Belvo has been one of the companies selected among the 30 most promising businesses of 2021 by Forbes in Mexico.

Each year, the business magazine recognizes through this selection in Mexico the work of 30 entrepreneurs for their contribution to society. In this year, marked by the health crisis, Forbes advocates that Mexican entrepreneurs have “the formula to lead the recovery”. “Disruption and creativity are the indispensable components of success,” adds the magazine.

Belvo, the leading Open Finance platform in Latin America, has been one of those selected in this year’s list. The magazine has recognized its work helping financial institutions, banks and fintechs interpret their users’ banking and financial data through its API platform.

“Our API is the easiest way to connect bank accounts and financial data to fintech applications,” Belvo co-founder and co-CEO Pablo Viguera explained to Forbes in an interview.

Building the infrastructure

The magazine covers the journey that led Belvo founders Pablo Viguera and Oriol Tintoré to the creation of the company in 2019. After their experience working in financial technology companies in Europe, and later in Latin America, the founders realized that the lack of financial infrastructures prevented fintechs and other entities from being able to take advantage of the true potential of technology in the region.

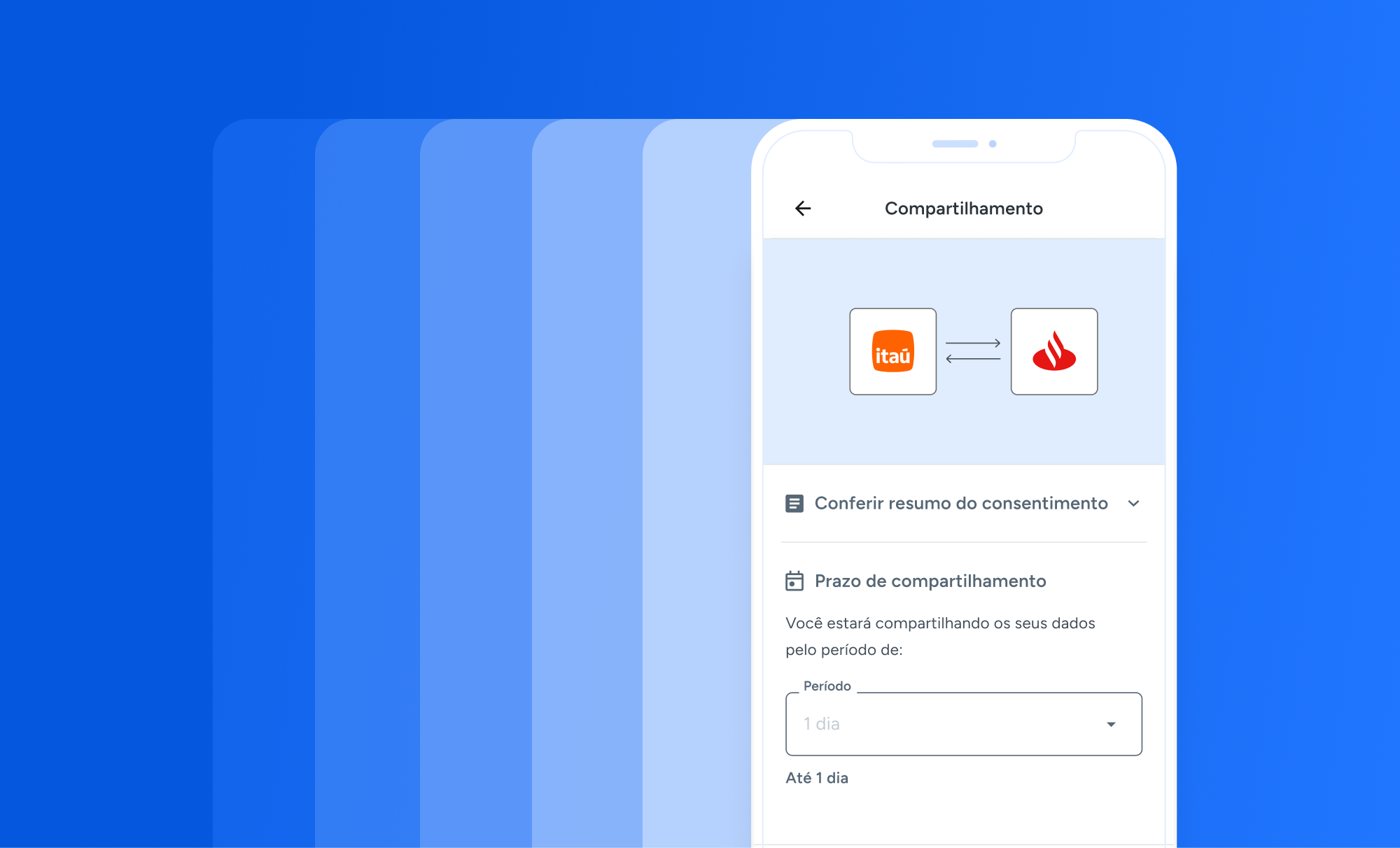

From this came their motivation to create an Open Finance API platform. This technology acts as a secure communication channel that allows users to share their financial data hosted by banks or fiscal institutions with other companies. These companies can then extract, analyze this data and link their products to it in order to offer users more innovative financial services.

Aggregation, enrichment, and payments

Today, the company offers its clients data aggregation services, which enable access to users’ financial information in Mexico, Brazil, and Colombia from more than 40 institutions.

In addition, earlier this year the company launched its first data enrichment solution. This is an income verification product that enables companies to obtain an accurate picture of their potential customers’ ability to pay in order to offer them credit products that are more tailored to their needs.

Looking ahead to 2021, Belvo plans to continue expanding its coverage of financial institutions in Latin America and it will continue to launch data enrichment solutions. But also, Belvo is already working on the launch of its first payment initiation solution. This will allow making payments and moving money directly from fintech applications, such as neobank wallets, without the need to leave these apps to perform the operation.

Photo: Pablo Viguera and Oriol Tintoré, founders of Belvo. Credit: © Oswaldo Ramírez / Forbes México.