These are three examples of innovations with a direct impact on consumers that are already possible thanks to open banking models in Latin America.

Great innovation comes with great changes in the way societies think. In the case of open banking, its main transformational premise is to give consumers control over their financial data: the information generated by a consumer always belongs to themselves.

And as the owner of their information, the consumer has the right to decide to share it with other institutions in order to have access to financial products and services that offer better conditions.

Examples of open banking in everyday life

Open banking is a powerful innovation that has contributed to accelerating the transformation of the financial sector, allowing new products and services to be built in a short time on the basis of a standardized API.

Today, companies and consumers of financial services in Latin America are already benefiting from financial infrastructure built on open banking.

Some business models that are already taking advantage of this technology today are:

- Innovative credit models to support the growth of startups and SMEs in the region.

- Automation of accounting processes that save time and money.

- Access to more convenient mortgage loans tailored to consumers' needs.

However, the financial industry in Latin America has other areas that could still be modernized thanks to this alternative source of information, both by fintech companies and the traditional financial industry.

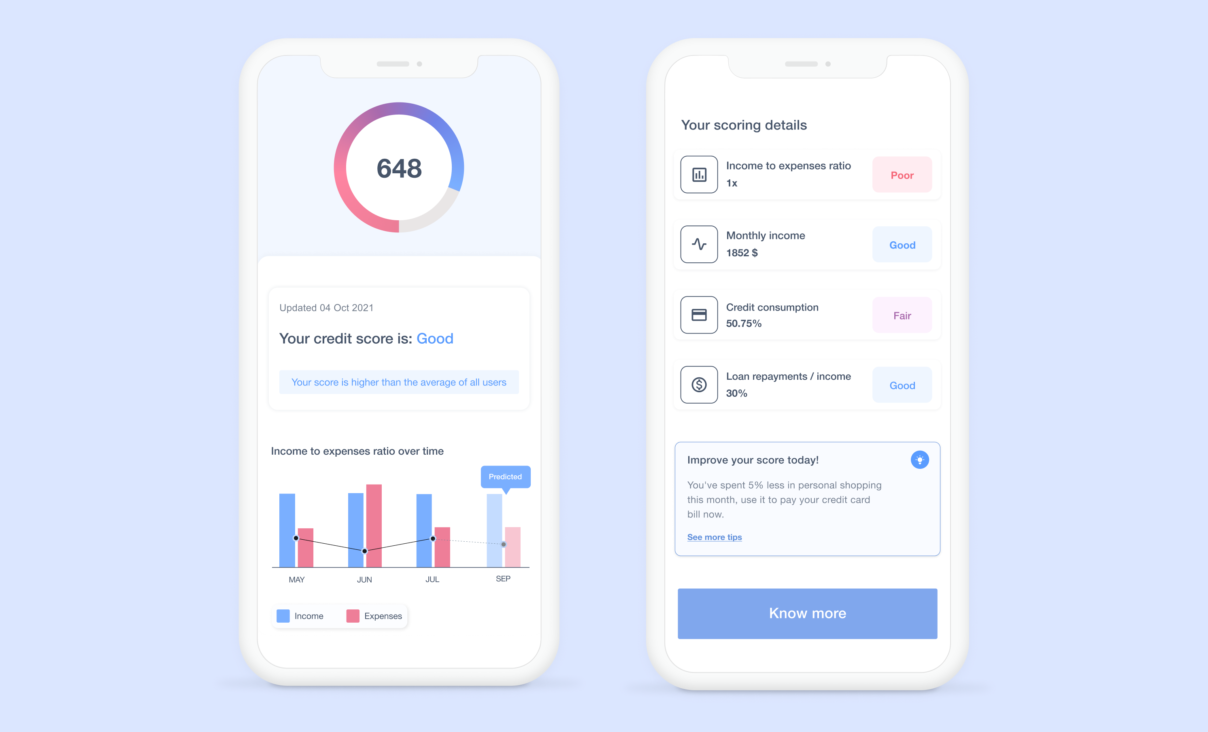

1. Tailor-made credit scoring

The traditional process used by lending companies to evaluate people's payment capacity who want to access credit involves credit reporting agencies. Normally, these provide a score according to the credit history that the applicant has generated with financial institutions over time.

This mode of evaluation has several limitations:

- The qualification criteria is not inclusive for people who mostly use debit cards or who are not comfortable financing their purchases with credit cards, even when their finances are stable.

- The information available at these credit bureaus is usually months behind the applicant's most current financial situation.

- This rating ignores spending habits, which can be key to a company's assessment of whether an applicant's risk profile meets its criteria.

With open banking, credit risk assessment models can be strengthened by taking advantage of transaction history in savings and checking accounts, analyzing the relationship between income and expenses to build a risk profile in seconds, and identifying indicators based on spending patterns found in bank transactions.

2. A more convenient credit card in an open market

For many people, their first credit card was issued by the same bank where they receive their salary. Some institutions even charge an annual fee for offering this service. However, it is common for users to be unaware of many of the benefits that are included in this annual fee.

Over time, underutilization of the benefits of a credit card in relation to the spending habits associated with it can cause consumers to stop using these products because they perceive little value for the annual fee, or simply because their current lifestyle is no longer compatible with their first card.

Open banking benefits these consumers because it opens the way for the creation of open marketplaces, where financial providers can build services that leverage their banking transaction history and analyze their consumption patterns to recommend the most suitable credit card for different lifestyles.

As more sources of consultation are enabled through open banking providers, the range of tailored services that can be offered through these marketplaces will also grow. The financial sector will essentially become smarter, enhancing the consumer experience and even exceeding end-user expectations.

3. A smarter line of credit

There are currently more than 50 digital banks (or neobanks) in Latin America, with Mexico being the current leading country, with 19 registered startups offering 100% digital banking services.

Most of these startups offer a credit card as their entry-level product. But given that they don't usually have visibility on their clients' credit history (which is guarded in large banking institutions), the process of contracting these services usually requires submitting account statements to prove a good payment capacity.

These institutions can use open banking to design products that are better adjusted to the consumption patterns or real financial situation of their prospects. And to offer them new lines of credit for which they were previously ineligible due to the lack of more complete credit history.

By supplementing their analysis with alternative sources of financial information, these companies can replace these traditional processes with instant verification of financial data. They can then create more engaging digital experiences, reduce the turnaround time for offering products to their customers, and personalize their offerings based on user activity with verified, real-time data.

The road ahead is promising

The opportunity for innovation in Latin America's financial sector is still huge. The region is home to more than 650 million people across 33 countries, who together form a mass of consumers increasingly demanding modern and more accessible financial services.

The promise of open banking is to reduce consumer friction in accessing financial services and to generate ever-greater demand. For the fintech industry, this reduction in barriers to entry will foster innovation in the sector, modernizing the current infrastructure and motivating the next financial innovators to build more convenient and efficient solutions that promote the region's prosperity.

And for traditional financial institutions, it provides an opportunity to reach customers who were previously out of reach. For example, adding complementary data sources to their scoring models to create more accurate risk models, as well as advancing the personalization of financial products so that they increasingly fit the real needs of their users.