Income Verification

High-accuracy income verification

Predict repayment capacity with verified financial data. Access clean, categorized information to get a real picture of the user's income and sharpen your underwriting.

Trusted by the leading financial innovators

Get a clear, verified view of your customers’ true income

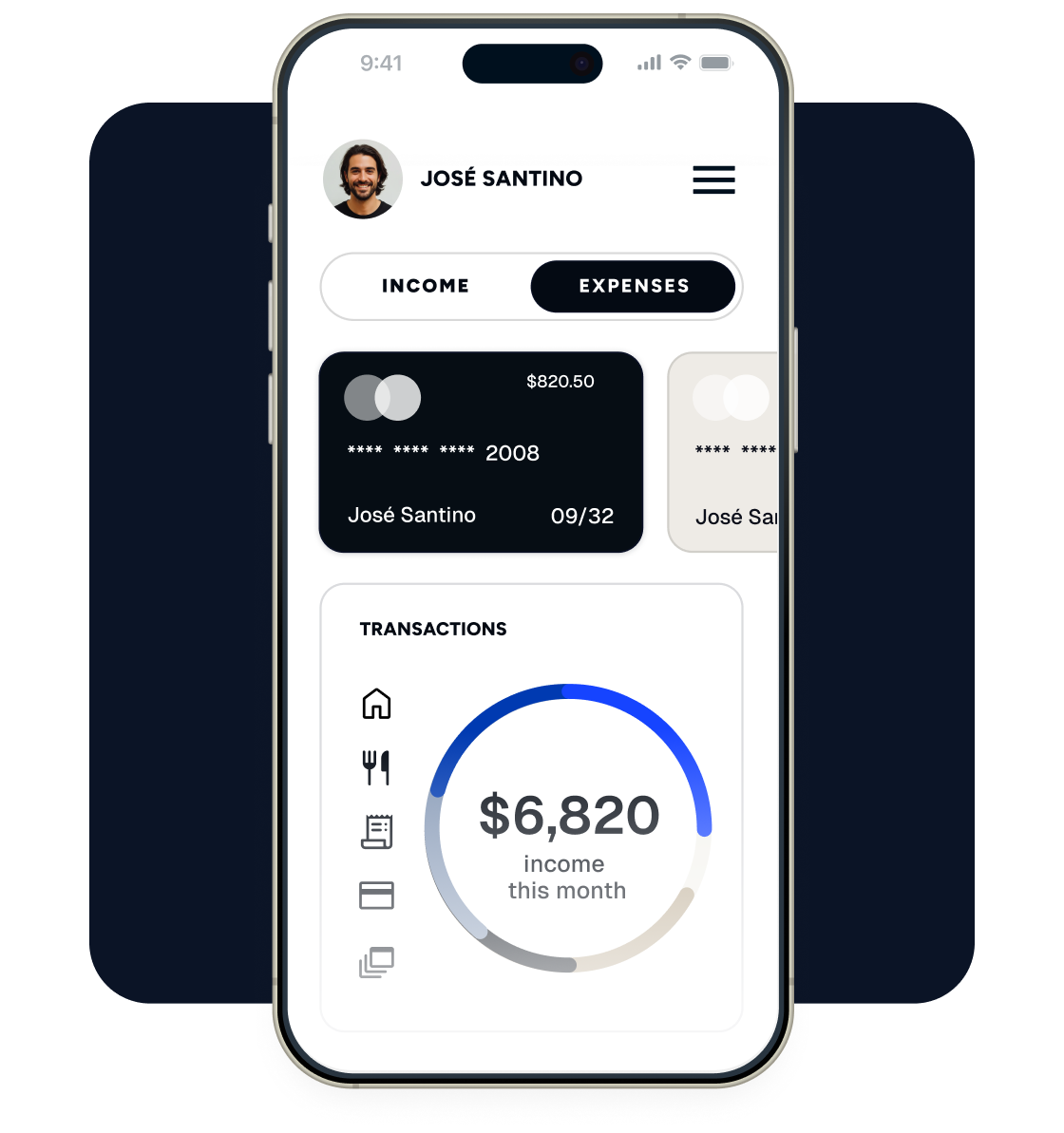

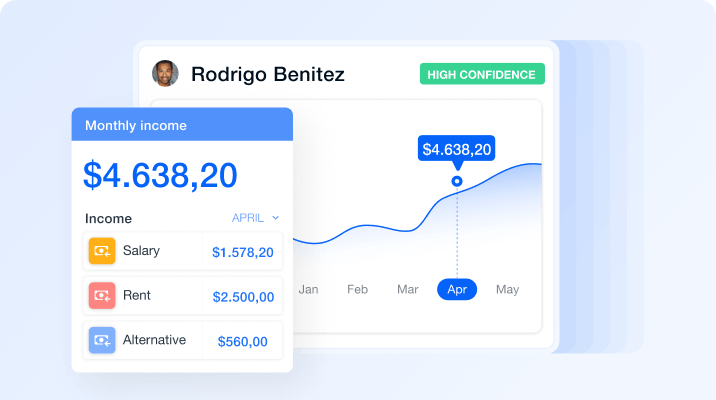

Lending-specific metrics

Use specialized filters to identify applicants who meet your exact credit criteria and boost approval rates.

Total income visibility

Consolidate every revenue stream (from salaries to freelance gigs) to fully understand a user's repayment capacity.

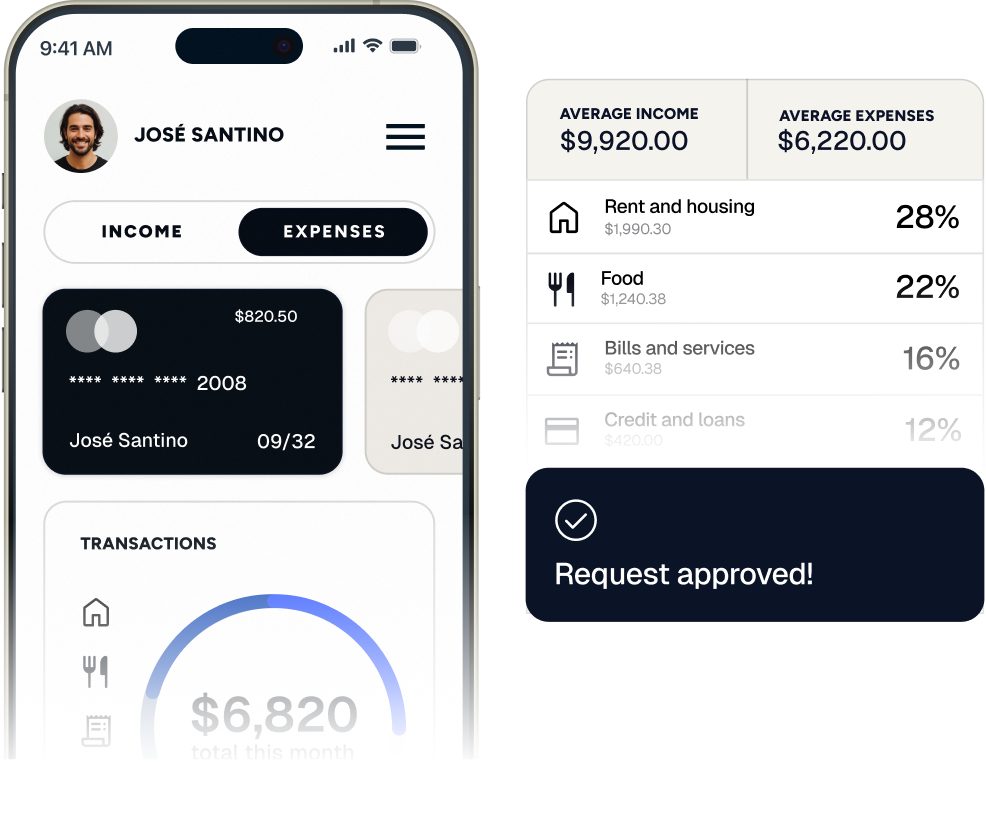

zero-touch underwriting

Eliminate manual document reviews to process applications faster and lower your operational costs.

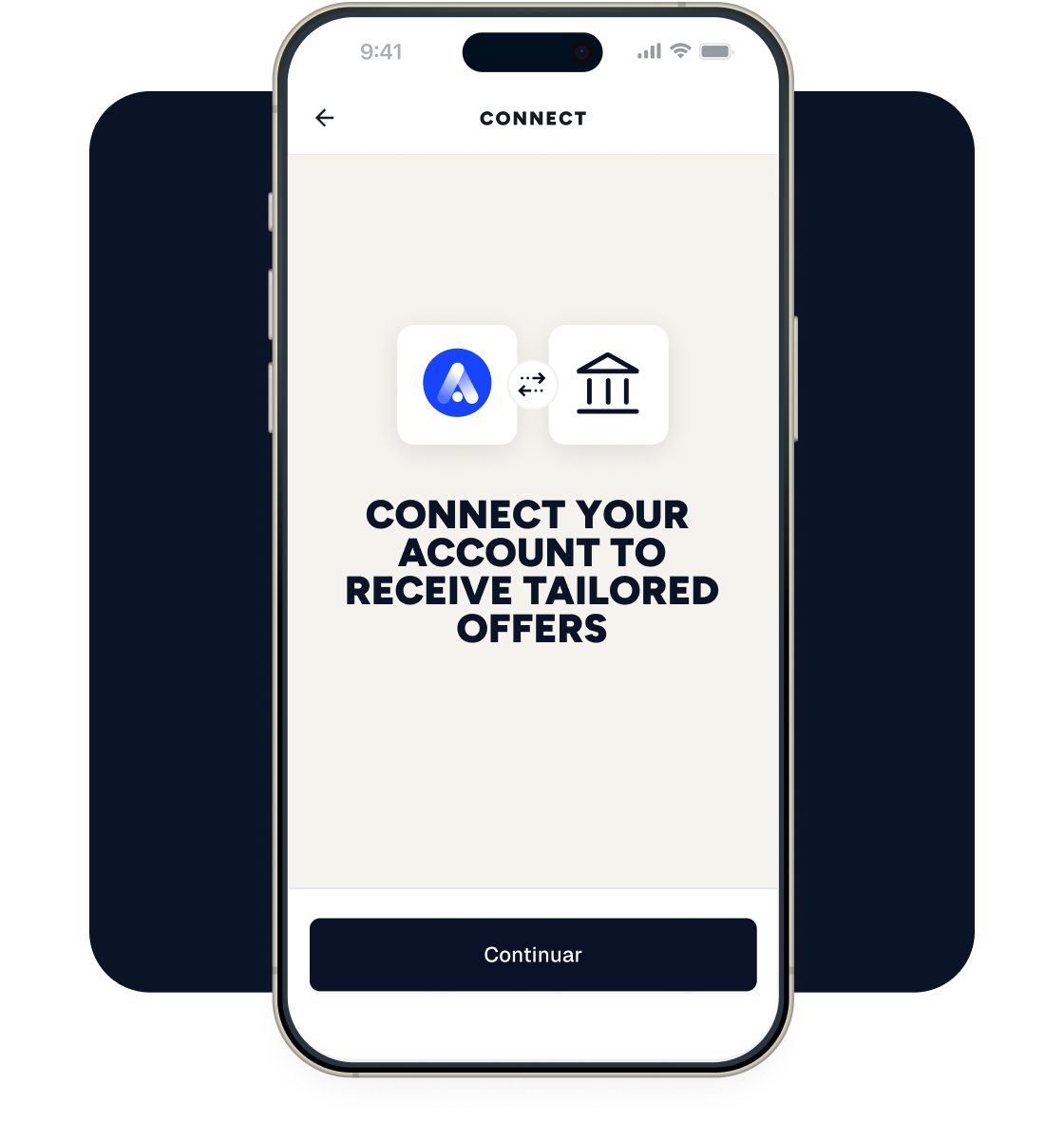

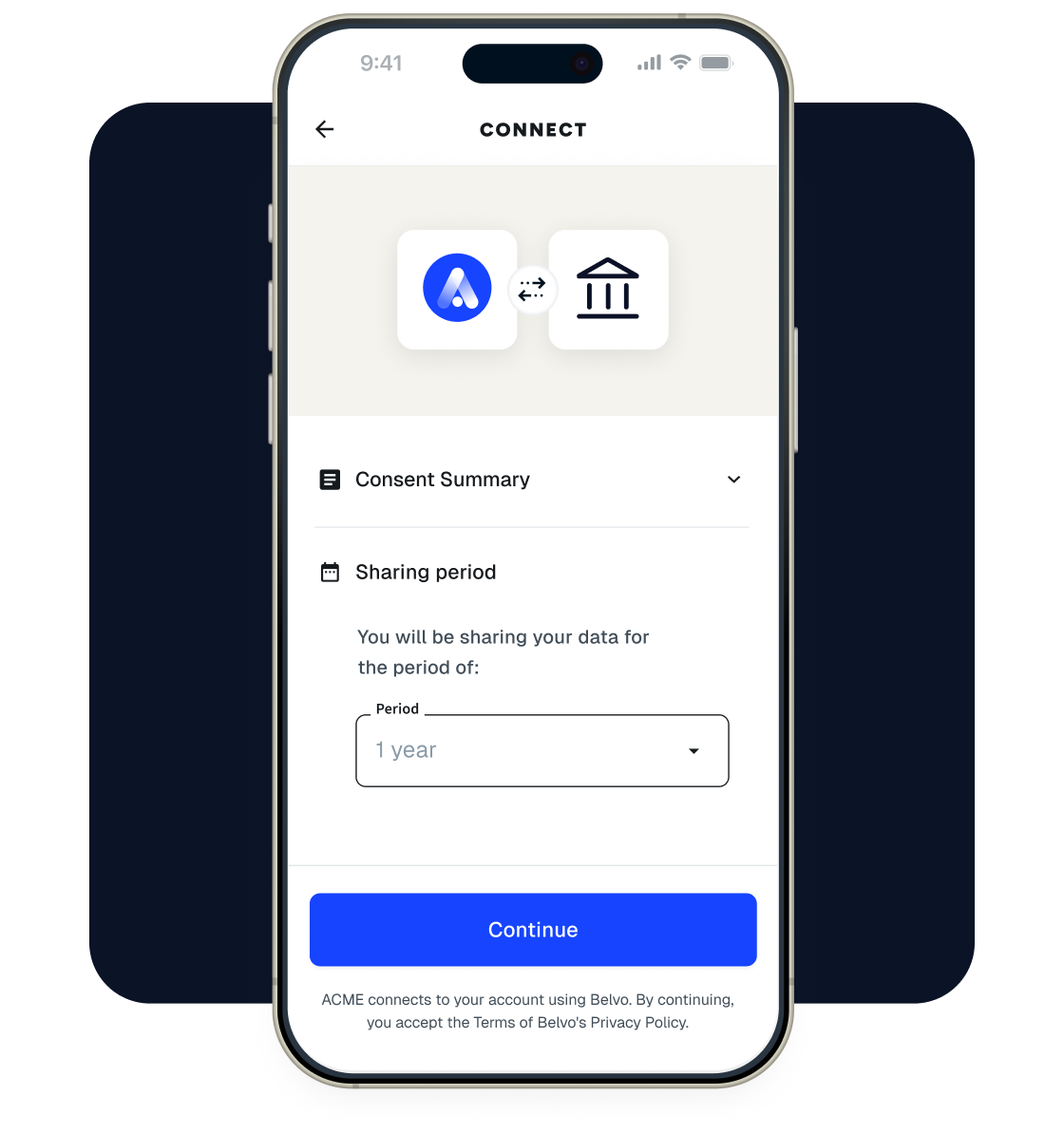

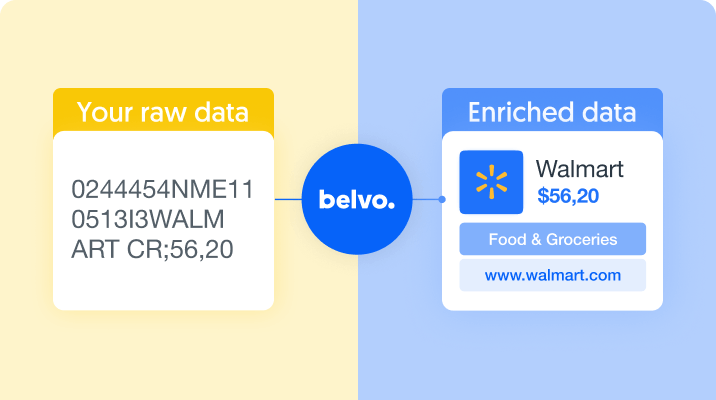

Verified Open Finance data

Use direct banking connections to retrieve clean, structured transaction history that is ready for your credit models.

Accurately understand your users’ financial

stability and ability to pay

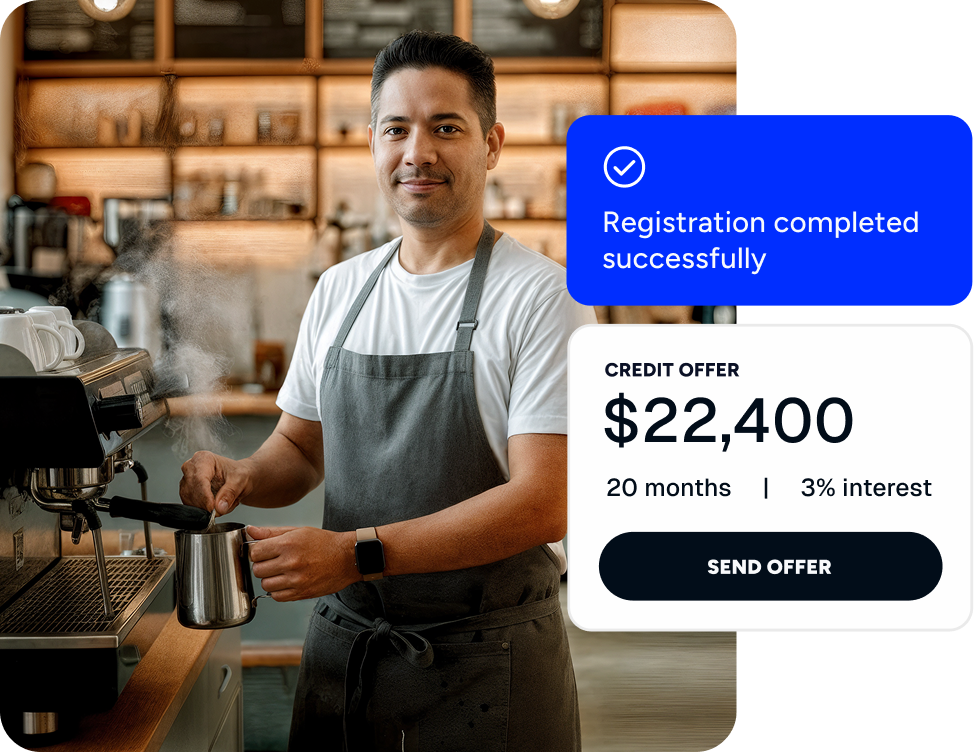

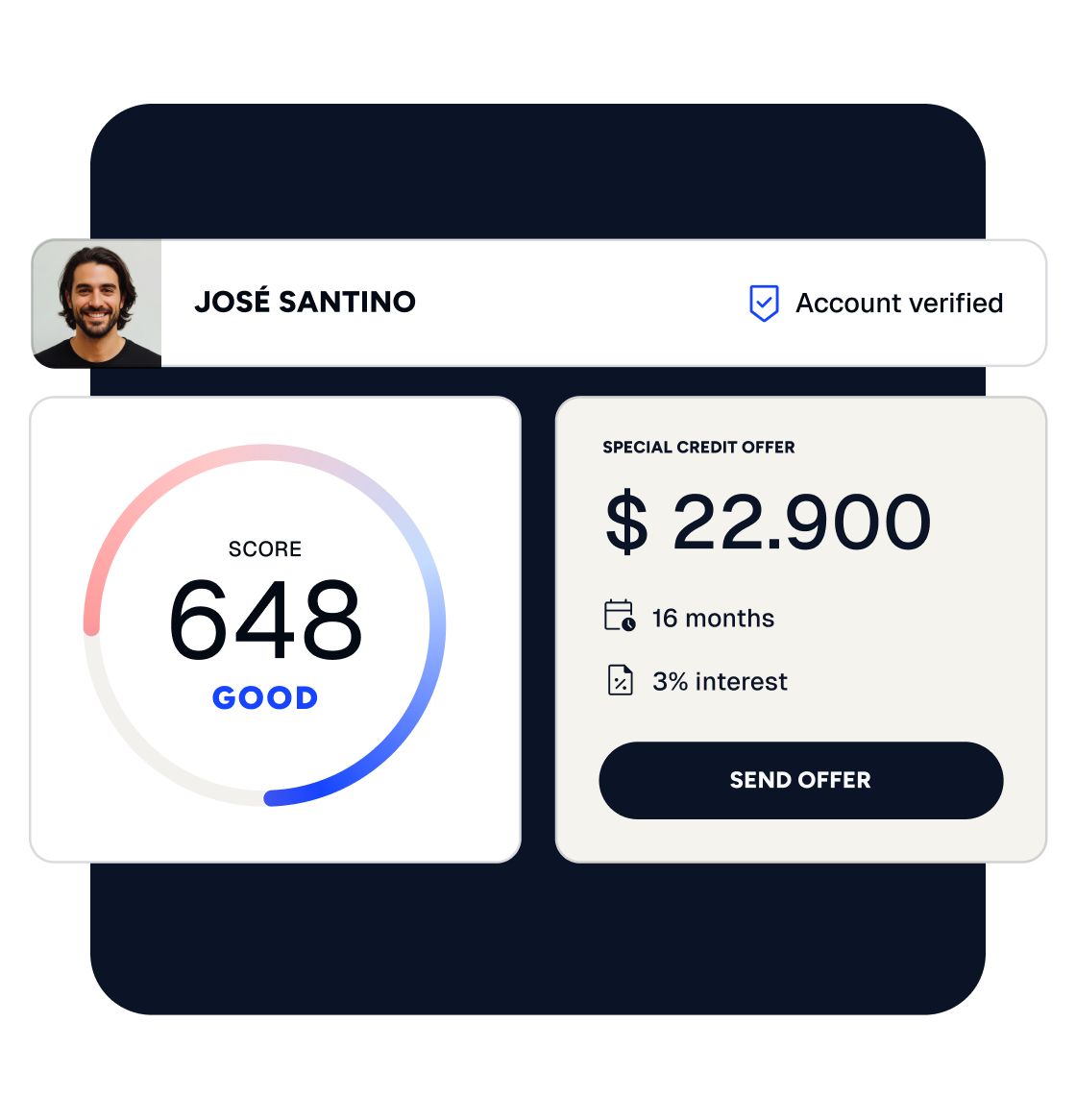

deeper credit insights, 20% more approval rates

Analyze spending habits and diverse income streams to approve more applicants. Lenders can increase approval rates by 20% while maintaining the same risk profile.

scale underwriting EFFICIENCY

Speed up loan processing by removing manual document reviews. Identify financial instability early and process applications with higher precision.