Belvo has released a report that looks into the trends that will impact the adoption of Open Finance in Latin America in 2021.

At Belvo, we’re on a mission to power the next generation of financial services in Latin America. And we believe that encouraging the development of the Open Finance movement is key to this achieve this end.

To understand what awaits in the near future, we prepared this Open Finance Trends in 2021 report. It explores six key trends to expect this year and analyzes new regulations, players, and models like embedded finance.

In order to gather relevant insights around these topics, we surveyed 150 professionals in the Latin American fintech sector. We also interviewed nine experts, including representatives from Visa and Mastercard, Mexico’s CNBV, and fintechs like Ualá and Mobills.

“By allowing the flow of financial data from banking and alternative sources to be easily and securely shared with others –and by generating insights on top of that data–, it is possible to build a more inclusive ecosystem. One where users can access the services they truly need at the best possible rates, and with the freedom to choose from a wider range of possibilities, ” explains Pablo Viguera, Co-Founder and Co-CEO of Belvo.

Speeding up digital adoption

The results of this report point at an accelerated demand for digital financial services in Latin America. The need for social distance has pushed millions of users to shop, pay bills, or access bank accounts digitally for the first time. And experts believe that these new digital habits will remain: 96.4 percent think that covid-19 will increase the digitalization of financial services. Almost half of them (47.3 percent) think that payment providers will be the more affected segment of the industry.

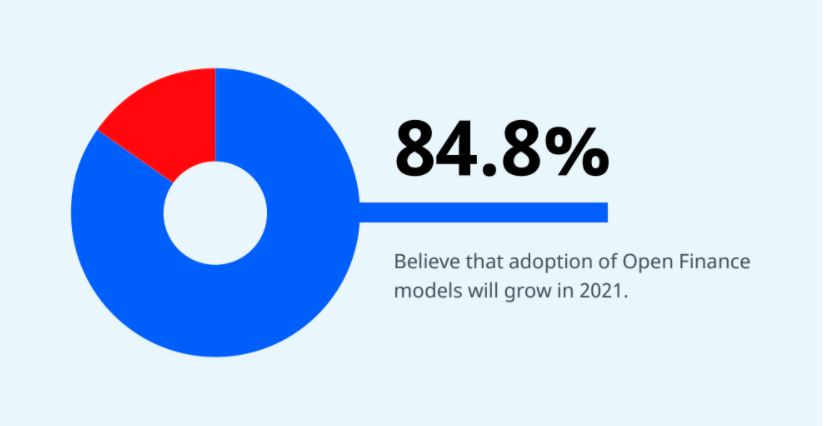

As a result of this increased demand, most professionals (84.3 percent) believe that the adoption of Open Finance models will grow in 2021. This will be driven by a more favorable regulatory environment (particularly in Mexico and Brazil) and more visibility about its benefits among end-users and companies.

And while 38.4 percent consider that regulation remains the biggest challenge, 90.2 percent think that companies should start preparing for this scenario. Technology providers like Open Finance API platforms will help build the necessary infrastructures to make it a reality.

A maturing ecosystem

Emerging non-traditional players –like fintechs, big techs, and gig economy platforms –, will increasingly invest in this new ecosystem. These players will help consolidate the popularity of these new business models. Either by forging alliances with financial institutions or by building their ecosystems with embedded financial services.

The growing maturity of the fintech ecosystem during 2021 will also lead to new and more sophisticated use cases. Beyond the access to data, companies will be able to add an extra layer of intelligence to their businesses thanks to data enrichment solutions. They will also start offering instant payment solutions through APIs directly within their apps.

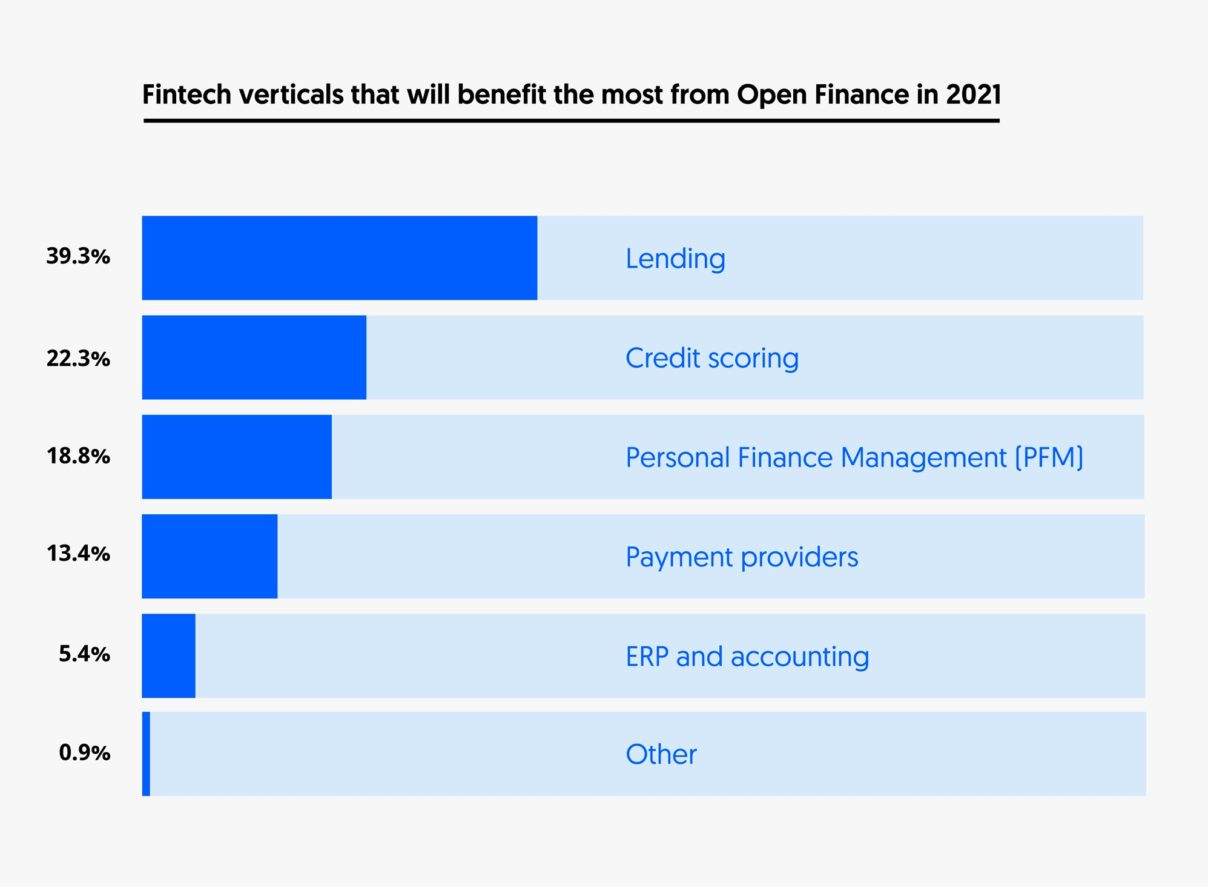

Lending companies will benefit the most from these new models, according to 40 percent of professionals. Followed by firms specialized in credit scoring (22.3 percent) and personal finance management tools (18.8 percent).

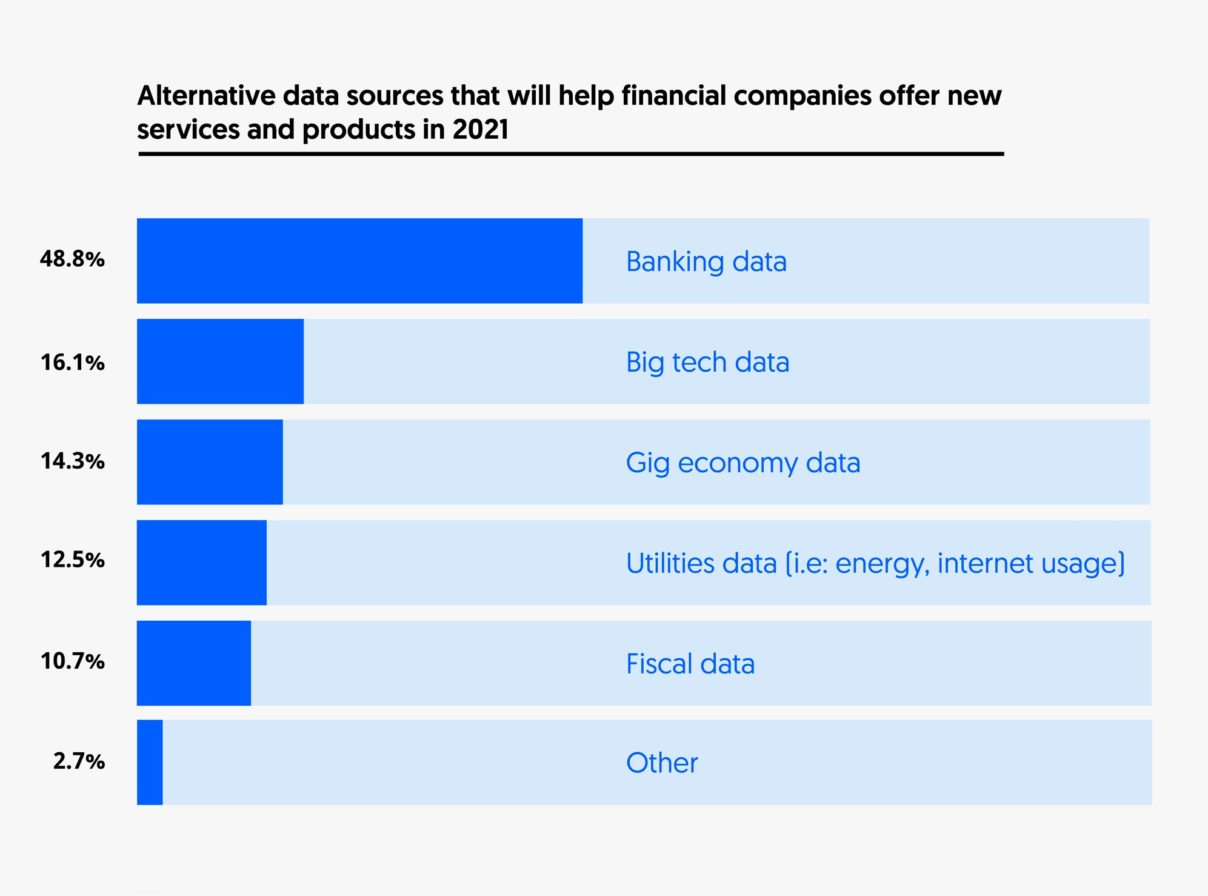

Alternative data sources will increase financial inclusion

Access to enriched data is the most relevant benefit of implementing Open Finance models, according to 32.1 percent of professionals. And a majority believe that using new alternative sources of data will help create better financial products in 2021.

Experts agree that this will lead to the development of more tailored and relevant financial products. And that these will reach people that are unbanked or underserved by traditional entities. Gig economy platforms will become increasingly relevant to build more inclusive financial products. These platforms have seen a surge in the employment of independent workers to fuel increasing demand.

If you want to learn more about the Open Finance trends across Latin America in 2021, download our full report.