To wrap up an awesome year for all the financial innovators working towards leveraging open finance in Latin America, we share our latest product updates and releases on three fronts: data enrichment, data aggregation, and our developers portal.

Data enrichment updates

This year we’ve worked hard to keep building the most powerful and complete set of out-of-the-box insights with two new enrichment products and major improvements.

Get an instant picture of your users’ monthly recurring expenses

Now, with Recurrent expenses, you can use Belvo API to get an overview of your users’ recurrent spending habits on subscription services such as Netflix or Spotify, as well as other cyclical payments including electricity bills, loans, and periodical transfers.

Understand your users’ risk profile

In addition, we’ve also released Risk insights (BETA), which provides a set of high-quality and easy-to-integrate metrics to assess customers’ risk profiles.

Lenders and financial innovators can easily integrate these insights into their credit scoring models and use them to optimize risk assessments processes, offer lower interest rates, get higher margins, and reach wider audiences.

Merchant identification for all!

We’ve opened our Merchant Identification field to all our clients. Now, any new transaction that your users make will be enriched with the merchant logo, name, and the URL to their website.

New data sources and coverage

We’re constantly expanding our range of products to make sure you have all the best open finance data available.

Investment portfolios

We’re thrilled to announce that our Investments Portfolios product is in open BETA! This is a whole new category of financial data that’s been added to our data aggregation solutions.

With our Investment Portfolios resource, you can quickly get key information about your users’ fixed and variable investment portfolios to analyze their long-term deposits as well as investment funds.

💡 Investment Portfolios is currently only supported for long-term deposits and investments funds in Brazil. We are working hard to add support for other types of investment products soon. For more information, check out our Investment Portfolios documentation.

New banking institution

Coverage is key – we know this. That’s why our team is constantly working on expanding the number of institutions we support to provide you with the best from the banking and gig institution worlds across Latin America. This month, we’re happy to announce:

- Itaucard (Brazil), a credit card product, joins the Belvo family of retail banking Institutions in brazil.

If you’d like to know more, check out the full list of our supported institutions.

Developers portal updates

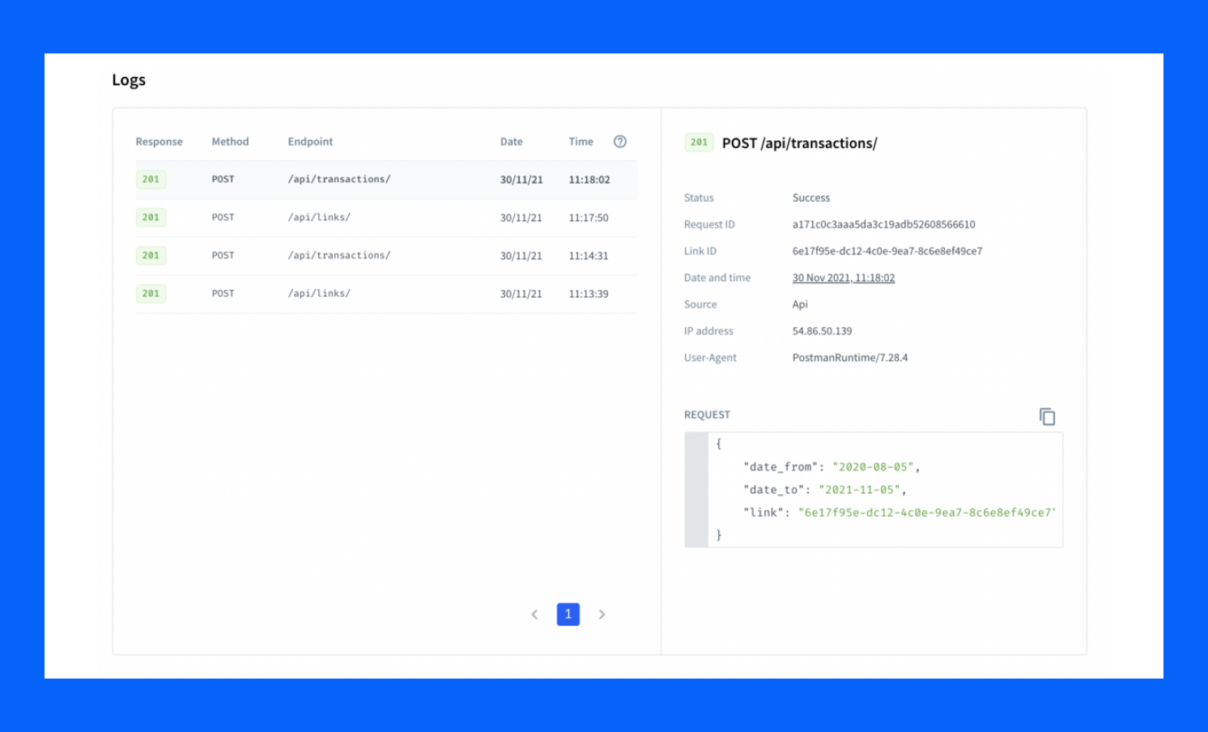

Revamped activity logs

Our activity logs had a major visual and functional facelift to debug faster than ever! Now you can:

- Enjoy better navigation with our redesigned table and side panel

- Get more detailed information for each request

- Work faster thanks to our paginated view

- Easily share request or response bodies to debug faster

Granular visibility with our documentation changelog

We know that documentation is important, and that we need to communicate our changes as clearly as possible to ensure your development goes smoothly. As such, we’ve recently started a documentation changelog in our DevPortal. Now, every two weeks, we’ll include a detailed list of the changes we make to our documentation and API.

If you have any wishes for next year, don’t hesitate to get in touch and if you want to join our team visit our careers page, we’re always looking to expand the team!

Greetings from the entire Belvo team 🚀