Risk insights: empower credit scoring models

A set of high-quality metrics to better understand users’ risk profile

![]()

Belvo Team

5 benefits of open banking for consumers

Consumers will have full control over how their financial data.

![]()

Julio Orozco

Jeeves and its model that helps entrepreneurs grow

Jeeves is driving a new credit and financing model.

![]()

Julio Orozco

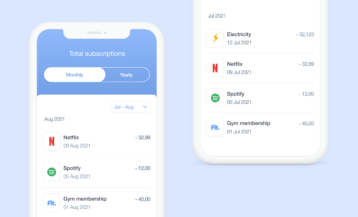

Identify regular payments for subscription services

Like Netflix, the gym, or electricity bills.

![]()

Clem Le Theo

How Open Banking is facilitating the proptech sector

APIs are helping eliminate inefficiencies in the real state sector.

![]()

Belvo Team

Belvo and Visa sign strategic partnership

To support the acceleration of open finance in Latin America.

![]()

Belvo Team

How to avoid unconscious bias in hiring processes

There’s a lot of invisible work put into managing a hiring process.

![]()

Karla Romero

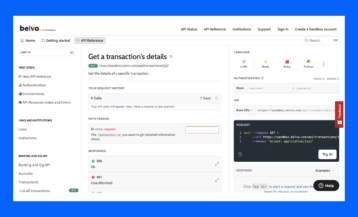

Introducing our new API Reference in our developers portal

Test our API straight from the documentation.

![]()

Belvo Team

Belvo is now 100-strong!

These are some figures about how the team has grown.

![]()

Pablo Viguera

Belvo achieves ISO 27001 certification

Doubling down on its commitment to security.

![]()

Belvo Team

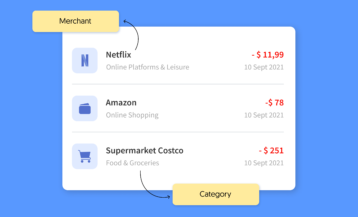

Identify the source of transactions with Belvo's merchant ID

With this new beta you can extract the logo, URL, and name of the merchant.

![]()

Belvo Team

Work from any office and other perks at Belvo

Find out more about our benefits package.

![]()

Aurora Lastres