Risk insights: empower credit scoring models

A set of high-quality metrics to better understand users’ risk profile

![]()

Belvo Team

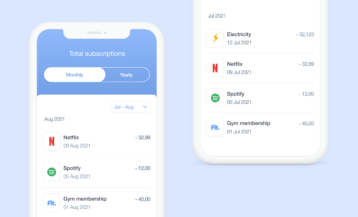

Identify regular payments for subscription services

Like Netflix, the gym, or electricity bills.

![]()

Clem Le Theo

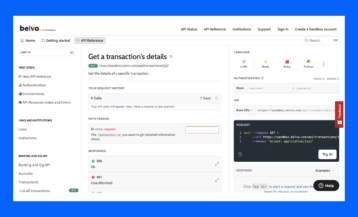

Introducing our new API Reference in our developers portal

Test our API straight from the documentation.

![]()

Belvo Team

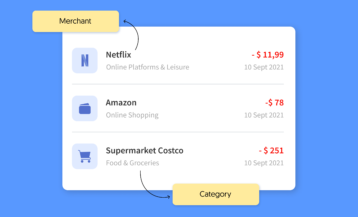

Identify the source of transactions with Belvo's merchant ID

With this new beta you can extract the logo, URL, and name of the merchant.

![]()

Belvo Team

How to drive conversion in open finance

UX principles to improve your user journey with Belvo.

![]()

Belvo Team

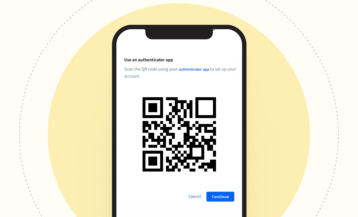

Introducing two-factor authentication in our dashboard

To ensure that your account is as secure as possible.

![]()

Belvo Team

More powerful and accurate income verification

We are bringing more accuracy, intelligence, and metrics to this product.

![]()

Belvo Team

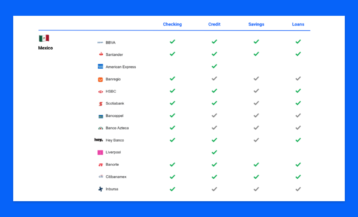

Expanding our banking coverage with credit cards and loans

Access data from credit card and loans and Uber Eats.

![]()

Belvo Team

Introducing our new institutions status page

Developers can now receive automated alerts about our connections.

![]()

Belvo Team

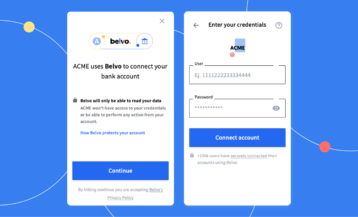

Belvo Connect Widget: how does it work?

The easiest way to connect bank accounts with your app.

![]()

Miguel Domínguez

Providing a clean separation of environments

So you can test your product with real data before going into production.

![]()

Isabel Cabrero

Open Banking, the perfect ally to improve credit scoring

How Open Banking helps building stronger risk models.

![]()

Julio Orozco

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits