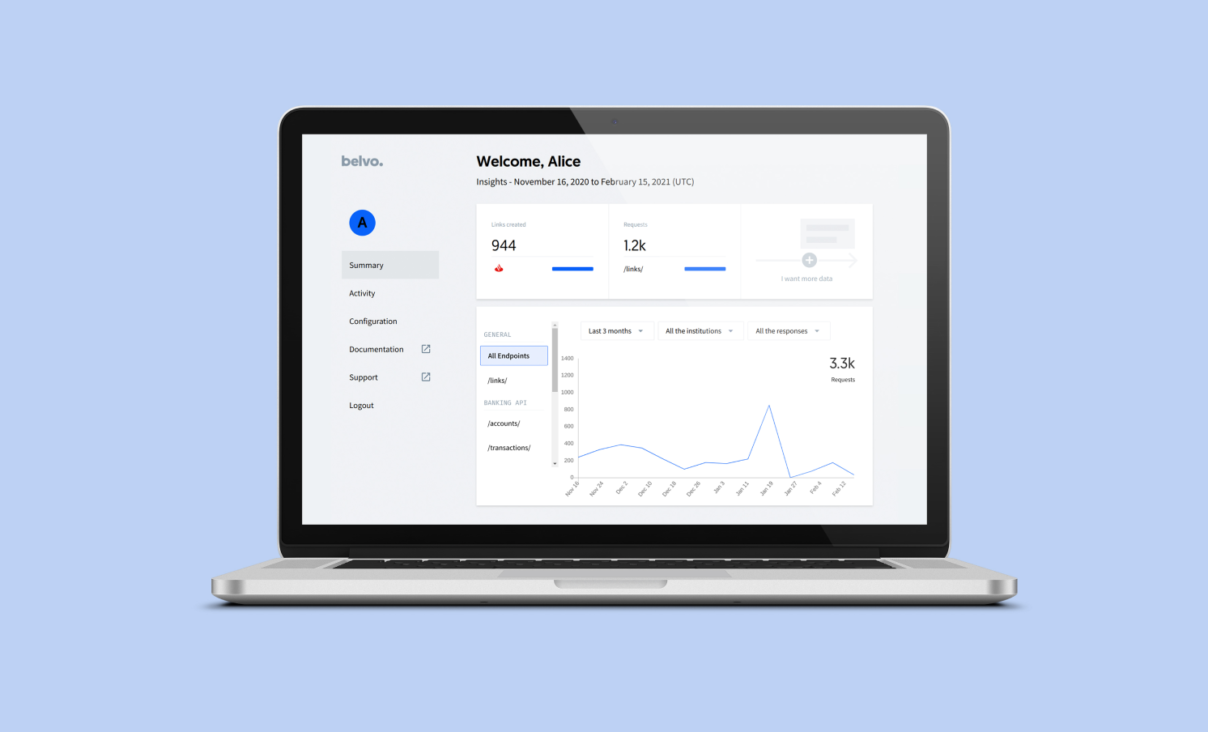

Since our last post, we have been heads down working on the product. We have continued to grow our tech team and are now shipping harder, better, faster, stronger. 💪

In this context, we have released a number of new features and resources that will greatly contribute to enhancing and streamlining the developer experience with Belvo.

Belvo SDKs

The first resource we have upgraded is the SDK packages we offer to easily integrate with Belvo. Up until now we had a Python SDK which was released a couple of months ago. We have now added libraries in Ruby and Node.js that can be used if any of those are your default coding language. Both of these libraries are available via open source on our GitHub page. More information can also be found in the Resources section of our Developer Portal.

Another relevant improvement we have made based on client feedback has been to enable a greater configuration of Connect widget parameters. Now you can customize the Connect widget to only show or open up with specific parameters. For example, you may only want to display specific institution types (if you only wish to display banking institutions), specific countries (if your app is only live in Colombia for example), or start the widget to ask directly credentials on a specific institution (if you want to link directly a Santander account). You can read more about all possible parameters here. This is a starting point and we will be adding more and more personalization capabilities going forward so that every developer can create a fully-customizable experience.

Increased coverage

We have also worked on expanding our institutions coverage in Mexico and have added several banks with retail support (e.g. Banco Azteca) as well as some banks with business support (e.g. Banorte and Banregio). Our API now covers 12 banking institutions in Mexico and many more, both on the retail and business side, will be going live very soon. More information and a full list of institutions and coverage can be found here.

In line with our increased coverage in Mexico, we have launched our first set of integrations in our second country, Colombia. We currently support 5 banking institutions, namely: BBVA, Banco de Bogotá, Davivienda, Banco Falabella and Bancolombia. Together, these institutions provide approximately 70% coverage in terms of assets and deposits. A full breakdown and granular overview of what products are available from these integrations can be found here.

Growing fast

Lastly, we have also worked on revamping our blog. Up until now, we were using Medium as a platform to share relevant progress and product updates. We have now switched to this new internal blog. Going forward, this will be our main content outlet.

Also, we’re still actively hiring for close to 10 roles in Mexico and Barcelona and will be opening up many more in the coming weeks. All current and future openings will be posted here. Given the current climate, if you find yourself having lost your tech job in Barcelona or in CDMX due to COVID-19 and would like to join a dynamic, fast-paced and growing startup, feel free to hit us up. We will be more than happy to chat and help out in any way we can.

If there’s anything you’d like to reach out to us about, let us know.

Stay tuned for more updates coming from us soon!