WHITE PAPER

Open finance use cases guide for financial institutions

How banks are innovating through open finance

This white paper addresses the potential of data democratization for banks and other financial institutions. Access to rich, quality financial data can accelerate conversion processes and help institutions offer solutions that better meet the needs of their users.

What you’ll find in this document:

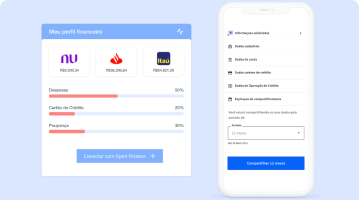

- Current situation of open finance in Latin America

- Identifying use cases for financial institutions

- The power of transactional data to improve risk analysis

- How to develop a roadmap for implementing open finance in financial institutions

“Open finance gives us a much more holistic view of our own customers’ current financial situation. And I think that’s super powerful in understanding what other products and other services are being used beyond us as a bank.”

Esteban Domínguez

Head de Digital Business Development no Citibanamex