This month we’ve added new business institutions to our coverage in Brazil, expanded our fiscal data sources, and made improvements to our Connect Widget. Discover what’s new in April at Belvo!

In some parts of the world, spring is coming with its flower bosoms, blue skies, and warmer temperatures. Unfortunately, it also announces the official season for the annual tax declaration 😱

But we have good news: to help our customers and their end-users navigate this process, we worked hard on our fiscal product to upgrade it with new data sources!

We also expanded our B2B banking institutions’ coverage in Brazil. And last but not least: there are still some seats available for Open Views 22 🎉

Product updates

Strengthening our SAT connection with new data sources

Fiscal data are very powerful because they provide insights for both businesses and individuals under the same format: tax declarations, invoices or tax returns for example. They are also a key component for accounting and ERPs’ businesses to monitor the economic activity of their customers and evaluate their financial health while reducing the risk of document forgery.

We just included a new data source for this product: tax retentions. Customers are now able to quickly access users’ tax retentions for received and sent invoices over a given period of time. Through this endpoint you can retrieve data such as the invoice’s amount, the total amount taxed and the ones exempt from taxation.

Combined with other data sources from our SAT connection such as returns or invoices, this product can help reduce the risks of manual errors by automatically synchronizing your clients’ fiscal activity and understanding their fiscal obligations.

Filter institutions in the Widget

Our Connect Widget allows end-users to connect their bank accounts to your app in just seconds. It works as a plug-and-play solution while providing the highest security standards and the best conversion rates.

To continue optimizing the user experience to increase conversion, we now offer search functionality within the widget. What does this imply? Starting from now, end-users have the possibility to look for the institution that they’re interested in by typing it directly in the search bar. In case we currently don’t offer it, a message pops up to inform the end-user.

New data sources and coverage

More coverage for Brazilian B2B banks

We said it before, and we’ll continue to do so: expanding our coverage with key financial institutions, requested by our customers, means a lot to us.

That’s why we’re excited to finally bring in da-house two newbies to broaden our coverage for B2B banks in Brazil. Retrieving data from business banks is essential for companies building new ERP tools.

- Banco Inter Business: for which you can access to the following data sources: accounts, balances, owners and transactions. And we support the following products: checking and credit cards accounts.

- Banco do Brazil Business: with which you can retrieve data for: accounts, owners and transactions for all the checking accounts.

With these new additions, we currently support 12 institutions in Brazil including Sicoob, Nubank and Banco Bradesco.

Belvo’s related

Open views 22 is coming

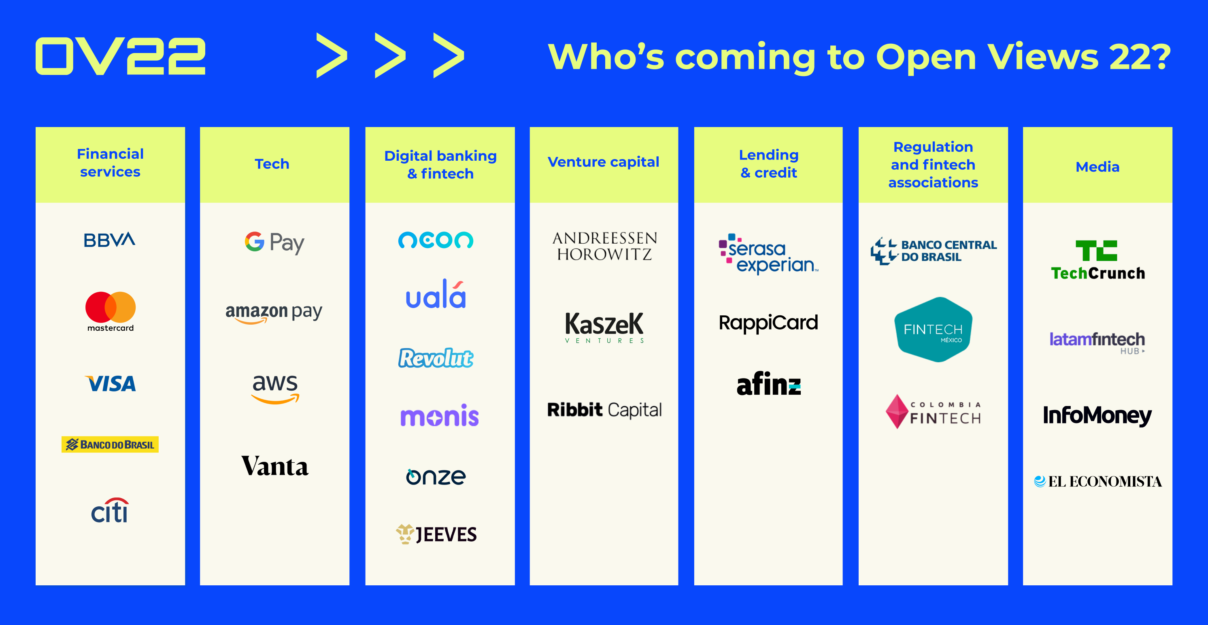

The event is just around the corner and we still have some spots left! The online event is free, will take place on the 18th and 19th of May, and will be followed by closing parties in CDMX, Bogotá and São Paulo.

The agenda is now closed! Registrants will be able to attend more than 15 talks with the participation of more than 30 speakers from the most relevant financial businesses in Latin America including Rappi, Mastercard, BBVA, Jeeves, Revolut, Neon, and many more!

We also organized three unique workshops focused on explaining real examples, products and user journeys to inspire and teach each others how to build innovative financial solutions. You can register here!