As 2021 comes to an end, we wanted to take a look back on what we’ve accomplished this year and share with you some of the things that will come in 2022.

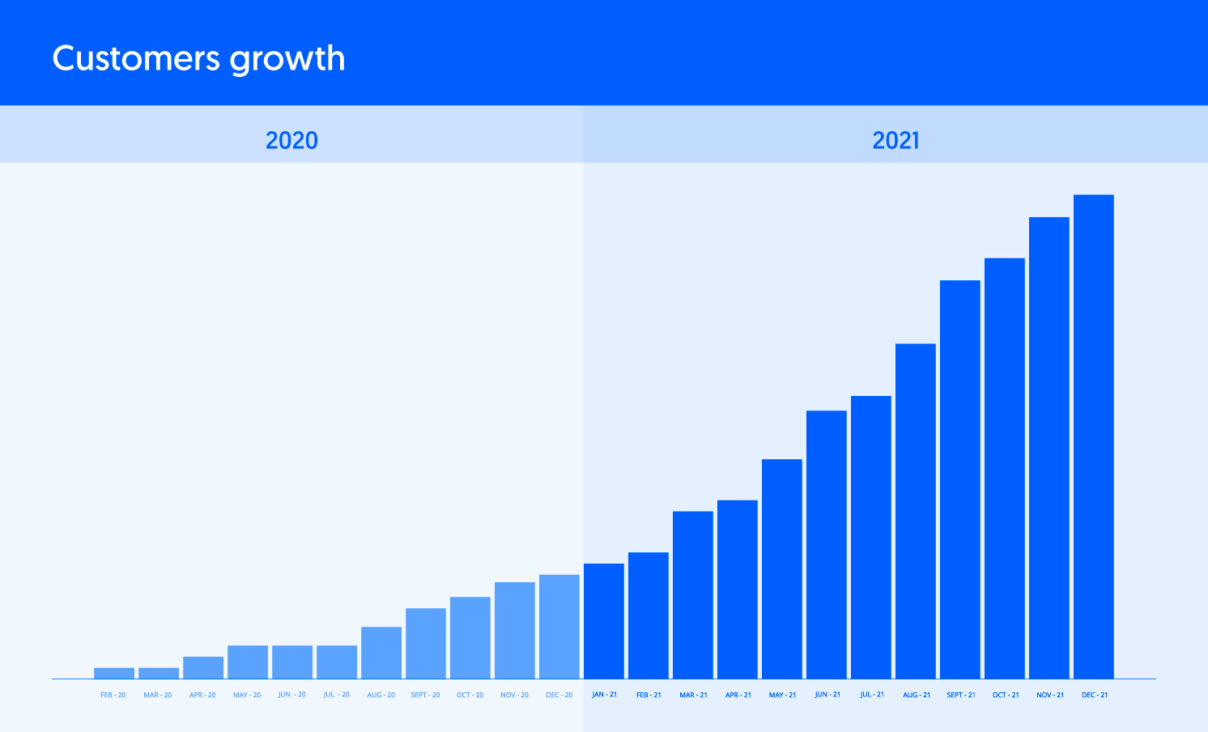

This year has been a turning point in terms of growth at Belvo. We founded the company in 2019 and officially launched it in January 2020. Since then, our team has grown to over 100 people, we provide connections with over 50 financial institutions through our API and work with close to 150 clients in Mexico, Brazil, and Colombia,

As we’ve built our product and team and grown as a company during our first two years, we’re now entering a new phase where scale, expansion, and collaboration with strategic partners are key to achieving our goals.

The usage of our API platform keeps growing exponentially and, as a result, every month hundreds of thousands of individuals and companies connect their financial data using Belvo. Thanks to this, they can access more inclusive, efficient, and empowering financial services, which brings us closer to our mission: to democratize access to financial services through tech and data.

After turning two years old in May 2021, this year we announced our $43m Series A funding round, which included participation from relevant investors such as Biz Stone, Twitter co-founder; Sebastián Mejía, co-founder and president of Rappi, and Harsh Sinha, CTO of Wise.

The round also included participation from Visa, with whom we also announced a strategic partnership this year to support the acceleration of open finance across the region.

Our work this year has also been recognized by relevant publications such as Forbes Mexico, which included us as one of the most promising companies of the year, and CB Insights, which mentioned Belvo within their Fintech 250, a list of the top fintech companies using technology to transform financial services.

Doubling down on security 🔐

During this year we’ve worked hard to expand our product portfolio with a particular focus on strengthening our enrichment capabilities as well as continue working on building the most secure and reliable solution to connect and interpret financial data in Latin America.

To that end, this year we’ve accomplished a major milestone: earning an ISO 27001 certification, the most rigorous global security standard for Information Security Management Systems. We started the certification process in March 2021 and concluded it in September 2021. This certification widened Belvo’s sales pipeline, gave us access to larger organizations and new markets.

Expanded enrichment products and coverage 📊

On the enrichment front, we’ve had two big product releases: Risk Insights, which provides a set of metrics to quickly assess and understand a customers’ risk profile based on transactional data; and Recurring Expenses, which allows companies to identify their end-users payments for subscription services. These are just the tip of the iceberg as we’ll continue to launch more products into 2022 that provide out-of-the-box insights for financial innovators.

We also launched Merchant ID to complement our Transaction categorization engine, a new feature that allows companies to easily extract the logo, URL, and name of the merchant of any transaction – extremely useful for any personal finance management application.

Our coverage of financial data sources now includes over 50 financial institutions which we added to our API this year.

Besides the new capabilities, this year we’ve also made improvements in our developers portal and documentation to make building with Belvo easier than ever thanks to excellent tools and new features. We’ve integrated our API reference directly in our developers portal so that developers test our API straight from the documentation.

A growing community around open finance 👭

2021 has been probably one of the wildest years for the fintech ecosystem in Latin America, reaching unprecedented heights in funding and countless new products and companies being born.

One of the most rewarding aspects of working at Belvo is to see how our clients grow thanks to us. This year we’ve been able to collaborate closely with many of them and share their success through case studies, including companies like Ferratum, Jeeves, Mobills, Monet, and Aplazo, to mention a few.

We’re proud to be part of this growing ecosystem and have been largely involved across relevant events and meet-ups this year. We celebrated our (first of many!) happy hour with clients, partners, and friends in Mexico; sponsored relevant conferences across the region such as Finnosummit in Mexico and B2B Finance Conference in Brazil, and attended some of the first in-person events that took place this year such as Lendit in Miami.

A global team with a shared culture 🥳

We started the year with 50 people on the team and we’re already 110! Back then, we already counted 12 different nationalities across all Belvoers, and now there are people on the team coming from over 20 different countries.

Having a highly diverse and global team as we do, we continue to bet on giving people the freedom to work from wherever suits best for them, whether that’s from home or from one of our offices in CDMX, São Paulo, and Barcelona. But this year we’ve also made it easier for everyone at Belvo to be able to spend time together and continue building a strong culture.

To make it possible, this year we launched a new perk: ‘work from any office’, which allows Belvoers to travel to one of our headquarters twice a year to meet and work with teammates across the world. Since we launched it back in September, already 16 people have used it to share fun moments together and, in some cases, to meet each other in person for the first time!

Looking at 2022 🚀

This has been a great year for us, a great year for open finance, and a great year for Latin America. But we know this is really just the beginning of a long journey and we’ve got big plans for 2022 to continue pushing open finance forward in the region.

This year we’ve been working to prepare the launch of our payment initiation solution in Brazil and Mexico, which will be live very soon. By adding these capabilities to our API, moving money in and out of bank accounts will be as simple as running a few lines of code. We’ll also launch new enrichment products to empower our clients to extract even more out-of-the-box value from financial data.

While our focus in 2022 will remain in Mexico, Brazil, and Colombia –where we will significantly increase our institution coverage–, we’ll also continue exploring opportunities to expand Belvo to new countries in Latin America.

If you have any wishes for next year, don’t hesitate to get in contact with us and if you want to join our team visit our careers page. We’ll be hiring +150 people in 2022 across locations, roles, and seniority levels. And we’re creating one of the best cross-functional and mission-driven teams in Latin America. We’d love to hear from you and help you achieve your goals in 2022 and beyond.

All the best from Pablo, Uri, and the entire Belvo team.