After two days of learning and networking, we’ve had the chance to realize that Open Finance is truly reshaping the financial ecosystem and that there are many stories to be heard from the people building it. We went from analyzing the foundations of the fintech movement in Latin America to looking at the success stories that these models are already enabling.

See the panels and workshops from Open Views 22. 👇

Table of Contents

- Regulation talks: the state of Open Finance in Brazil and Mexico

- How Open Finance is enabling success stories in Latin America

- Payments, Reimagined: Pix and Open Finance in Brazil

- Fireside Chats: Ualá and Neon success cases

- The building blocks for Open Finance

- Hands-on with Open Views workshops

Regulation talks: the state of Open Finance in Brazil and Mexico

🇧🇷 The state of Open Finance regulation in Brazil

To discuss the state of Open Finance Regulation in Brazil, Latin America’s most advanced ecosystem regarding the implementation of the model, we asked fintech advisor Bruno Diniz to moderate a panel discussion with Banco Central do Brasil’s Diogo Costa (Head of Division), Neon’s Larissa Arruy (VP Legal), and Banco do Brasil’s Karen Machado (Open Banking Executive Manager).

During the conversation, panelists talked about the advancement of the model, led by Banco Central do Brasil, the main challenges for regulated institutions to adopt, the expectations for innovation, and how competition fomented by Open Finance data will bring better products and experiences for customers in the country.

🇲🇽 The state of Open Banking regulation in Mexico

Discussing the current state of Open Banking regulation in Mexico and the expectations that the market has for the regulator’s next steps, we were happy to host a very lively debate with guests Diana Zamora Bonnet (Mastercard), Ernesto Calero (Fintech Mexico), Rocío Robles (Tenet Consultores), and journalist Fernando Gutiérrez (El Economista ).

How Open Finance is enabling success stories in Latin America

🤑 VC and fintech hypergrowth in Latin America

Why are venture capitalists looking to Latin America and investing a record $15.3 billion in financial companies in the region? And what are the trends for the future as the financial ecosystem evolves?

We invited TechCrunch reporter Mary Ann Azevedo to ask seasoned investors like Angela Strange (a16z), Nicolas Szekasy (Kaszek), and Nick Shalek (Ribbit Capital) for their insights, including the importance of investing in API platforms and other infrastructure players to help build next-generation finance solutions.

🏦 Banks and Open Finance: how can institutions benefit from these models?

To share their views on how banks in Latin America can benefit from open banking today, we had the pleasure of receiving Carmela Gómez (Head of Global Open Banking at BBVA), Romina Seltzer (Senior Vice President at Visa – Products & Innovation) Esteban Domínguez (Head of Digital Business Development at Citibanamex), and Erick Rincón Cardenas (President of Fintech Colombia).

Watch the panel where our guests discussed open banking strategies, how to build engaging customer experiences and their perspectives on the future of Open Finance.

📈 How will Open Finance impact investments?

From helping banks make more personalized investment offerings to allowing customers to decide faster on products with the help of automation, sharing Open Finance data has the potential to make investors out of millions of Latin Americans.

See what André Vilar (Founder & CEO at Monis), Antonio Rocha (CEO and co-founder at Onze), and Belvo’s Operation Lead Leandro Pupe Nobrega discussed about these challenge and the responsibility of educating the public and offering good products as access increases and user journeys become simpler.

💳 Building new credit models through Open Finance

One of the major promises of Open Finance in Latin America is to improve risk assesment for banks and then increase access to credit offers for the population, as well as small and medium businesses.

To talk about this scenario in the Brazilian landscape, we invited Infomoney reporter Giovanna Suto to moderate a panel with Leonardo Enrique Silva (Head of Open Banking at Serasa Experian) and Henrique Seije Nogueira (Chief Data & Analytics Officer at Afinz).

🏍 The gig economy opportunity for fintech in Latin America

The gig economy phenomenon is booming in Latin America, and these companies also have a role to play in the Open Finance ecosystem as institutions use APIs to connect to data from gig economy apps.

Industry leaders Fernando Gonzales (Rappi) and Arnoldo Reyes (Visa) talked to Edwin Zacipa, from Latam Fintech Hub, about how digital habits are shifting in Latin America and debated how these growing “super apps” could merge with fintech services.

Payments, Reimagined: Pix and Open Finance in Brazil

Financial innovators across the globe have marveled at the adoption of Pix in Brazil, one of the most successful instant payments systems in the world, with more than 107.5 million registered accounts in less than two years of implementation. How will this system and open banking models work together?

For Glauber Mota, CEO of Revolut Brasil, Leonardo Franco, from Amazon Pay, and Felipe Cunha, from Google Pay, the payment revolution in Brazil is just beginning, and the Pix system will work together with Open Finance to improve customer experiences when shopping online and in person and make lives easier for businesses and banks. See the panel, which was moderated by Belvo’s payment strategist Mariana Cunha e Melo.

Fireside Chats: Ualá and Neon success cases

We put the spotlight on Uala’s success story during a fireside chat where its COO Mariana Franza talked about the story behind this company, the value of data, their vision around Open Banking, and their next steps.

For our second fireside chat, we discussed the case of Neon, one of the fastest consolidated neobanks in Brazil, with Paula Martinelli, who talked about how the company focuses on its mission to create social change and empower Brazilians.

The building blocks for Open Finance

All of the possibilities for product, innovation, and financial inclusion discussed in Open Views would not be possible without reliable infrastructure players to build the blocks that make financial transactions and data sharing as simple as possible for the consumer, with easy-to-integrate solutions for institutions and secure processes.

💻 How we build products at Belvo

Ray Shan, VP of Product at Belvo, presented a keynote session in which he highlighted some of the main elements that guided Belvo over the last 3 years and allowed us to become the leading financial API providers in Latin America: think big, do things that don’t scale, make local solutions for local customers, and focus on building our company with the best talent to build the best products.

Read more about product building at Belvo and how we created a hiring culture in which the best talent can grow.

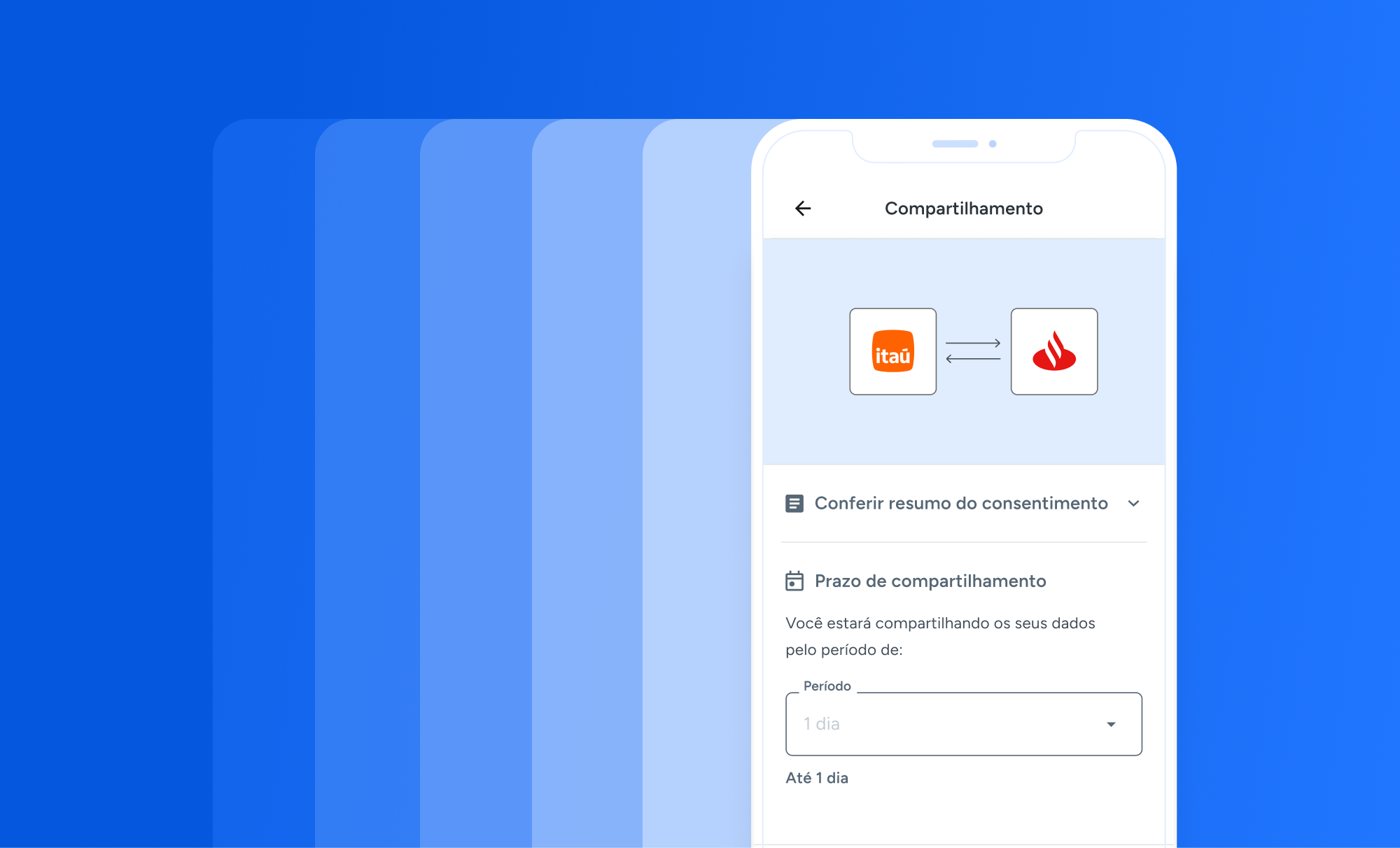

🔐 How to build secure and compliant customer journeys

Compliance is one of the most important aspects that regulated entities need to address to enter the open finance ecosystem.

For this panel, Giuseppe Ciotta (VP of Engineering at Belvo), Claudia Bellido (Financial Services Compliance specialist at AWS), and Matt Spitz (Head of Engineering at Vanta) discussed how to achieve compliance without sacrificing agility in a conversation with two major keypoints: good security is good engineering, and when compliance is a core value, building trust isn’t done at the expense of growing fast as a company.

🤝 Building trust in Open Banking

One of the main challenges in the new Open Finance ecosystem is communicating the value of sharing financial data, and, from then, earning trust from partners and consumers.

To discuss strategies to building reliable and safe APIs, Belvo’s Co-Founder and Co-CEO Uri Tintoré invited Dileep Thazhmon (Co-Founder and Co-CEO of Jeeves), Juan Guerra (CEO of Revolut Mexico), and Jesse Dhillon (Co-founder at Basis, previously Product at Plaid) to share their experiences leading key companies in the ecosystem.

Hands-on with Open Views workshops

After watching these panels, we invite you to put knowledge to practice with workshops powered by Belvo.

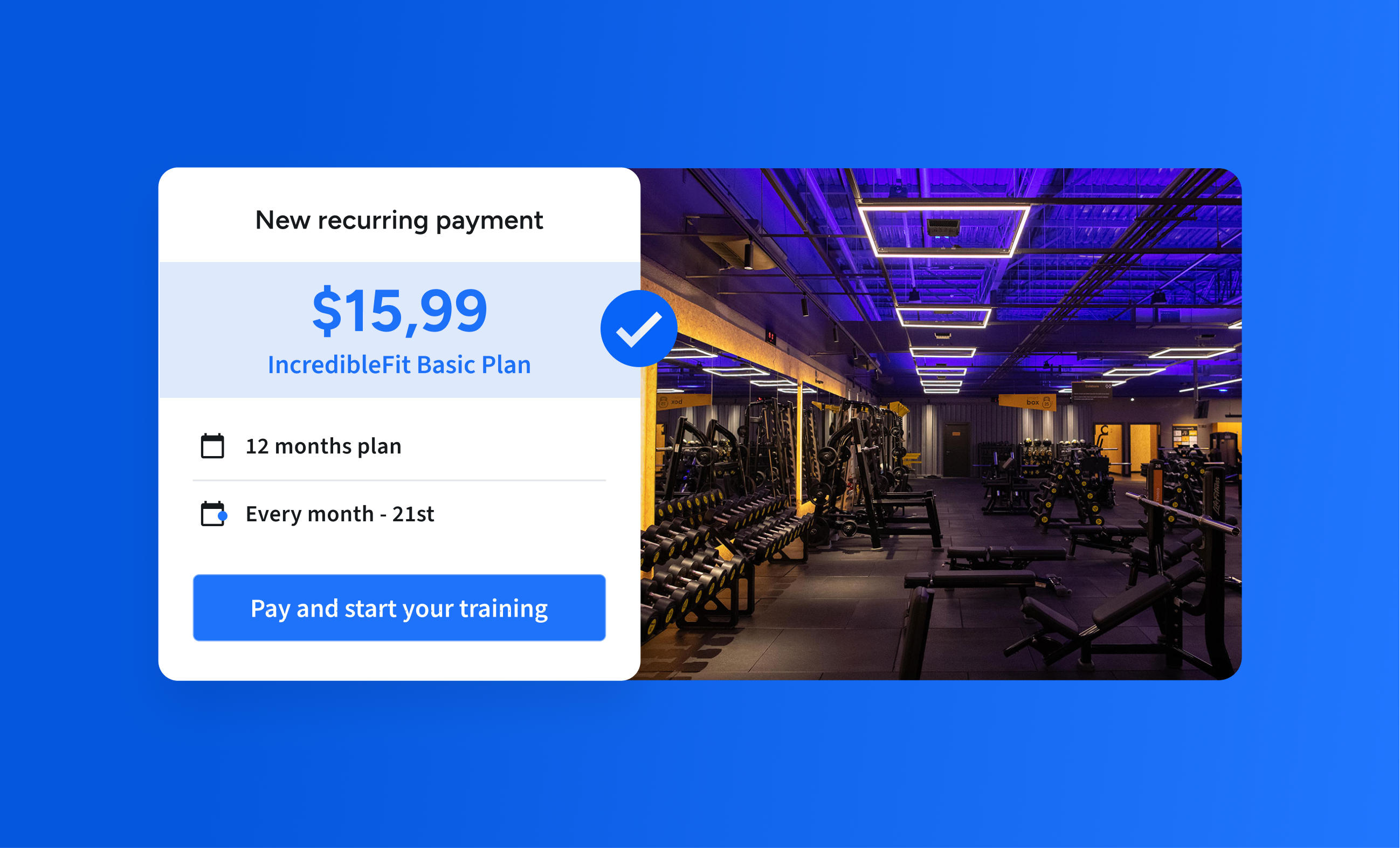

✅ See UX best practices to improve conversion rates, with Adrián Lombera and Yasmin Lima, Belvo’s Product Designers.

🪙 Learn what’s next for Open Payments, with Jero Llacay, Belvo’s Senior Product Manager

📊 And finally, learn from Leandro Pupe Nóbrega, Belvo’s Operations Lead about how to extract value from Open Finance data.

Subscribe to Belvo’s YouTube channel to keep up with new content about Open Finance in Latin America.