This article was originally published in the bi-monthly column around Open Banking and the fintech universe by Albert Morales, Belvo’s General Manager in Brazil, in Spacemoney.

A new financial ecosystem focused on digital services is progressively consolidating in Brazil. Digitalization is growing at a fast pace and those who do not adapt and innovate will certainly miss out on all the opportunities this situation has to offer. Due to the covid-19 pandemic, we witnessed in a few weeks a digital transformation that would otherwise take several years to happen, with the Brazilian population using more digital services every day.

The financial industry is consequently affected by this scenario. According to the Brazilian Association of Credit Cards and Services Companies, contactless payments in the country grew 330% in a year. From digital wallets and social media payments to platforms targeting gig economy workers, financial services are no longer restricted to banks and are increasingly accessible to the general population.

And behind all the new disruptive products that are now emerging, we find in the gears the work of fintech startups that quietly provide the infrastructure necessary for the most innovative financial solutions to get off the ground and become a reality. Playing the role of enablers, this niche ranges from fraud and authentication tools to Open Banking APIs.

Even without as much visibility and acting behind the scenes, these fintechs have the potential to make a big impact by democratizing financial technologies in Brazil and allowing more companies to offer financial services to the population.

Promoting disruption vs. enabling

The role of fintechs working behind the scenes is not about disruption itself, but about providing a solid foundation for other companies to improve their services or offer new solutions.

It’s not just about creating a whole new market or breaking up a traditional institution. These services enable the renewal of old processes and help legacy financial institutions like the big banks – which have been trying to meet the needs of the market for years–, to improve their services.

Thanks to the Brazilian Central Bank’s regulations around Open Banking, we are now seeing the perfect scenario for the development of enabling technology providers that work behind the scenes to offer access to financial data. But also the frontline fintech companies focused on solving users’ problems.

It is obviously a huge opportunity for the creation of never-seen-before financial products that meet the specific needs of the Brazilian. However, traditional institutions can also use these new technologies to reinvent themselves, simplify processes, and promote a better user experience. The ultimate purpose here is not to completely undervalue the current financial/banking system or to diminish what has been done so far, but to connect the whole ecosystem and enhance what has already been done best by these institutions.

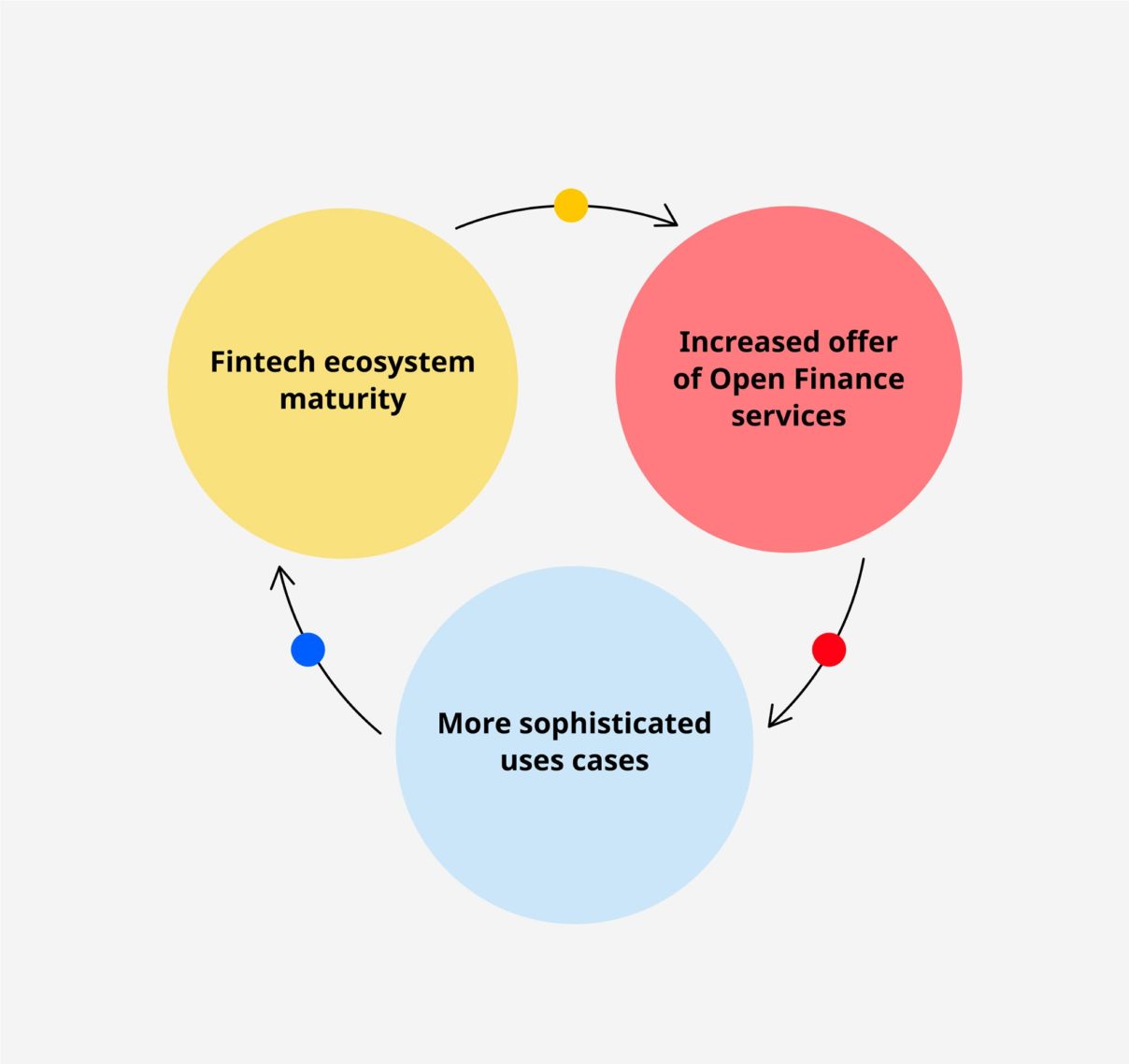

With all these changes, it will be possible to expand the financial industry and create more business opportunities in a way that vastly benefits society. And, as these opportunities grow and the platforms become more solid and robust, more sophisticated products will be offered, increasing the demand for new Open Finance solutions, forming a virtuous circle of innovation.