Monet and Belvo partnered to explore the use of open finance data and machine learning techniques, successfully building a new credit scoring model.

In the world of finance, credit plays a fundamental role. It allows people to access loans and other financial services, but unfortunately, many people in Latin America lack access to these opportunities due to a lack of credit history or an expensive traditional financial system. It is in this context that Monet, a fintech specializing in small loans in Colombia, has embarked on a mission to develop inclusive financial services based on open finance.

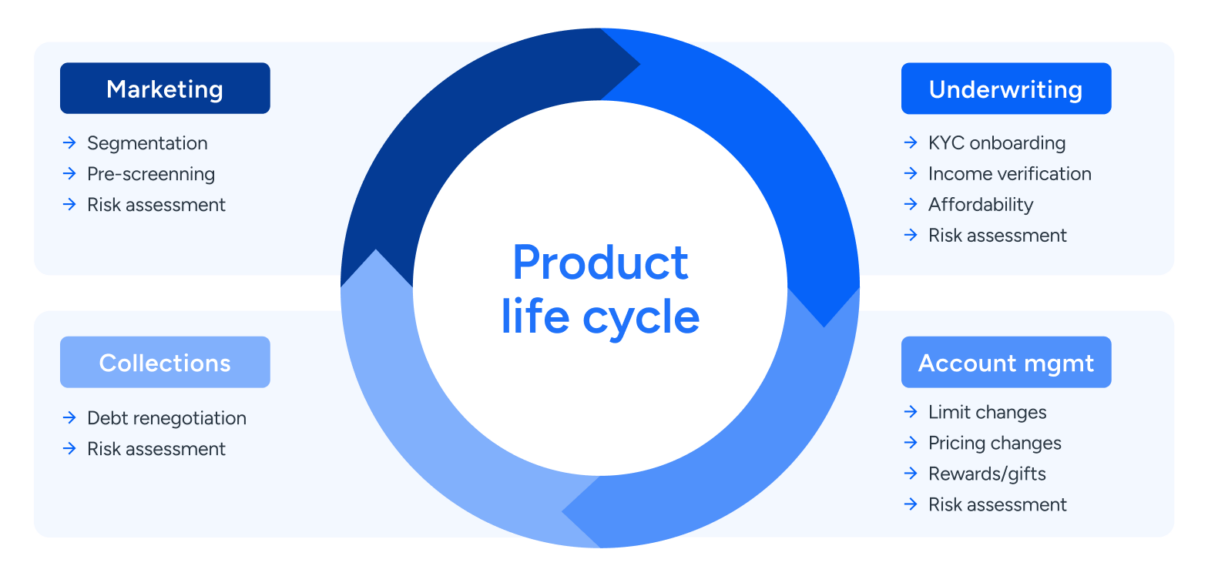

Monet has been closely collaborating with Belvo to explore the potential of open finance data in the field of credit scoring. Credit scoring is a tool used by financial institutions to assess an individual’s creditworthiness and determine eligibility for a loan. Traditionally, this process has relied on limited information such as credit history and credit bureau data. However, Monet decided to adopt an innovative approach by using alternative data from open finance sources.

To this end, it has worked with Belvo in the application of machine learning techniques on the data extracted from open finance. Specifically, supervised learning techniques were employed using the XGBoost machine learning classifier.

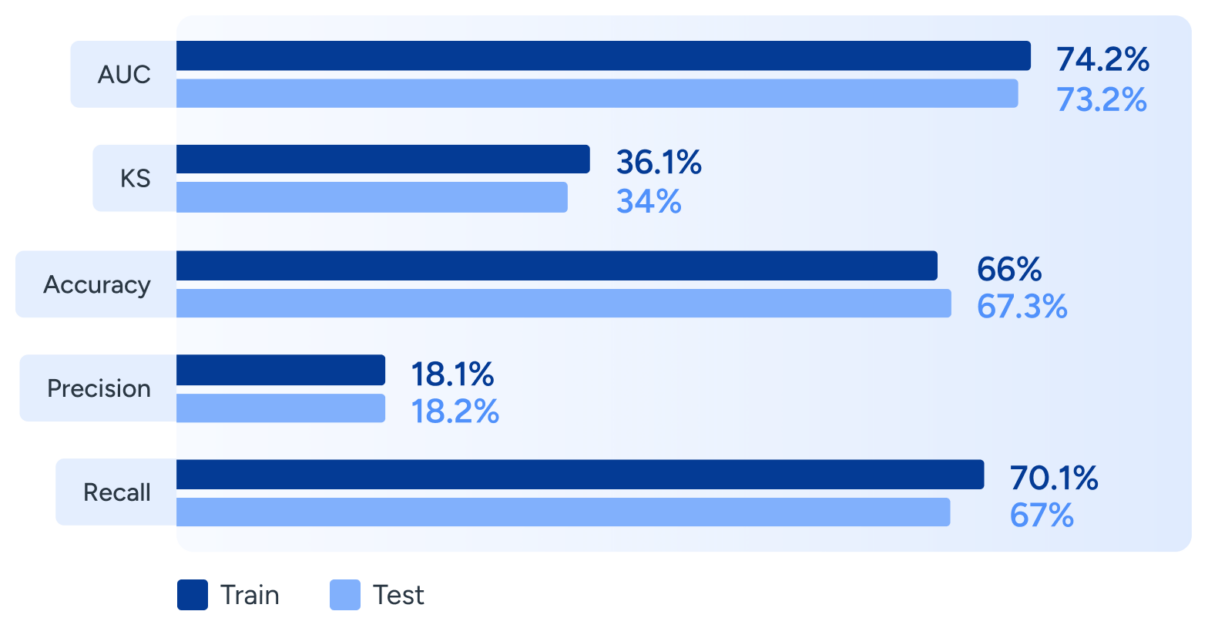

The results of the project were very positive. From a classification perspective, the scoring model showed successful performance, with an AUC of 73% and a KS of 34% in the test sample. These metrics are solid indicators of the model’s ability to predict individuals’ creditworthiness.

From an economic standpoint, the results were also encouraging, as the implementation of these probabilistic models is estimated to allow Monet to save more than 20% on default loans.

The partnership between Monet and Belvo has demonstrated the power of open finance data and machine learning techniques in the field of credit scoring. Thanks to the application of probabilistic models, Monet has successfully built a new credit score that offers a more inclusive and accurate assessment of individuals’ creditworthiness. This represents a significant step towards the development of accessible and fair financial services for underserved workers in Latin America.

To understand all the technical details behind this project and how these results were obtained, download the full case study here: