Learn about all the benefits and advantages that all consumers have when sharing their data with financial companies that use open banking and open finance platforms.

Table of Contents

The financial services market is undoubtedly one of the most competitive worldwide historically, in addition to the fact that it is currently facing great challenges such as technological advances and changes in users’ consumption practices.

In regions such as Latin America, where financial inclusion and informality continue to be a reality – in Mexico, only 53% have a bank account and 31% have access to formal financing, according to the CNBV’s 2021 National Financial Inclusion Survey – financial companies have the enormous task of providing services and products that generate well-being, include a larger population and offer a better experience for consumers.

With these challenges in mind, open banking and open finance solutions act as the main allies for financial innovators.

These new models make it possible to offer a better experience to consumers and take advantage of the variety of integrated systems that are widely available today.

What is open finance and how does it work?

Historically, traditional financial institutions have been solely responsible for storing and processing data about people’s financial lives. For this reason, our understanding of financial information – and what we can do with it – has been limited almost exclusively to the services offered by banks.

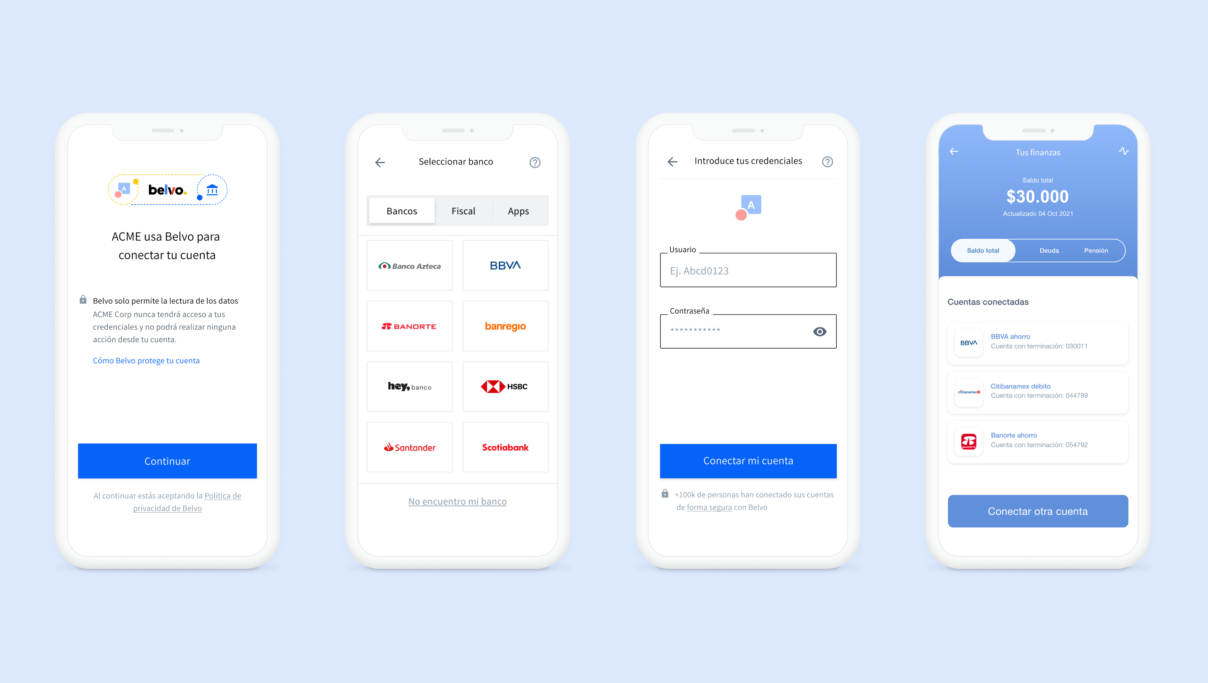

Or at least it was until the advent of Open Banking and Open Finance models. This movement established the rules that allow users to share their banking information with third parties through APIs (Application Programming Interfaces).

This means that people now have a secure channel to easily share their banking information with other companies. Thanks to this – always with the consent of each individual – these companies can use banking data to build new financial products and services linked to users’ bank accounts and more tailored to their specific financial situation and needs.

But how does this benefit the end consumer?

With all this in mind, here are the main benefits that open finance offers to users:

Increased number of tailored products 🎯

Open banking has the potential to offer personalized and relevant product and service options for consumers, thanks to access to more data sources that allow tailoring experiences to their specific needs. By providing access to financial information, users will now have services that match their consumption logic, as well as a much friendlier, simpler and faster experience.

Consumers would now have the ability to access different services from one place, they would be able to enjoy the best offers available with greater transparency, and they would have the opportunity to view their current financial situation in a single application on their Smartphone. It’s just a matter of “one-click”.

Security and transparency with the use of data 🔐

While there are efforts that have helped financial inclusion accelerate around the world, the reality is that the population’s distrust of online (and general) financial products and services; and the perception of inaccessibility to financial institutions remain major challenges in Latin America.

This is why financial institutions and fintech companies have to find ways to convince potential customers of the benefits of their products and services, focusing on two key factors: security and transparency.

With the implementation of open banking, consumers will have full control over how their financial data is used and who can access it. They also have the confidence that they are being handled under the best security standards throughout the process.

Faster access to credit and financing 🏡

Undoubtedly, one of the main benefits is the diversity of credit services to which consumers can apply. By using open banking, companies that offer loans will now provide credit offers much faster, helping consumers get the money they need at the exact moment they require it.

Companies such as Dineria are using open banking to nurture their models and increase the amount of credit they offer to consumers almost immediately.

But it is not only for traditional credit models, as these models help to promote and create new products. A clear example is Aplazo, with its “Buy now, pay later” service, which offers the possibility of buying in installments in different stores and establishments to people who do not have a credit history or a credit card.

In addition to all this, mortgage credit is also benefiting from these solutions. Startups such as Yave are taking advantage of the access to their users’ fiscal data to streamline all processes and help all their customers to buy a property in a simple and secure way.

Control and improve personal finances 💸

Another great opportunity for consumers would be to improve the management of their personal finances through products that provide visibility, control and timely advice on how to optimize the use of their finances.

A clear example of such services is provided by Mobills in Brazil, which has an application where users can manage their money, create budgets, track their current account and credit card spending, all in one place.

Salary on-demand is now a reality 📈

As mentioned earlier, open banking is helping to drive new financial models and products. One of these is on-demand payroll, which allows hundreds of workers in Latin America to get their paychecks paid whenever they want without having to wait until the pay date.

Companies such as Monet in Colombia, TiFi in Mexico, and Blipay in Brazil help workers avoid having to resort to informal sources of financing (which have high-interest rates) and can have the money they have worked for when they need it most.

These are just a few clear examples of how users benefit from open banking and open finance models, but these advantages can radically increase depending on the creativity and new services that financial companies are willing to launch. This is why open banking is so important, as it serves as a foundation for innovation and the financial services revolution to continue throughout Latin America.

If you are looking to bring these benefits to your customers, contact us and we will help you to help more and more consumers benefit from the power of open finance.