Categorization

transform messy banking data into insights

Maximize the value of transaction data by turning it into clean categories. Identify income, spending behaviors, and potential risk indicators to create a more effective credit risk model.

Trusted by the leading financial innovators

GET A COMPLETE, AI-POWERED PICTURE

OF YOUR CUSTOMERS

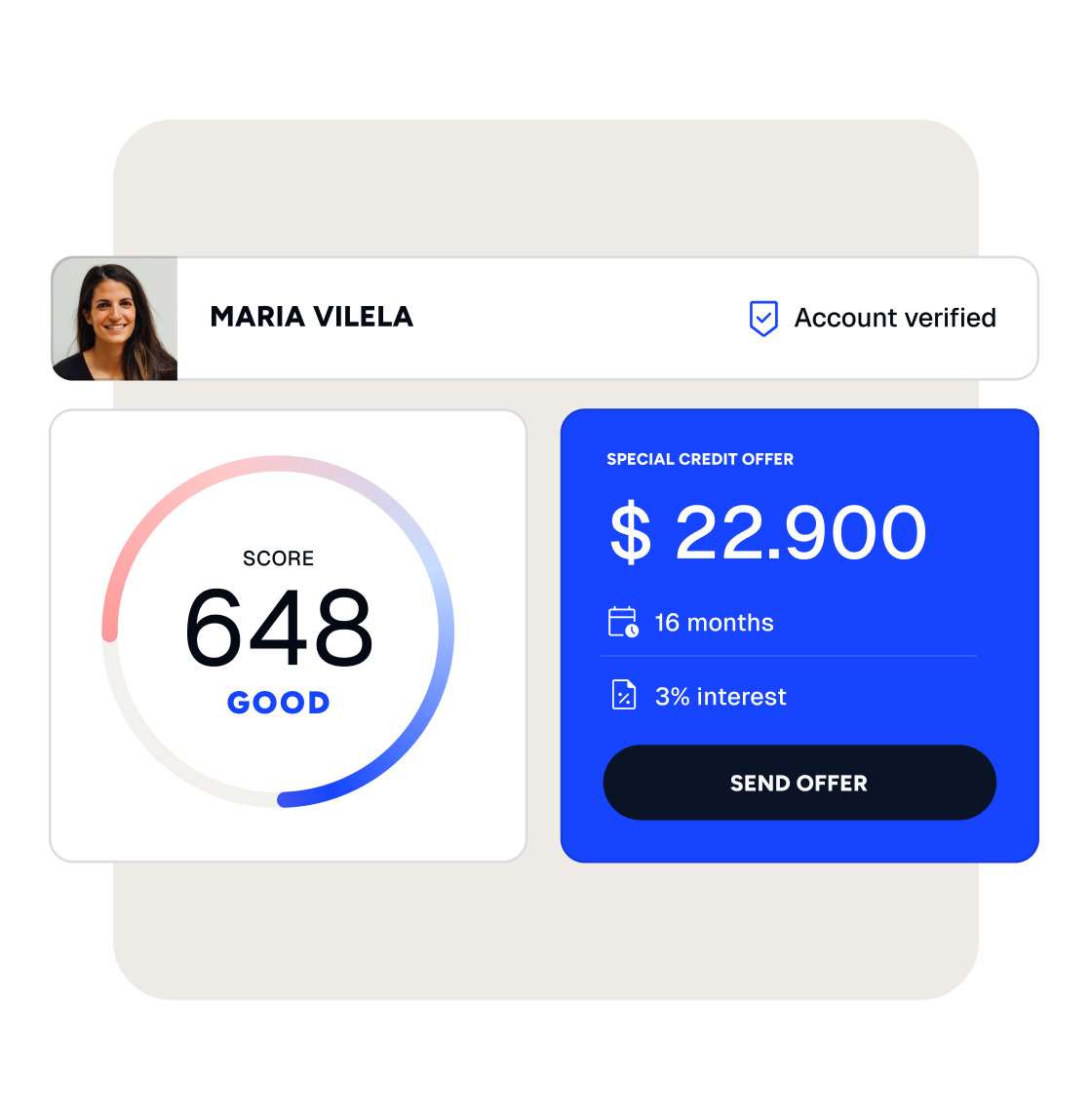

Tailored for credit and risk

Capture the nuances of the lending industry, providing the precision you need to make data-driven decisions.

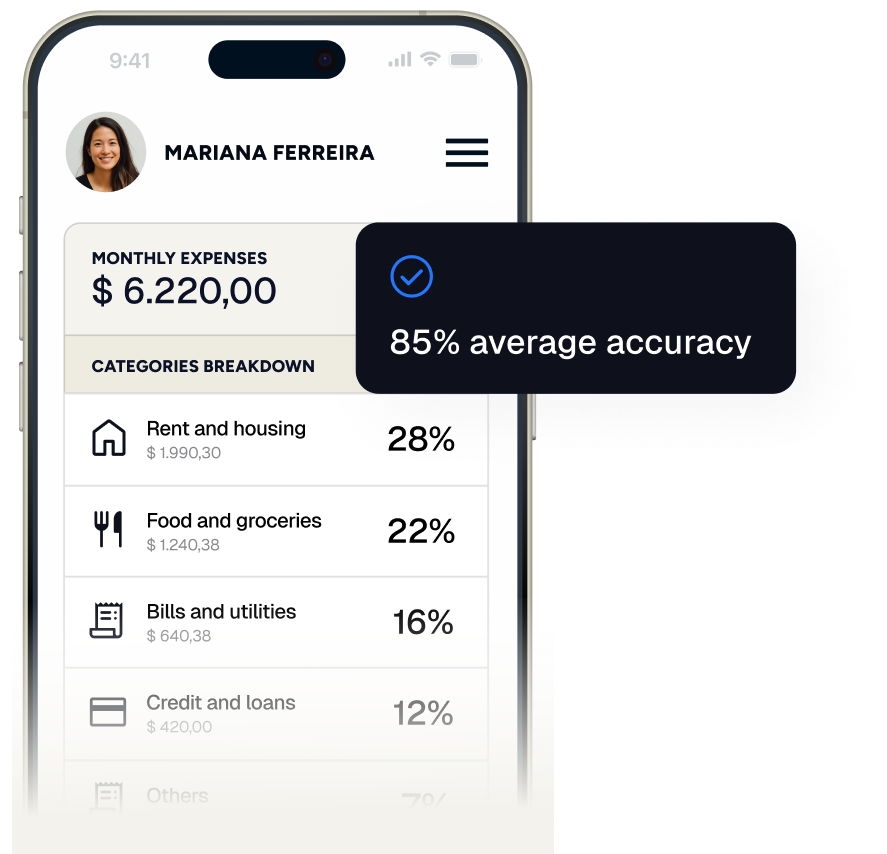

Best coverage on the market

Access detailed insights on income and lending categories. Our models achieve over 85% accuracy.

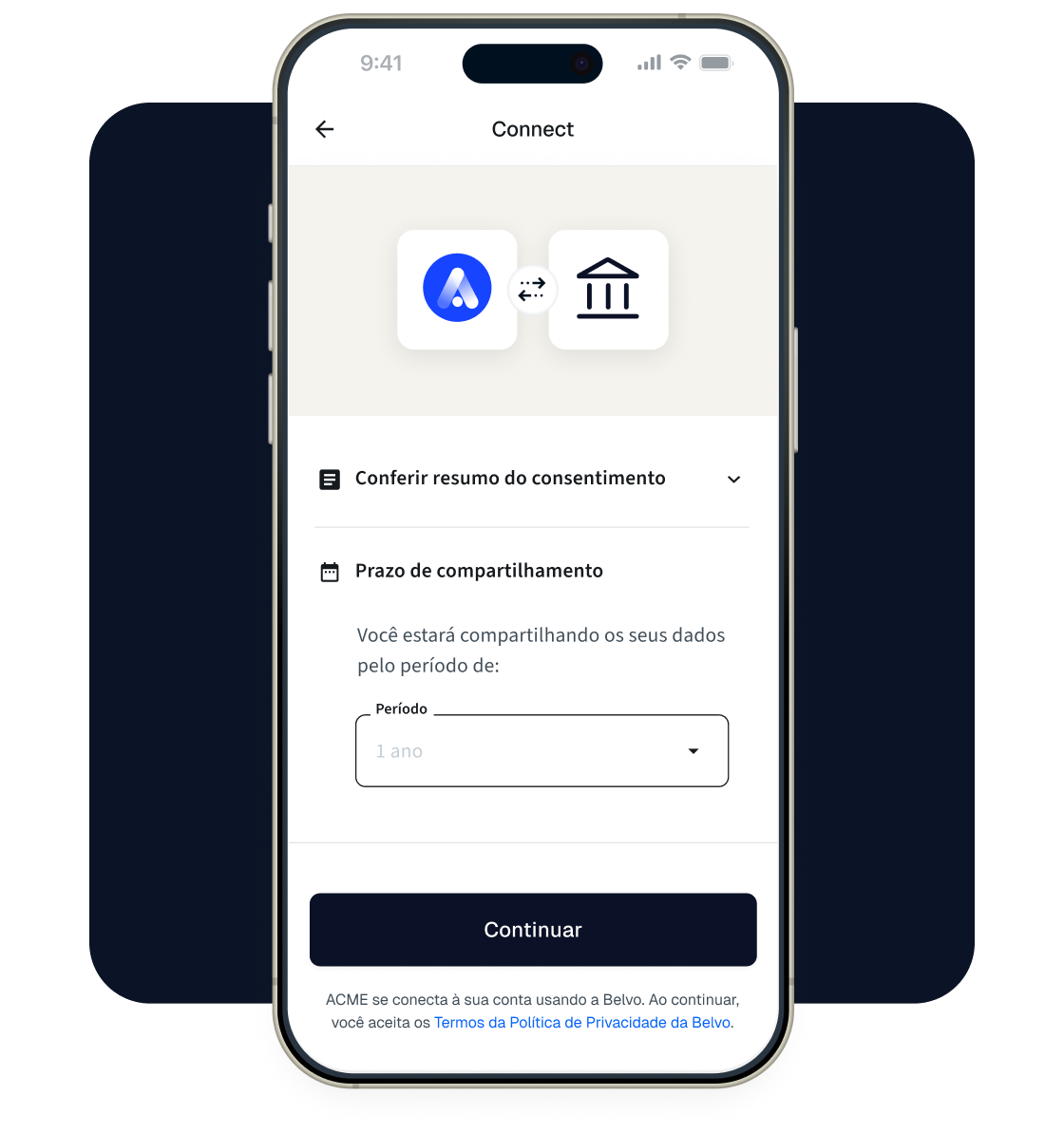

Standardized bank data

We harmonize data into a consistent schema, so you get the same structured output regardless of the institution.

Constant improvement

By analyzing transactions from millions of users across Belvo-powered apps, our model ensure your data remains accurate.

Product features

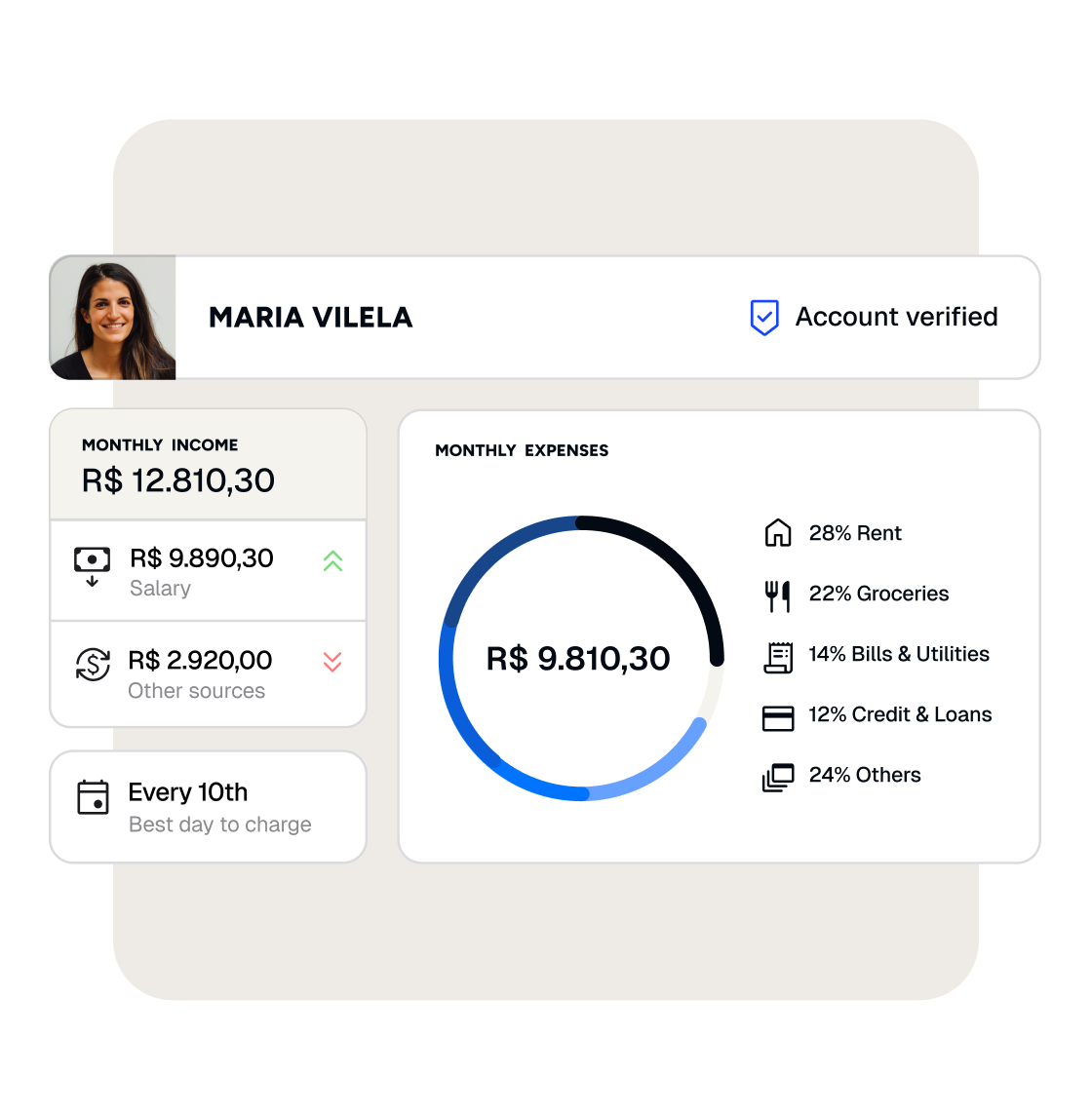

From raw data to

a comprehensive profile

GAIN 360° VISIBILITY INTO FINANCIAL HABITS

Powered by machine learning and artificial intelligence, our categorization product offers detailed sub-categories such as income, credit and loans or gambling. We provide lenders with the granularity they need to make data-driven decisions.