reduce friction: Eliminate unnecessary steps, provide clear instructions, and show progress throughout the journey.

- Build trust: Highlight connection security, give users full control over their data, and provide clear error messages.

By applying these principles, companies strengthen trust, simplify the journey, and maximize conversion rates in Open Finance.

To ensure you are maximizing every connection opportunity, we recommend reading our full detailed guide: Best UX Practices for Conversion with Open Finance.

Designing Experiences That Create Value

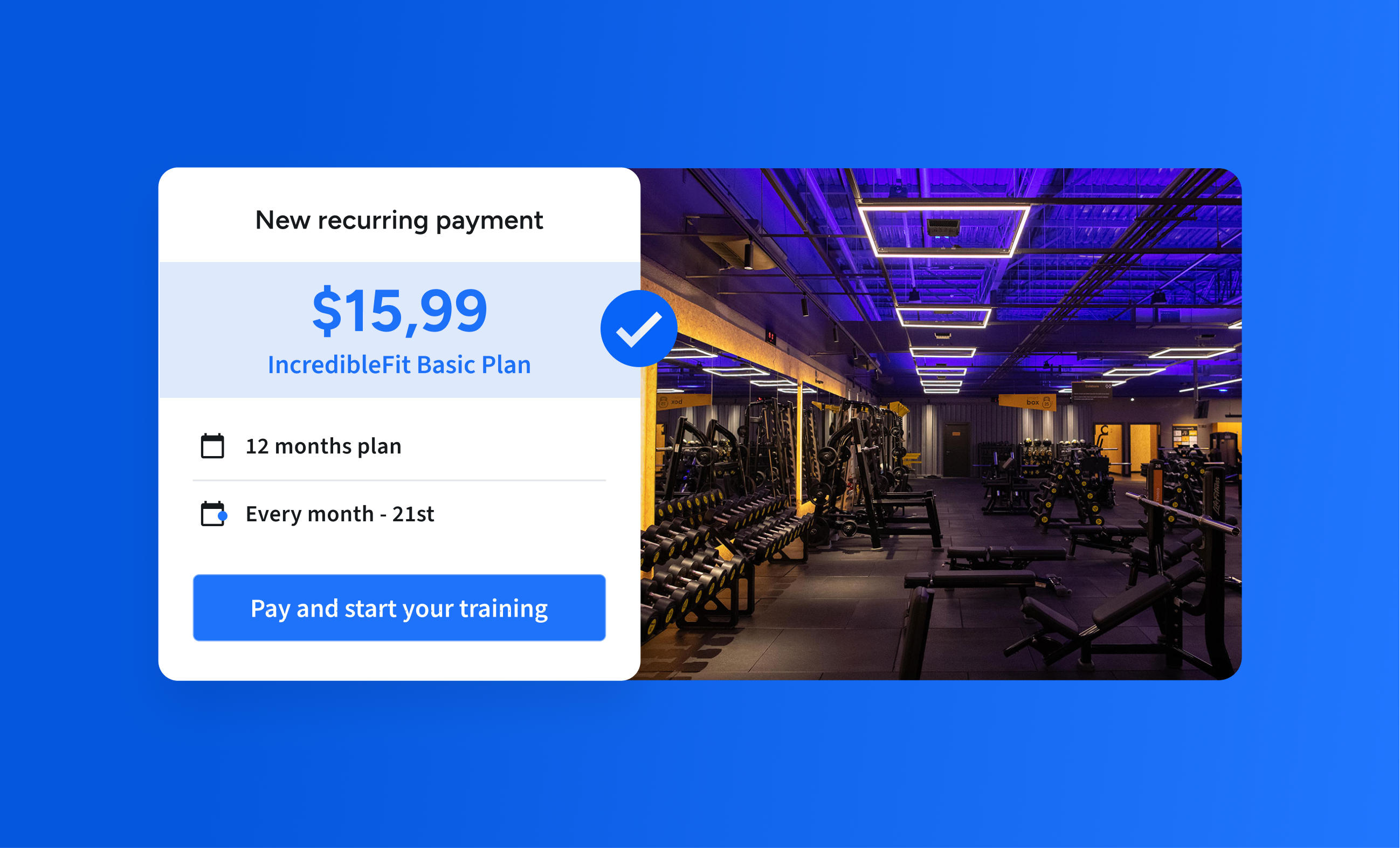

Open Finance is not just about data access, it’s about turning that data into real value and empowerment. This means designing experiences that help users understand what they gain by sharing their information, which is vital for democratizing financial services.

Whether through fairer, more personalized credit offers, smarter financial planning, or faster, less bureaucratic onboarding processes, every interaction should make users feel empowered—not exposed—by sharing their data.

How Belvo and Its Partners Are Leading the Change

Fintechs and financial institutions using platforms like Belvo, and placing UX at the core of their Open Finance strategies—stay ahead by following essential practices for the Latin American market:

- Design with clarity: Explain permissions and benefits in simple, jargon-free language. Belvo invests in standards that help clients communicate transparently what data is being accessed.

- Reduce friction: Minimize screens or steps during data connections, ensuring a fast and efficient journey.

- Empower the user: Provide visibility and full control over their data at all times, allowing users to revoke consent easily.

- Reliable infrastructure: Ensure that connection technology (APIs) is robust, secure, and highly available, as Belvo provides, since the tech foundation directly impacts the connection experience.

Conclusion: UX Is the Key to Democratization

At Belvo, we believe Open Finance only thrives when users truly feel its value, and that starts with a great experience. UX is not just a design layer, it is the foundation of trust, engagement, and sustainable adoption.

By combining secure and reliable data connection technology (like Belvo’s) with a user-centered mindset, we can help Open Finance-powered financial innovation become part of everyday life, ensuring that the power of data is accessible and beneficial for everyone.