Here you’ll find everything you need to know about the Belvo Connect Widget: how it works, what it’s for, and the benefits of integrating it into your app.

At Belvo we know that user experience is ‘king’. People are looking for fast, immediate, and convenient interfaces to manage their money on a daily basis. And, in the fintech universe, one of the keys to achieve this is to offer them easy ways to connect their financial data with the apps they want to use in their daily lives. For example, to access credit options tailored to their needs, smart saving tools, or apps to create budgets based on their expenses in real time.

All these solutions have one thing in common: they require companies to be able to easily and securely access their users’ banking data.

How to connect accounts in seconds ⚡️

Until now, many companies still relied on manual systems to solve this challenge, such as requesting bank statements and payroll receipts from customers. But to make it easier – and to eliminate as many manual tasks in the process as possible – we developed the Connect Widget. An account authentication interface that companies can easily integrate into their digital products to give their customers the option to securely link their bank accounts with their apps in just a few clicks.

This gives companies direct access to verified information about their users. For example, to determine whether they are eligible for a loan or to offer them personalized savings advice. And from their side, users can (finally!) forget about having to manually submit documentation, such as PDFs and bank statements, and receive a response from the company as soon as possible.

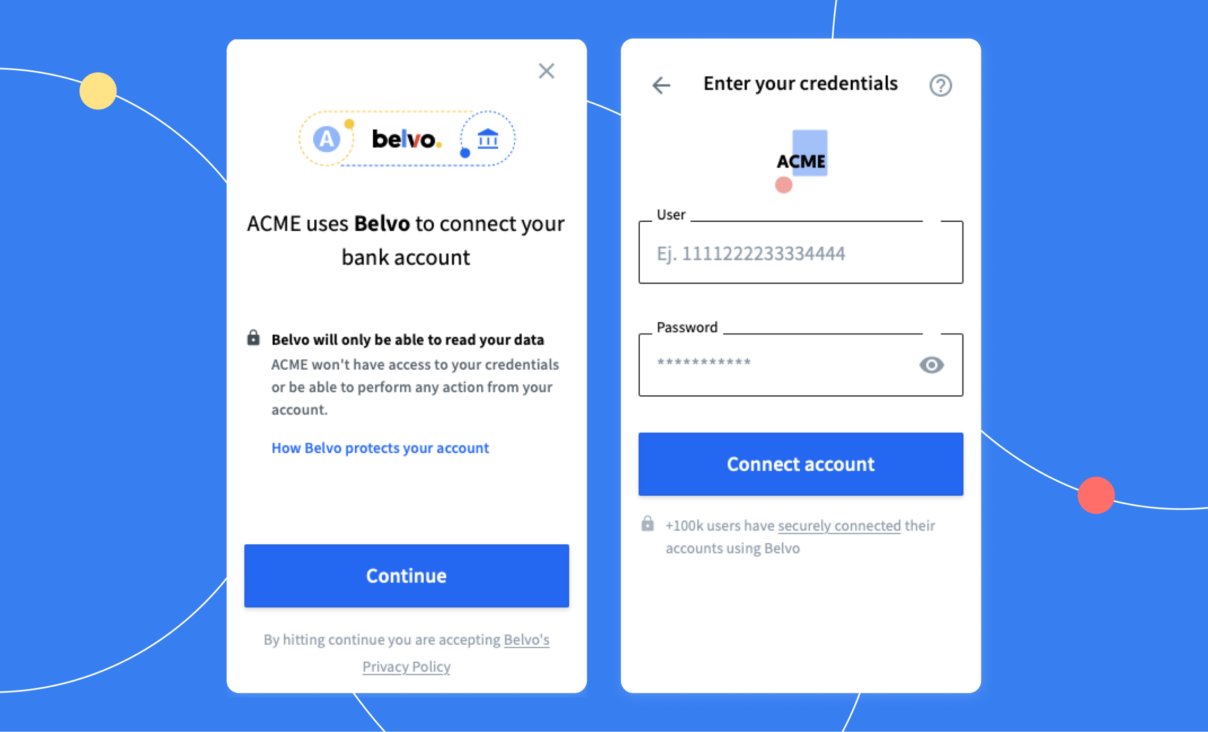

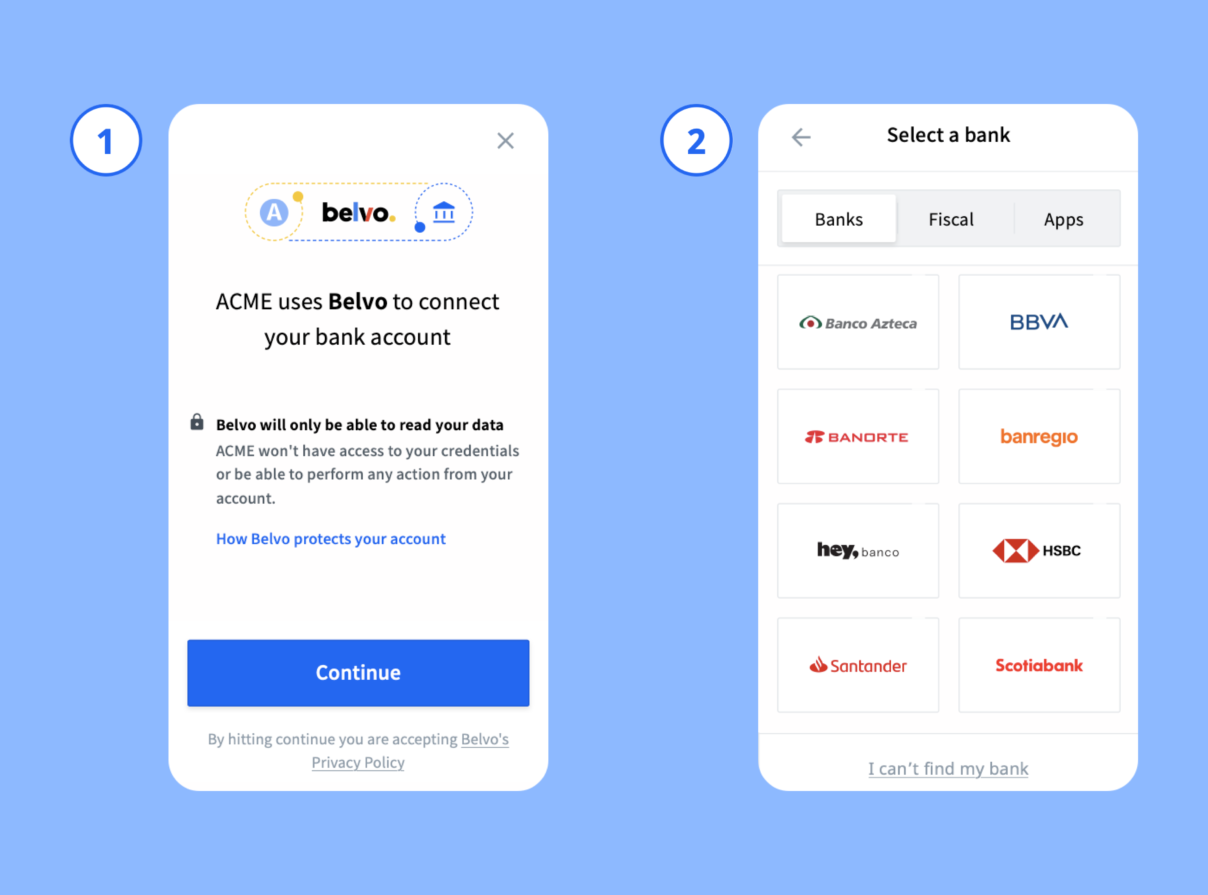

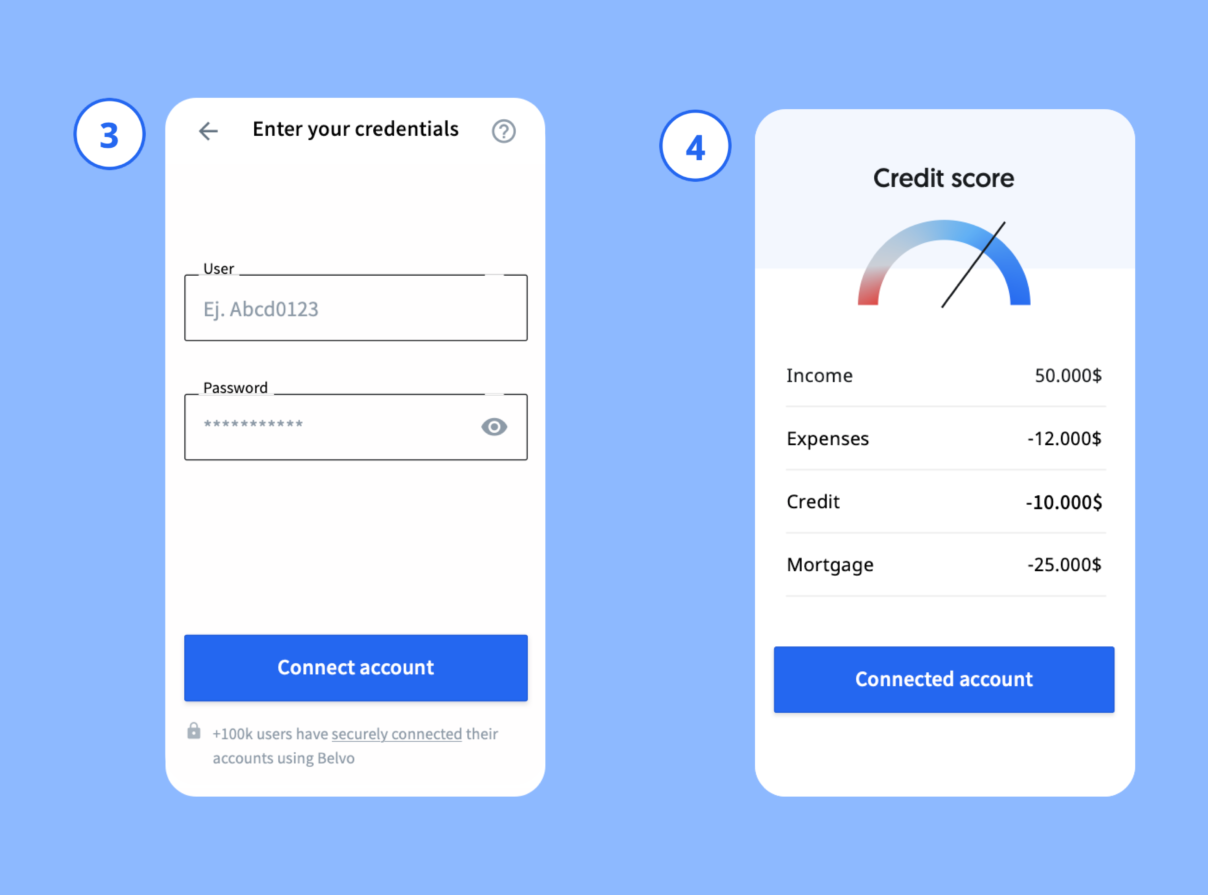

To connect their accounts using the widget, users need to follow simple steps. First –and without leaving your app–, they will be asked to securely connect their accounts. Then, they will be able to choose the financial institution they want to connect to your app.

After that, they will connect their account by securely entering their login credentials. And, in just seconds, all their financial information will be automatically connected to your app!

Through this process, Belvo creates a secure and robust connection between your customer’s bank and your application, which is constantly updated with real-time data.

Minimum integration time ⏱

At Belvo we want the integration of our product to be as quick and easy as possible. That’s why we designed the Connect Widget as a 100% plug-and-play tool, which means that it is ready to be integrated into any product and start working immediately, without the need to spend a great deal of time and resources.

Companies can integrate the widget in less than an hour, as opposed to the months of work it would take them to develop from scratch a solution to connect their products with the great diversity of banking institutions that their users may require.

If you want, you can take a look at the documentation we have prepared to make it even easier to integrate the widget into your product.

Designed to solve any UX scenario 🤸🏽♂️

The challenge fintech companies face is not just to create the connections they need to access their users’ data at financial institutions. But to build an excellent user experience on top of it, ensuring that users can easily connect their accounts, without friction, in any circumstance and on any device.

Through the widget, Belvo automatically handles all possible scenarios that users may face when connecting their accounts, both in web and mobile applications. This includes the combination of a wide variety of factors that institutions may require when connecting an account: whether it’s asking customers to enter a username, password and PIN, using a physical token, or even scanning a QR code.

We handle all these possible scenarios at the different institutions and create specific solutions to solve each of them (so that you can forget about it!). And of course, ensuring maximum end-to-end security thanks to strong encryption mechanisms that protect data privacy and security at all times.

Improve user conversion rate 📊

When building Belvo’s Connect Widget, we have brought together industry best practices to increase user conversion during the connection process.

To achieve this, we constantly analyze and monitor user behavior to detect opportunities to improve the experience and provide the necessary support to ensure the highest possible success rate when connecting accounts.

This is the case for companies like askRobin: if before using Belvo their customers had to manually enter their financial data in the app to access personalized offers, now they only have to follow the steps of the widget and, almost instantly, the company can securely access their information without requiring additional processes.

| Conversion rates x4 This solution enabled the company to quadruple the conversion rate of their users, as well as multiply their revenue per transaction sixfold. 👉 They told us how they did it in this case study. |

Customizable for any use case ✔️

Another advantage of the widget is that it can be customized according to the needs of companies, which can incorporate their logo and brand colors. In addition, it can be adapted to the different use cases they may require. For example, a credit company may need a different type of information than a neobank or a financial management tool.

At Belvo, we know that there is relevant data about users’ financial lives that may not be in the banks. Something especially relevant in a market like Latin America, where in some countries up to 50% of users do not have an account in any traditional entity.

For this reason, the Connect Widget also allows you to connect with financial data from other institutions, beyond banks: such as tax entities like the SAT in Mexico.

If you want to see how our Connect Widget works, explore our demo, and if you want us to help you integrate it into your product, please contact us.