In this post, we cover what are the key differentiating factors that have helped Belvo become the main Open Finance provider in Latin America.

When we started Belvo back in May 2019 we had a clear goal in mind: to help businesses in Latin America access financial information from their users through an API. In order to achieve this, we knew we had to build an easy-to-integrate platform that could help financial service providers to easily link their solutions with users’ accounts through a great and successful user experience. And we knew this was a challenging mission.

Less than a year and a half later, Belvo is the largest, fastest, and more robust Open Finance platform in Latin America. And the way we’ve managed to get this far in record time has been by becoming obsessed with a set of key differentiating factors that are now the core components of our platform. This is how we’ve done it:

Widest coverage

The first thing we knew we needed to address was the reach of our platform. We wanted to build an inclusive solution that could enable the vast majority of the population in the region to link their accounts to financial apps. This meant that our priority was including the biggest possible number of institutions into our platform so that, no matter where users’ financial data is stored, companies can access it safely through Belvo.

We have been launching new integrations non-stop since July 2019 and we have now 40 institutions available, making Belvo the largest Open Finance platform in Latin America. And not just that: we are the only ones covering more than 90% of all financial institutions in the three major fintech markets: Brazil, Mexico, and Colombia, offering access to both personal and business bank accounts.

Fastest response time

As a user, you don’t want to wait for minutes until an app gives you a response. This is true for some of the most popular apps in the market, and also one of the main issues that Open Banking faces. When you’re connecting your bank account to an app, the last thing you want is uncertainty and long waiting times.

We knew from the beginning that this is key for customer retention. And that’s why we built our technology based on understanding that connection time was the most crucial aspect of the user experience. For this reason, we removed absolutely all the unnecessary steps in the user journey, making Belvo the fastest platform to connect accounts in the market.

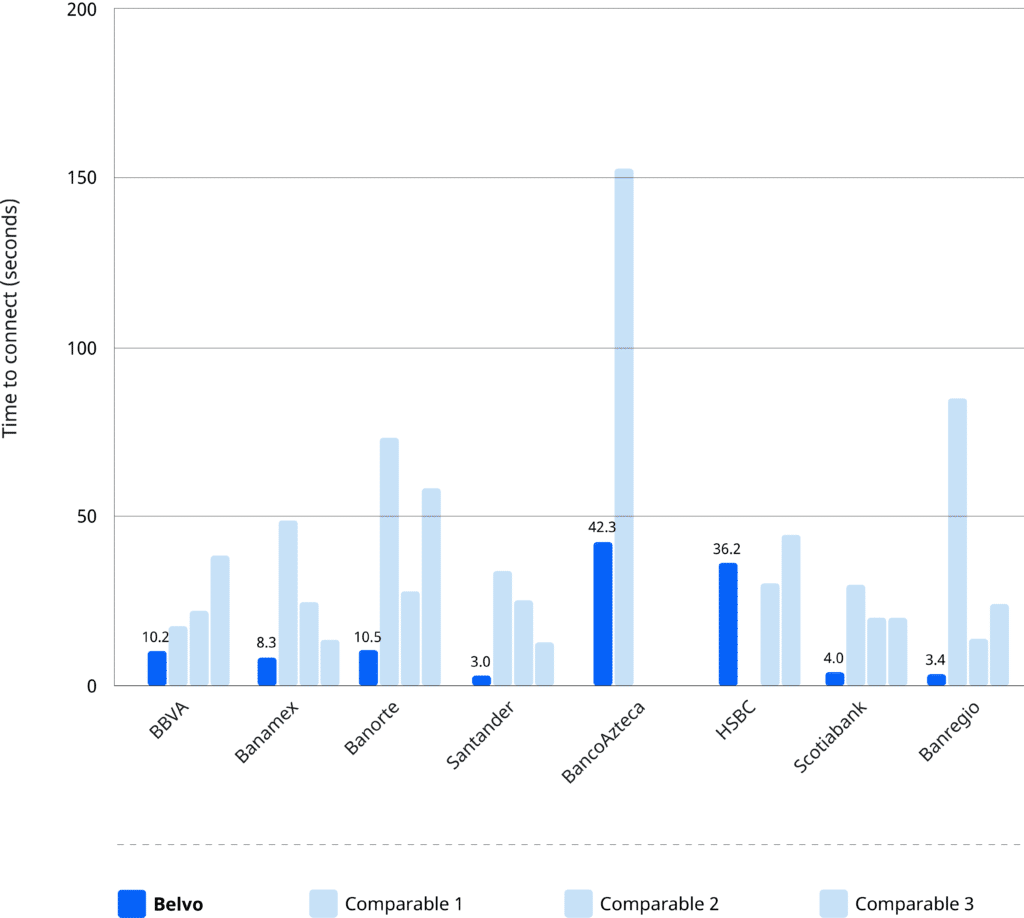

Connection time with Mexico’s eight top banking institutions

When it comes to connection speed, our tests show that Belvo outperforms the rest of the API providers in the market, connecting to institutions in just a few seconds.

In fact, Belvo is actually faster in accessing your bank account than the online banking platform itself!

Highest success rate

Another one of our core principles when building our platform is success rate. This metric tells us how many times end customers finish the process of linking their accounts using our technology and how many fail or give up.

The entire team at Belvo is obsessed with this indicator. We constantly track it –it’s the first thing we do in the morning– because we know that our coverage and speed would mean nothing without a proper success rate. Mexico, Brazil, and Colombia have posed very interesting challenges in this regard because we had to consider all the potential scenarios and obstacles that customers can face when connecting accounts –within different institutions with completely different requirements–, and build specific solutions for each of them.

This is why we have a part of the team exclusively dedicated to improving the success rate of every integration on a daily basis. We have not only built better integrations but also extremely detailed user flows that guide the customers to successfully link their accounts in an easy way, in every possible situation.

Multiple data sources

A key differentiating factor of Belvo’s platform is the flexibility it offers when it comes to adding new data sources to provide a more complete picture of the financial activity of an individual or a business.

We realized early on that banking data wouldn’t be enough in Latin America, a place where 50% of the population lack access to traditional financial services. Integrating new data sources such as tax data allows our clients to better understand the financial needs of their users, enabling the development of new, more tailored, and relevant services for them.

Developer centric

When a company is thinking about adding Open Finance data to improve its services, the journey can be long and difficult to follow. It requires a lot more than implementing a simple API: you need to build an entire flow that starts with the end-users linking their accounts, reading this information, and processing it. But then continues with analyzing this data in order to trigger real actions for the customer, such as using transactional data to approve a loan or providing insights into their daily finances by identifying in which categories they spend more money.

This is why, at Belvo, we have created a comprehensive set of resources to take care of the entire end-to-end process for our developers:

- We provide a front-end fully customizable widget that handles the entire login process for the client and its end-users.

- Our documentation, libraries, and use case examples reduce the integration time to the bare minimum (another of our key metrics).

- Companies have full access to our sandbox environment to test without the need for real accounts.

- Our dashboard provides all the necessary information to set up an integration with Belvo, track the activity, and check the status of API calls. And in case you are in need of help, we have a dedicated Slack channel for all our clients where the entire team is ready to help with the integration.

- We have launched a proprietary transaction categorization service to simplify the post-processing the data requires and to help our clients make data-driven decisions in a matter of seconds.

End-user centric

Our clients’ customers are our customers too. This is why we constantly analyze their behavior to improve the guidance we need to give them when linking their accounts in every possible situation.

For instance, depending on the client we are working for, the needs of their customers will be totally different: a lender might not need the same type of information from a user as a digital bank, or a tool to manage employees’ expenses. Belvo’s widget is the only one in the market that is fully customizable for each client and all the possible use cases they can require, which improves the awareness of the user.

On top of that, we automatically handle all the potential scenarios that users can face when connecting their accounts to different institutions. And this is not simple at all. For instance, some banks might ask customers to enter a username, a password, and a PIN. While others might require a physical token to enter their account, or even scanning a QR code.

The combinations are endless. But all of them are covered by Belvo. We’ve explored every possible combination of factors, including every use case and how they vary from institution to institution, and we have had to adapt our platform to each one of them, so our clients don’t even have to think about it.

All of that, with the best security

“Security should always be a priority, before it is too late” is part of our mantra. Belvo not only complies with the highest certification standards of financial security by encrypting all sensitive data or dividing the different development environments but also performs regular penetration tests to ensure the maximum security of the platform.

We are the only provider with an infrastructure and security team that ensures the scalability and protection of our clients.

This is only the beginning

2020 was a tremendous year for us, and in 2021 we will keep bringing many exciting updates for our clients. Starting with the release of the first endpoints of our enrichment solution, we’ll keep adding intelligence to our platform and building new solutions that will enable a myriad of use cases in Latin America, such as instant bank-to-bank payments.

This year we will keep working relentlessly to power the next generation of financial services in Latin America by enabling more inclusive, efficient, and empowering offerings through tech and data. And most importantly: we will keep having fun while doing it.

Our team is growing fast, if you want to join us, take a look at some of the roles we’re currently looking for.