Pix Automático is transforming the billing process for Brazilian companies, but it can be further optimized to ensure payments are received on time. Discover how Open Finance data analysis can predict your customer’s highest liquidity day, ensuring successful first attempts and smarter retries.

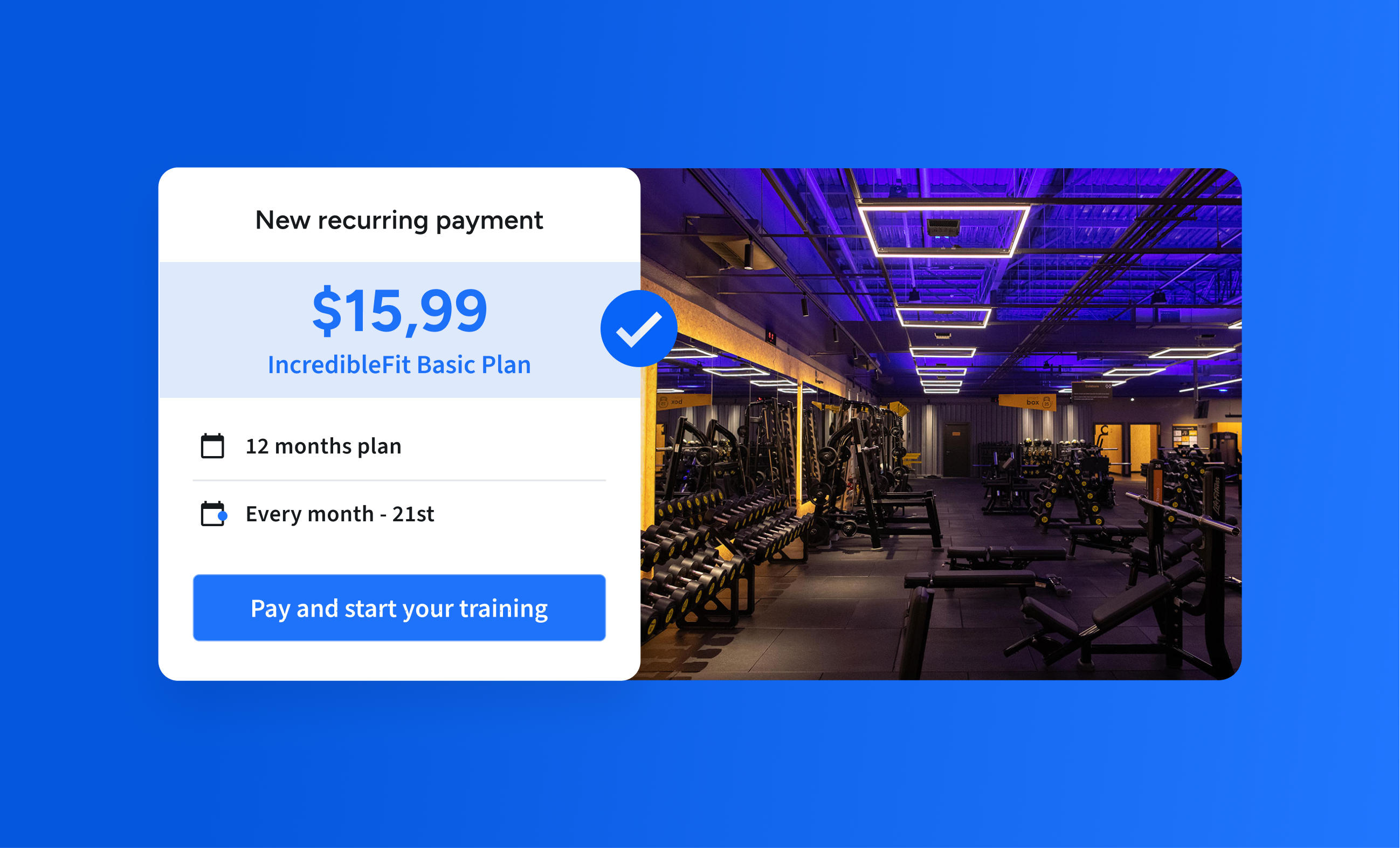

For billing teams across different industries, delinquency is a constant challenge that directly impacts cash flow and business sustainability. Pix Automático represents a major evolution in the management of recurring payments, but its success still depends on whether the customer has sufficient funds available at the time of charge. An attempt on the wrong date can fail — and this is where the real challenge lies, since the system allows only a limited number of automatic retries per charge.

If all retries are used during low liquidity periods, the chance of receiving that payment automatically within the month is lost. This forces the company to rely on manual collection processes, which are more expensive and create more friction with the customer. The goal, therefore, is not just automation, but making the first attempt as successful as possible.

To address this market pain, Belvo leverages Open Finance data intelligence. Our predictive approach is designed to identify the best billing date and maximize the success rate of Pix Automático collections.

How it works: using data analysis for smarter billing

Our solution transforms reactive billing into a predictive strategy, optimizing both Pix Automático and its retry mechanism.

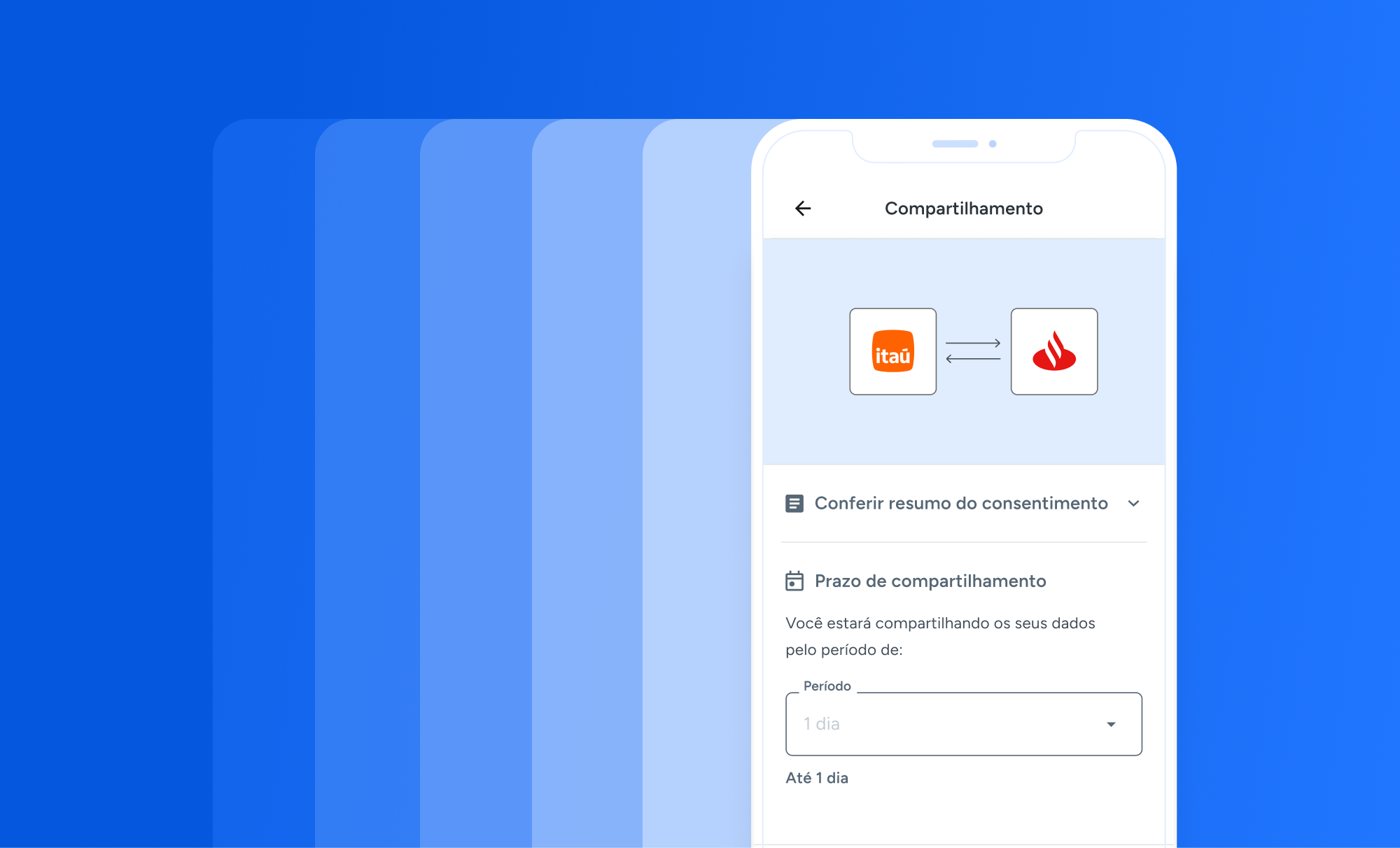

- Secure connection via Open Finance: With the customer’s consent — obtained securely through their own banking environment — our platform connects to their transactional data.

- Liquidity pattern recognition: Belvo’s API analyzes the account’s historical data to identify patterns in incoming funds, predicting the days of the month when the customer is more likely to have available balance.

- Smarter Pix scheduling: Instead of scheduling Pix Automático for a fixed date, your company can use this intelligence to program charges on the dates with the highest probability of success, preserving retries for exceptional cases.

- Intelligent retries: If the first attempt fails, data analysis can help determine the ideal time to retry — for example, right after a new deposit is detected.

Benefits of predictive billing powered by Pix Automático

By combining the automation of Pix with Open Finance data intelligence, credit companies gain clear and measurable benefits:

- Maximized success rate: Ensures the first billing attempt is the most effective, significantly reducing failures due to insufficient funds.

- Optimized cash flow: Increases predictability of incoming payments and reduces delinquency windows.

- Receivables cycle preservation: Prevents the loss of that month’s receivable due to exhausted retry attempts.

- Lower operational costs: Reduces the need for manual dunning strategies and the costs of recovering failed payments.

Communicating value to the customer

One of the key steps in calculating the best billing date is obtaining customer consent — and transparency is essential. The approach should clearly highlight the benefits to the customer. When requesting Open Finance connection, explain simply how the data will be used and why, like in the example below:

“To personalize your experience and avoid charges at inconvenient times, we’d like to identify the ideal billing date for you. By connecting your account via Open Finance — a secure system regulated by the Central Bank — you allow us to find the best day for payment, helping you stay financially organized. Your data is protected and you have full control over what is shared.”

The future of recurring payments is smart and data-driven

The future of recurring payments lies in using data to make automation smarter. By integrating Open Finance intelligence into your Pix Automático billing strategy, your company shifts from reactive to predictive, transforming how you manage credit risk and interact with your customers.

Want to implement smart billing dates with Pix Automático in your payment strategy? Just reach out to us [here] and one of our specialists will get in touch.