What is Belvo?

Belvo is a leading company that has built a secure platform that allows you to connect your financial data to the services you trust, providing better financial experiences and faster payments. Always with your consent and the highest enterprise-grade privacy and security standards.

Access better financial services thanks to Belvo

At Belvo, we work with financial entities throughout Latin America to ensure that more people and businesses have access to the financial services they need.

Over 50 million people have already securely shared their financial data or made payments using Belvo-powered apps.

Thanks to Belvo, you can share your financial or work activity with financial entities to access financial services that suit your needs, such as personalized credit and refinance rates.

You can save paperwork or travel to offices by sharing your financial information digitally and automatically.

With Belvo, you can automate direct debit payments in Mexico or use Pix and Open Finance payments on your favorite Brazilian platforms.

Through our platform, you can minimize the risk of fraud by directly controlling who you share your data with and the payments you make from your bank account.

The safest way to share your financial data and make payments using your bank account

Belvo acts as a technological intermediary and infrastructure provider between innovative financial companies and the institutions where your data is stored. Our mission is to be a secure bridge so that you can deliver your financial information and connect your bank account where and when you need it, whether to improve your chances of getting a loan, make your payments more easily, or have better control of your finances.

User

Your financial data

Financial companies

What security measures does Belvo use?

We’ve built a platform where security and privacy are not just features, but core values of our team. We use modern tools, industry standards, and have a motivated, well-trained team to keep your data secure and private.

Enterprise-level security

Protecting your account information and privacy is our top priority. We take strong steps to keep your data safe and private, following best practices and rules to ensure it remains confidential and secure. We’ve been certified to meet the highest international standards for security, including ISO 27001, meaning that an independent organization has certified our ways of working.

Data is always encrypted

Our platform was designed with security in mind from its beginning, ensuring that connecting your accounts happens safely and privately. All your data is protected using advanced cryptographic technology, so it is unreadable to anyone who shouldn’t have access, both when it is being sent across the internet or when stored on our servers. No data enters or leaves Belvo without being protected.

The best security infrastructure

We leverage the robust infrastructure of Amazon Web Services (AWS)’s highly secure data centers. Our platform is protected by multiple layers of physical and digital security and is designed to stay online even in the event of a major disruption. This setup ensures that our services are always available and reliable, even if something goes wrong. If one system fails, another immediately takes over.

Constant monitoring and security policies

We maintain a proactive security posture. We conduct regular third-party penetration tests so we can find and fix any weaknesses before they can be exploited. Our systems are monitored 24/7 for any suspicious activity. If something is detected, our team is immediately alerted and takes action to resolve the issue and restore service as quickly as possible. All employees follow strict security rules and our systems are regularly checked.

Frequently asked questions

Belvo is a secure platform that allows you to easily share your financial data with companies throughout Latin America and initiate payments, always with your consent and following the highest standards of privacy and security.

Belvo does not directly offer any financial services to users. It only acts as a technological intermediary so you can securely share your data and access better financial services.

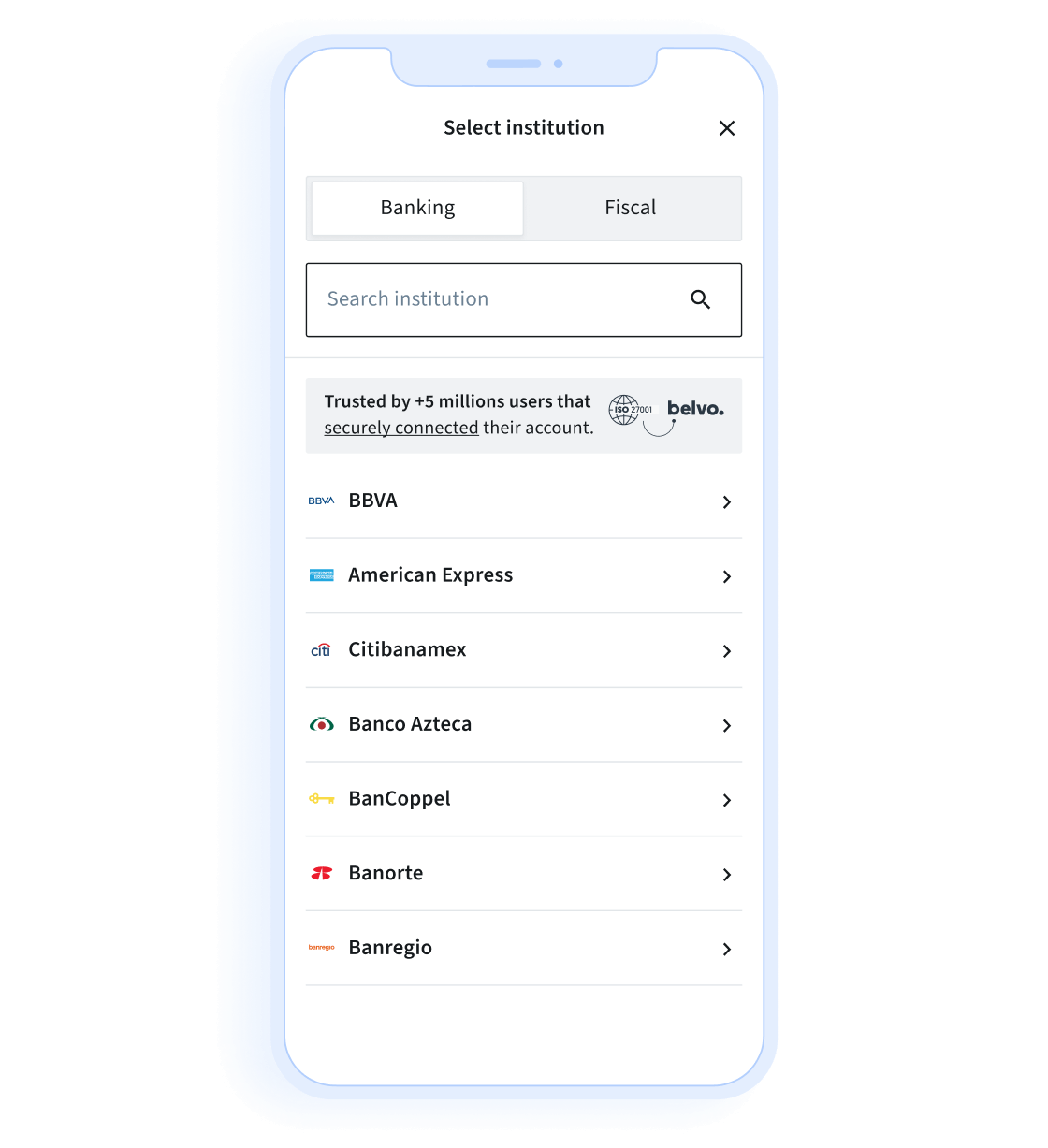

Over 150 financial companies in Mexico and Brazil such as BBVA, Banamex, Bradesco, Santander, Mercado Pago, Nubank and many more already work with Belvo. Thanks to us, these companies can better understand the financial information of customers like you to offer them better services or process payments in a more efficient manner.

More than 50 million people have used Belvo to securely connect their data to financial services and receive better offers and personalized products.

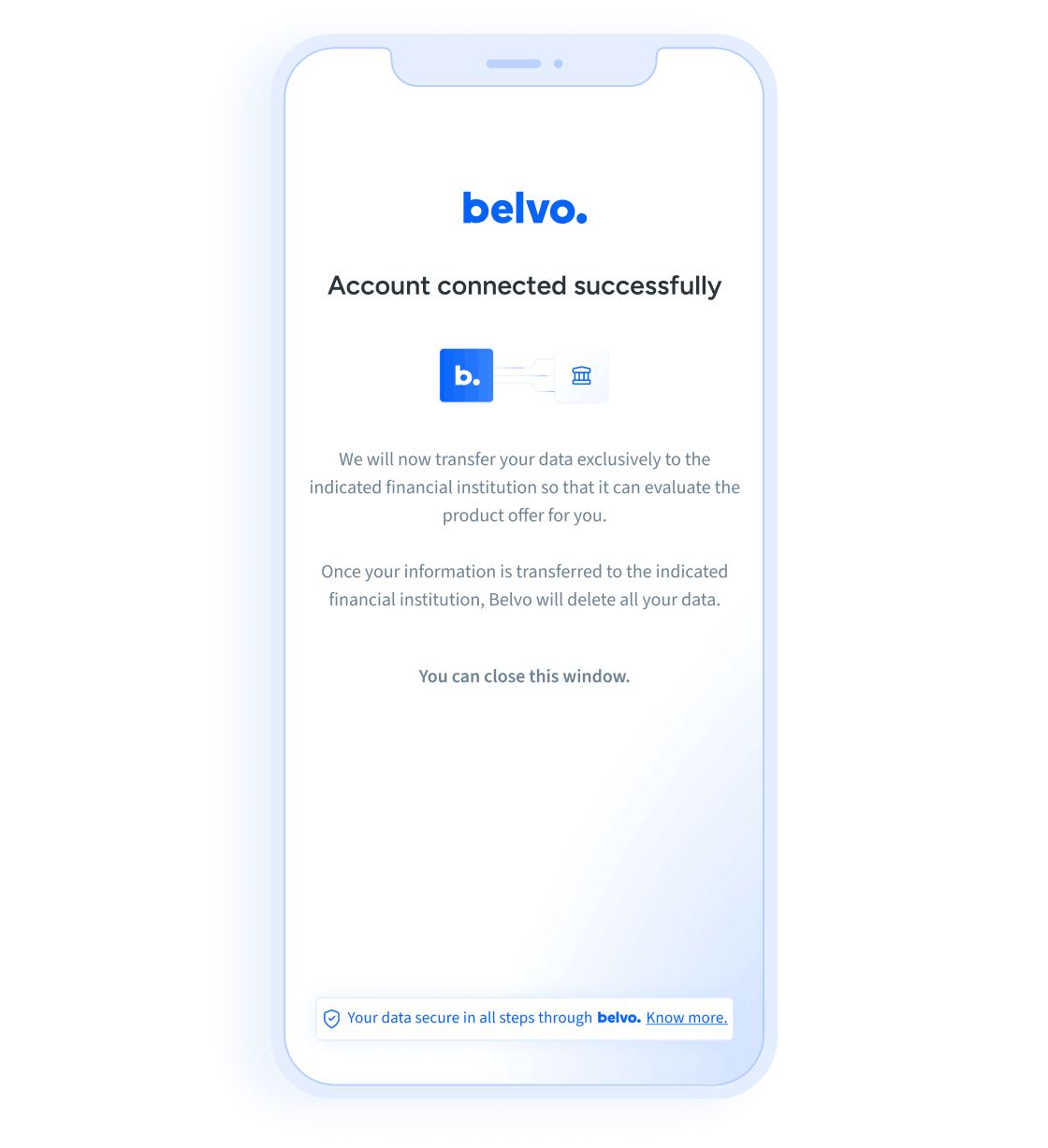

Thanks to Belvo, financial companies can easily and securely access your data without the need for physical documents.

By securely sharing your data through Belvo, you gain more control over your financial information as you can decide with which company you share it to access services that meet your needs.

Some of the benefits you can get by sharing your data through Belvo are:

Trust is the foundation of everything we do at Belvo. When you connect your data or initiate payments through our platform, you can be confident that your information is protected by industry-leading security measures.

Our platform was architected with a security-first approach, incorporating multiple layers of protection. Crucially, all data is encrypted at all times – both in transit and at rest – using advanced encryption protocols.

We are committed to upholding the highest standards of data protection and privacy, as demonstrated by our ISO 27001 certification and PCI DSS compliance.

These internationally recognized certifications are not just badges; they represent our ongoing dedication to maintaining a robust and continuously improving Information Security Management System, ensuring your peace of mind.

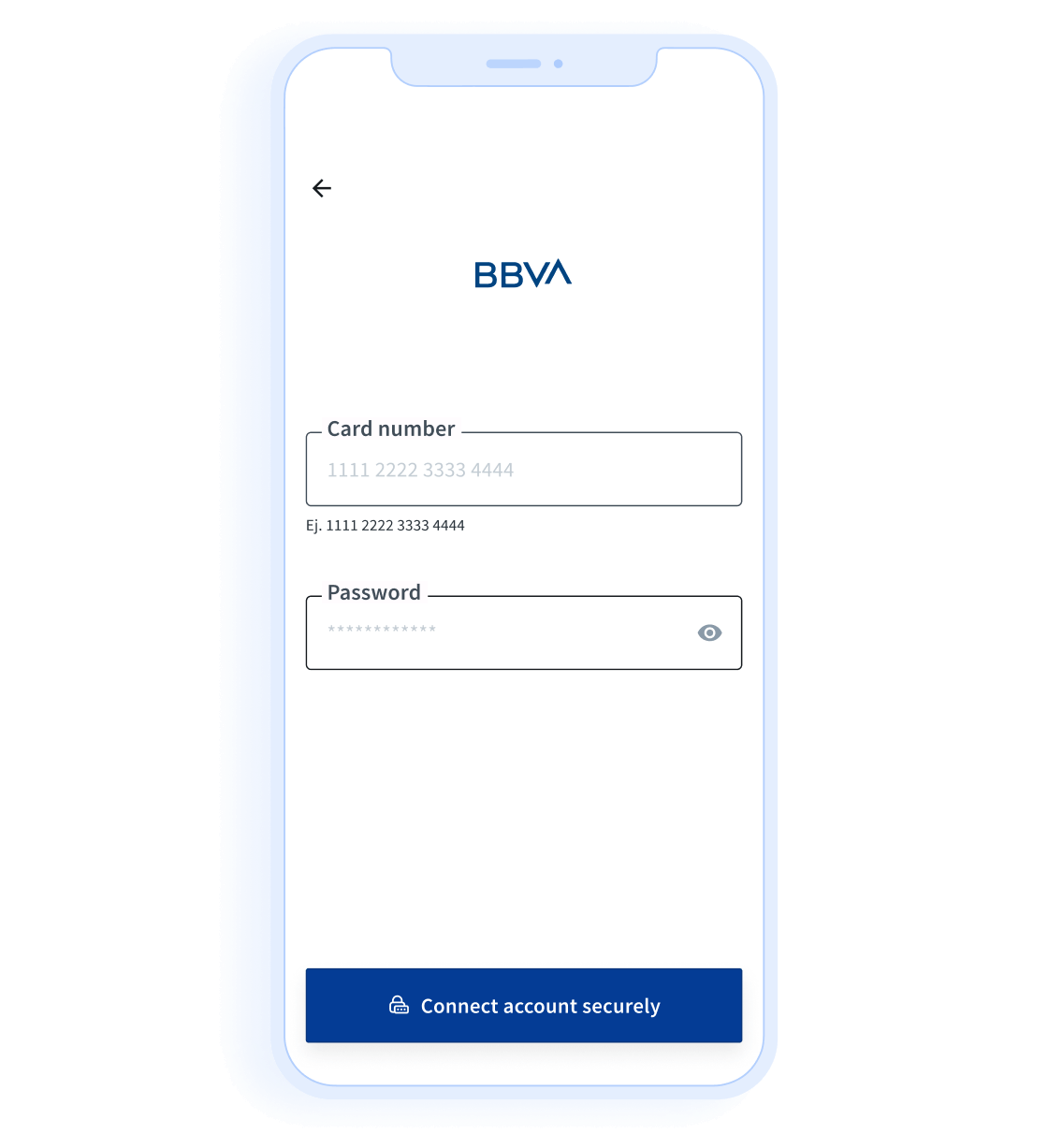

To share your financial information with companies using Belvo, you need to either connect your bank account (banking data and payments) or enter your credentials (fiscal and employment data). Belvo then encrypts and securely stores this information and safely extracts data from your account using a read-only access mode, always with your permission and without ever exposing its content.

To protect your privacy and security at all times, Belvo employs strong encryption that turns your credentials into unreadable data, while your keys remain safe in a private vault.

Neither Belvo nor the services using our platform will have direct access to your credentials at any time, and they will only be used to access your data with your permission through an automated and secure computer system.

Belvo works with hundreds of financial companies in Latin America, including some of the major banks in Mexico and Brazil, as well as neobanks, digital wallets, and credit providers. Some select customers include BBVA, Banamex, Bradesco, Santander, Mercado Pago, Nubank, and many more.

At Belvo, we believe that security and privacy are fundamental. We achieve this through advanced technology, a skilled team, and a dedication to exceeding best practices.

Our platform is designed to protect your financial information throughout its entire journey. We have multiple layers of security, so even if one layer is breached, others are still in place. This includes:

Belvo doesn’t just rely on current practices to make open finance more secure, we keep updating our defenses with the latest safety measures.