Enrichment

Enrichment products use advanced analytics and artificial intelligence models to provide out-of-the-box insights based on customers’ transactional data.

How Brazilian bank BS2 uses Belvo to improve credit analysis

Belvo is helping the bank improve their risk models to reach new customers.

![]()

Camila Faria

When data science meets open banking APIs

Enrichment products provide out-of-the-box insights.

![]()

Belvo Team

Risk insights: empower credit scoring models

A set of high-quality metrics to better understand users’ risk profile

![]()

Belvo Team

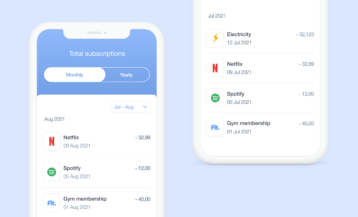

Identify regular payments for subscription services

Like Netflix, the gym, or electricity bills.

![]()

Clem Le Theo

Data categorization & open banking: how does it work?

We've trained our categorization engine with millions of transactions.

![]()

Jordi Soler

More powerful and accurate income verification

We are bringing more accuracy, intelligence, and metrics to this product.

![]()

Belvo Team

Open Banking, the perfect ally to improve credit scoring

How Open Banking helps building stronger risk models.

![]()

Julio Orozco

How to speed-up underwriting with Open Banking

Thanks to an automatized access to banking data.

![]()

Belvo Team

Helping credit providers verify their customers' income

Our first data enrichment solution.

![]()

Belvo Team