Belvo is the first in the market to allow access to standardized and enriched data from both regulated and non-regulated institutions through a single platform.

Exciting news in the Open Finance ecosystem in Brazil: with Belvo, regulated institutions in the country will now be able to access high-quality Open Finance data without spending time and resources on development and maintenance.

Through Belvo’s new Open Finance product, which is compliant with the guidelines from Banco Central do Brasil (BACEN), financial innovators now have an easy and secure way to access end-user data according to present and future regulations.

Thanks to this, Open Finance regulated companies won’t need to develop their own technology in order to communicate with other institutions’ APIs. Instead, they can access updated and standardized customer information through a single and easy-to-integrate interface with the highest levels of safety and conversion.

Belvo is the first in the market to allow access to data from both regulated and non-regulated sources through a single platform, enabling companies to navigate the current coexistence of regulated and unregulated models in Brazil.

“A solution like this has tremendous value for regulated financial innovators, who won’t have to go through the laborious processes of developing and maintaining the connection to hundreds of Open Finance APIs. These and other strenuous tasks, like normalizing data from different banks, extracting insights from raw data through advanced analytics, and keeping up with regulatory demands, are Belvo’s core expertise”, says Albert Morales, Belvo’s General Manager in Brazil.

“We want our clients to save time when consuming Open Finance data while we do the hard work so they can focus on building new products for their customers”

Albert Morales, Belvo’s General Manager in Brazil

This new solution was presented by Belvo's cofounders Pablo Viguera and Uri Tintoré during the Open Views 22 conference's opening keynote. Watch their presentation here.

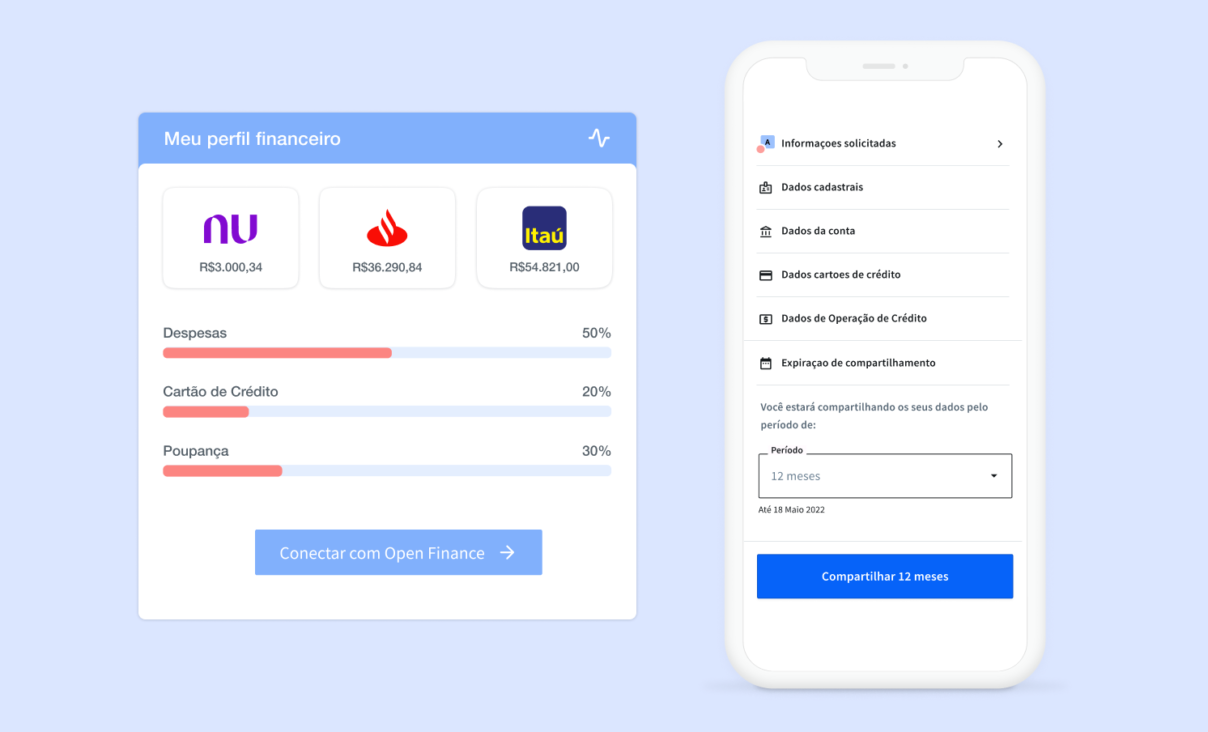

An optimized and compliant UX journey

As the implementation of Open Finance in Brazil increases throughout its final phases in 2022, regulated companies (S1 to S5 segments as well as Credit Societies and Payment Institutions) will need to not only build the necessary infrastructure to connect and send user data, but also invest in models for categorizing and extracting intelligence from this information.

This product is designed to make this process easier and faster for all these companies and help them start benefiting from regulated models in Brazil with less effort.

“Open Finance is already a game-changer for financial innovators in Brazil, like PSD2 in Europe and Open Banking in the UK have been for both fintechs and traditional institutions, and has huge potential for growth. We are excited to facilitate the transition to this new scenario in Brazil”

Pablo Viguera, Co-Founder and Co-CEO at Belvo

Through Belvo, regulated players will be able to consume Open Finance data from multiple sources through a single interface that they will be able to customize depending on which financial institutions they need to connect to.

This is made possible through a first-class user journey built by Belvo following Open Finance official guidelines. Companies just need to embed Belvo’s widget in their product to allow their end-users to easily consent to share their information. End-users will be redirected through a seamless process and have the option to consent to share selected information with the institution of their choice.

Make the most of Open Finance data through enrichment

Using Belvo’s Open Finance solution, regulated players will be able to receive consumer data in an already consistent and standardized format, with fewer API calls than they would have to make in a regular search of Open Finance databases.

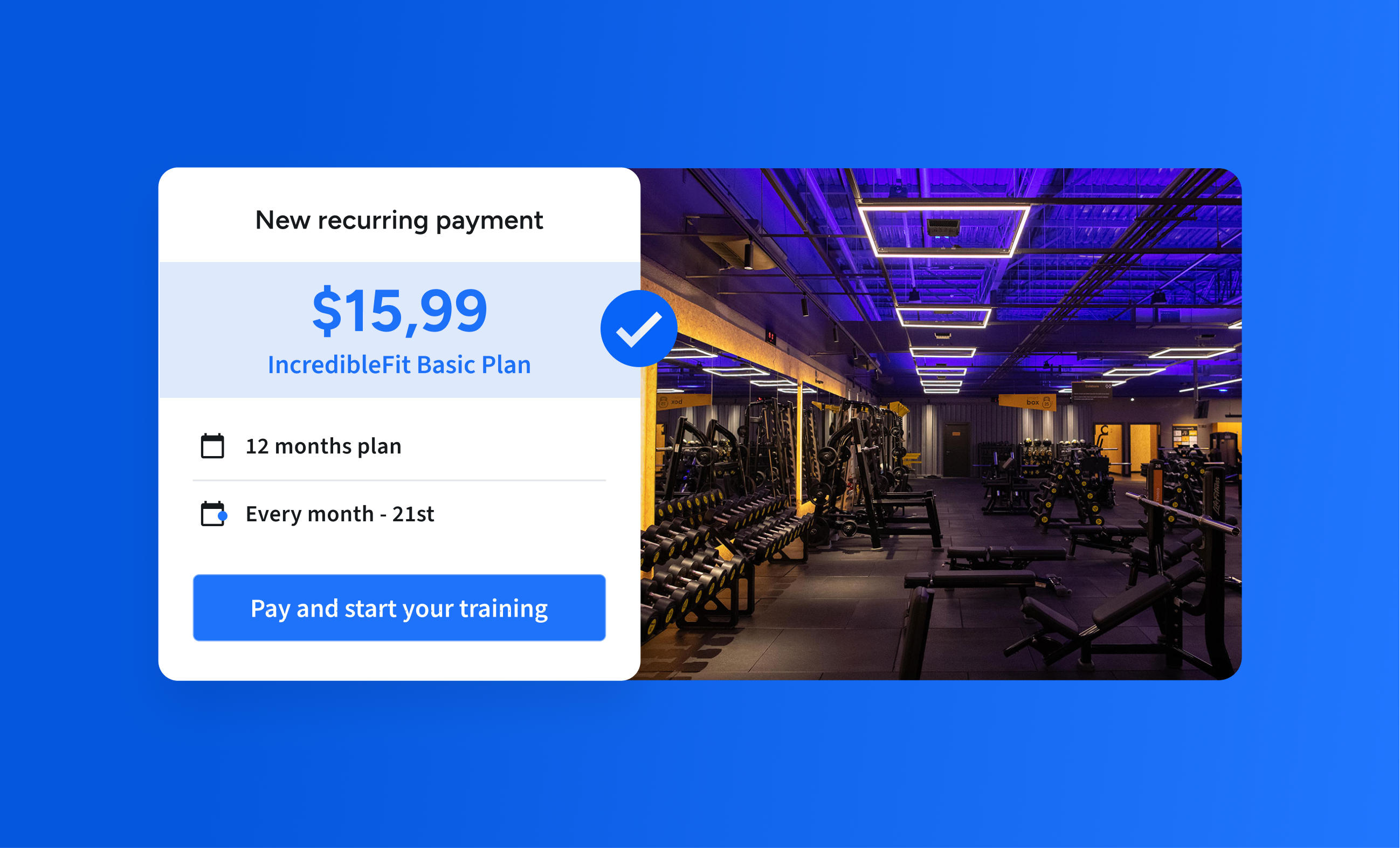

For instance, if an institution requests transactional information for a specific customer, Belvo can provide a whole set of categorized data, as well as additional information from different sources associated with that customer, like checking accounts, credit card accounts, or loans.

Additionally, customers can benefit from Belvo's existing categorization and data science capabilities through its enrichment products.

Enrichment solutions such as income verification and risk insights allow financial innovators to speed up time-to-market by leveraging the intelligence that Belvo has collected through the analysis of millions of transactions, and use it to build better and more innovative products, faster

Albert Morales, Belvo’s Brazil General Manger

With access to enriched data, banks can build stronger risk models to create personalized credit offerings, consolidate all customers’ financial account data in one single platform in order to better understand spending habits, and build better personal financial management features.

Learn more about our solution here.