CREDIT RISK

Reduce credit risk with Open Finance data

Get a clear picture of your customers' financial activities and income, better assess affordability and provide tailor-made credit products.

Trusted by the leading financial innovators

Strengthen underwriting processes while reducing risk

approve more borrowers

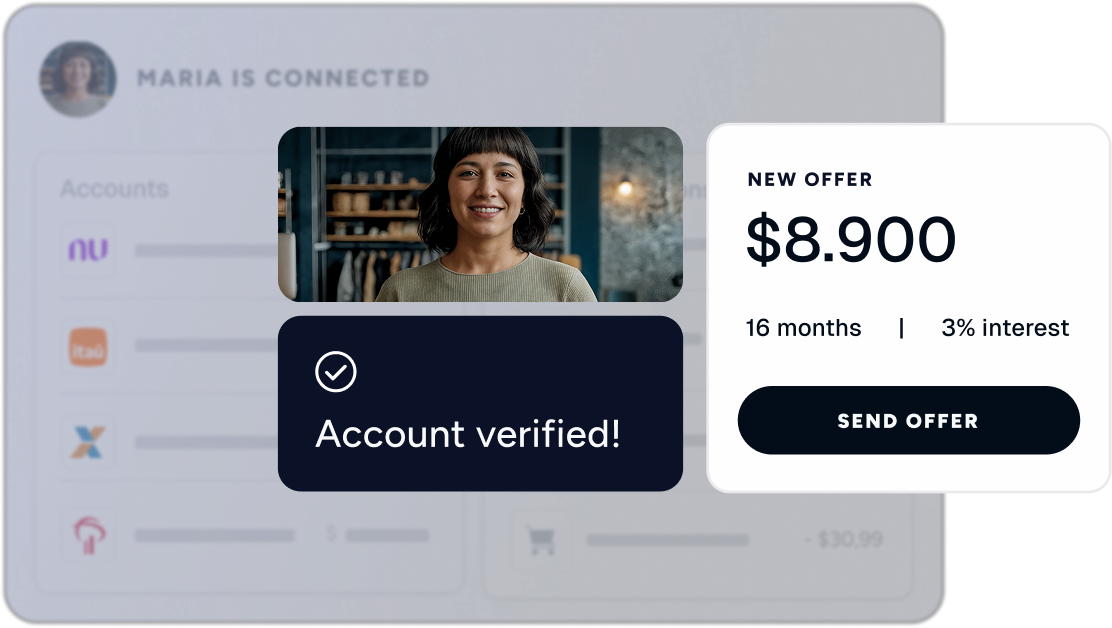

Stop rejecting creditworthy applicants due to a lack of history by analyzing transactional data and their true income.

slash payment default rates

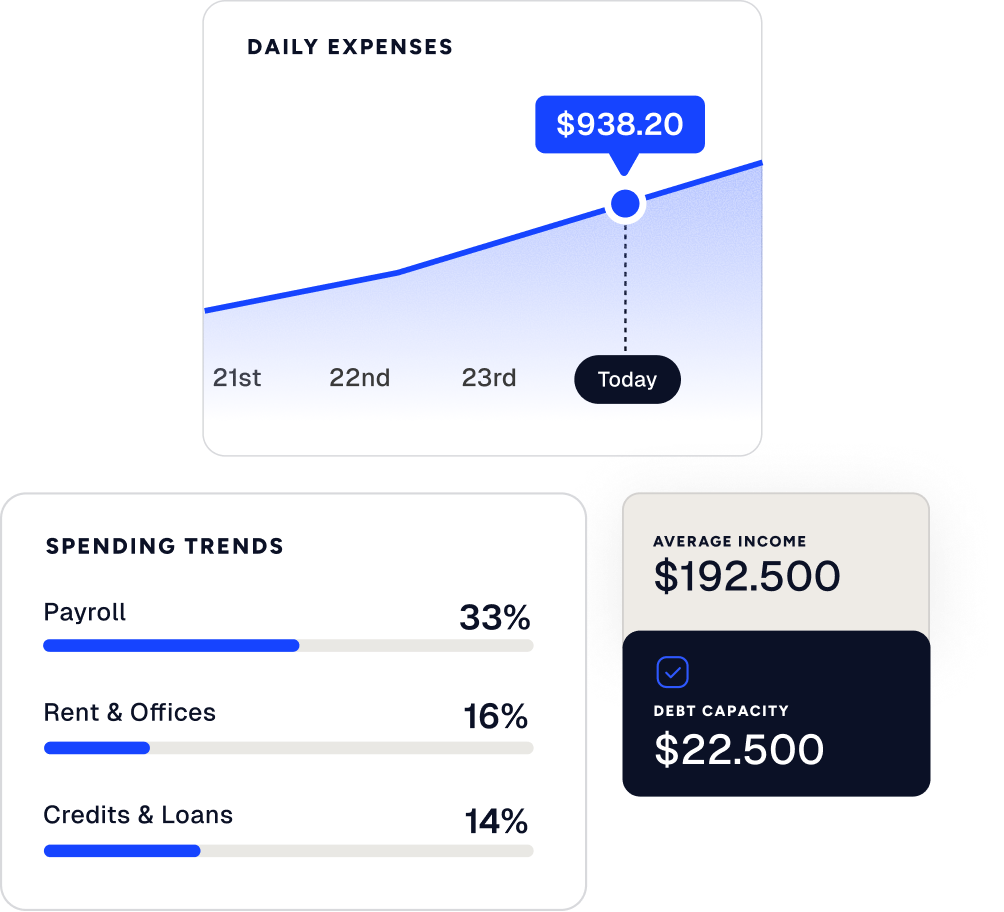

Get a borrower's actual financial health and income stability. Identify high-risk profiles that traditional reports overlook.

Automate your decisions

Automate the analysis of income and expenses to make instant decisions and close loans while intent is high.

Grow your portfolio and revenue by lending with confidence

reduce credit risk

in up to 50%

Get a thorough understanding of the applicants’ financial behavior and improve the accuracy of your underwriting processes.

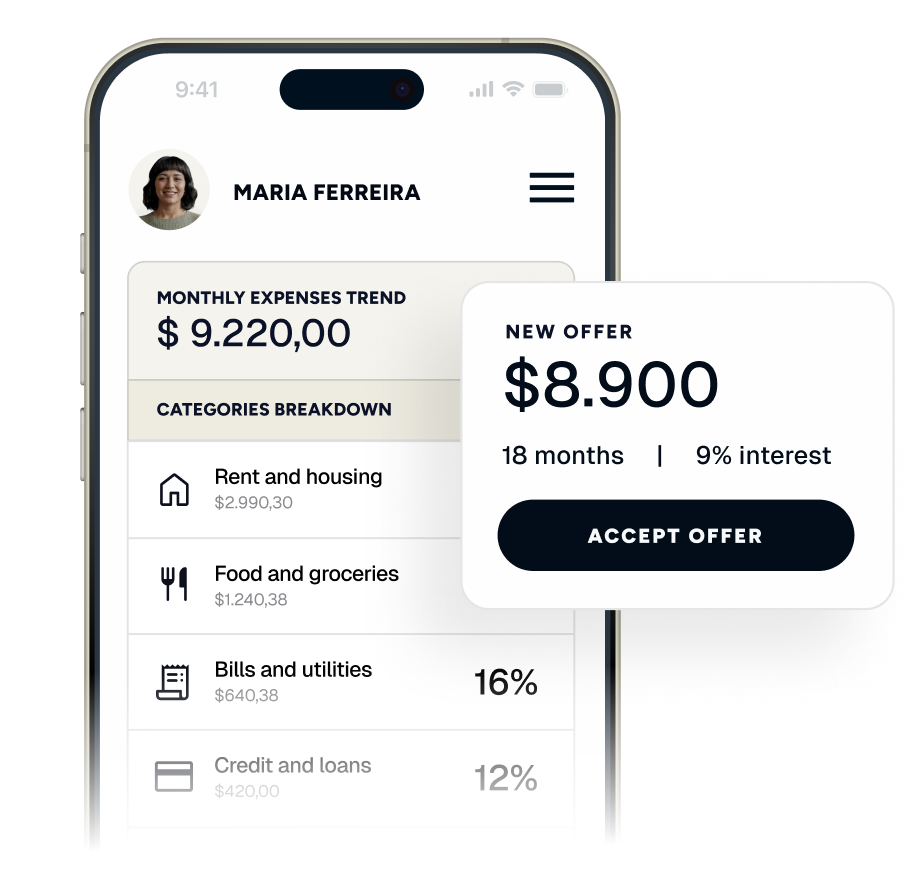

Personalize offers to boost acceptance

Use spending data to tailor loan amounts and repayment schedules to your user's actual cash flow. Increase uptake and ensure on-time payments.