After a record-breaking year for fintech in Latin America, in 2022 we expect open banking and open finance to continue to spearhead financial innovation in the region.

It’s that time of the year when we all look back at what we accomplished, but also make big plans for the next 12 months. And these are gonna be 12 very exciting months for anyone working in the intersection of finance, technology, and data in Latin America.

At Belvo we follow closely how regulation is evolving in these countries, the trends that are emerging as a result of open banking adoption, the most successful use cases, as well as the success stories that these new models are enabling in the region. And we honestly can’t stress this enough: it’s exciting times for anyone building innovative financial solutions here and the space to grow just keeps expanding.

Looking at the year ahead, these are some of the things that we at Belvo believe will gain more traction as the open finance ecosystem becomes stronger in 2022:

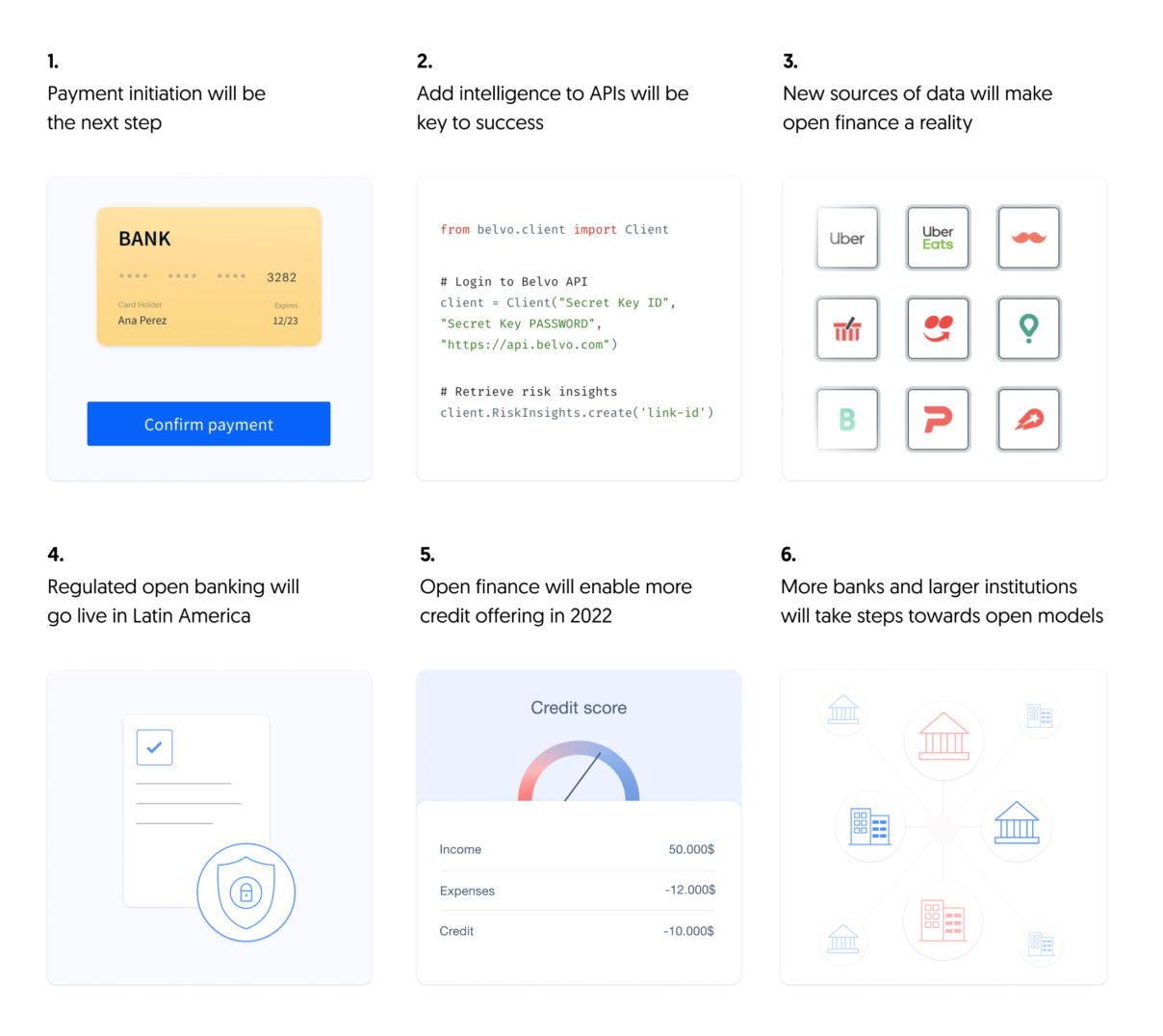

1. Payment initiation will be the next frontier 💸

Payment initiation through open APIs will allow moving money in and out of bank accounts to be as simple as running a few lines of code. We will likely start seeing these types of solutions coming out this year, enabling the growing number of neobanks, personal finance management apps, and other financial innovators to provide seamless payment experiences to their users.

We’ve already seen this happening in other markets where open banking has been evolving for a long time like the UK and Europe. As Joshua Fernandes, Product Owner of Open Banking at Revolut, told us in one of our reports this year, one of the main benefits they got from open banking APIs was enabling a frictionless experience when transferring funds to Revolut from bank accounts.

This was something key to Revolut –as it is for most fintech players during the first stages like many are in Latin America now– when encouraging customers to hold money on the platform is essential to build trust, use it often to spend, and eventually even put their salaries there.

2. Adding intelligence to APIs will be key to success 📊

As more companies adopt open APIs to connect to financial data, this year we will also see an increase in the need for more enrichment products to empower companies to extract even more out-of-the-box value from financial data.

Things like effortlessly extracting credit scores from banking data, translating raw transactions into clean feeds of information, and providing customers with more ways to understand their financial behavior, will be easier than ever before as data analytics models become more available, richer, and accurate.

Being able to make decisions on top of enriched financial data will make a real difference for many types of businesses (such as accounting platforms, or PFMs) and these capabilities will keep improving and expanding as more consumers adopt open banking-related products and services.

3. New sources of data will make open finance a reality 📱

With a large base of the population in Latin America being unbanked or underbanked, open finance is an ideal model for Latin America, as it allows any financial data –no matter where it comes from–, to be shared with multiple parties to foster the development of new products and services.

This includes data coming from alternative sources like gig economy platforms fiscal authorities, insurance companies, or investment institutions. And we believe this year there will be new additions of alternative sources of data into the open finance ecosystem from platforms like wallets, fintech applications, neobanks, utility companies, or even cryptocurrency platforms.

We’ve said it before: Wherever bills are being paid, and money is changing hands, there’s data that can help describe people’s real financial lives. And this year this will become more tangible than ever before.

“As open banking progresses beyond the scope of retail banking data toward open finance broadly, more and more areas of consumer and enterprise financial services — from credit scoring and lending to tax and payroll — will undergo the same transformation being seen in retail banking and payments today”

CB Insights

4. Regulated open banking will go live in Latin America 🇧🇷

Brazil is entering this year in a fully regulated open banking model. Phase 4 began on December 2021 and is expected to run until 2022. The latest stage is marked by the beginning of “open finance” and will allow the exchange of data from investments, pensions, and foreign exchange services.

With this new regulatory framework going live, this year we’ll see financial institutions starting to open their data through APIs to allow third parties such as fintech companies to build richer consumer experiences. This will lead to new services and products flourishing in a fintech ecosystem that’s already ripe with opportunities.

This new phase will also highlight the need for the coexistence of regulated and unregulated models. Brazilian regulation requires all institutions regulated by the Central Bank to expose their APIs to allow the sharing of user data. However, not all financial data sources are regulated entities in Brazil, and therefore not all of them will be yet subject to regulation.

For all of those, partnering up with open finance API platforms will be key to accessing the financial data of both regulated and non-regulated institutions through a single integration.

“Regulatory tailwinds in select markets are helping build momentum for fintech products. Also, several startups […] are working to build infrastructure that should help bring more financial services to market”

TechCrunch

In other Latin American countries progress continues, just not at quite the same break-neck speed we see in Brazil. Be on the lookout for further announcements and updates to regulations from countries like Mexico and Colombia as the world starts to regain some semblance of normalcy following the pandemic.

5. Open finance will enable more and better credit offerings in 2022 🎯

Big changes aren’t just happening in Latin America, open banking is set to have a significant impact worldwide in 2022. The United Kingdom released an update on open banking, laying out the next steps for implementation and encouraging widespread adoption. Research from PWC and the Open Data Institute predicts that 64% of adults will adopt open banking by 2022.

UK credit providers are also a driving force in open banking and 55% are expected to implement it in the next year.

Looking at Latin America, open banking has the potential to drastically change the lending industry and boost alternative lending practices and providers. We believe in 2022 this could help small businesses but also larger institutions start providing new credit solutions by including alternative data sources into their current risk models.

6. More banks and larger institutions will take steps towards open banking 🏦

“Open banking tech is here to stay, as evidenced by a slew of major banking institutions directly partnering with data aggregators […], as well as old-guard financial institutions self-organizing to create their own data utilities“

CB Insights

Together with new regulatory progress, the ecosystem of open banking API providers is taking steps towards adopting increasingly homogeneous and stringent measures and security standards that offer consumers and companies the same level of assurance as to the traditional financial industry.

This will lead to more adoption from a broader spectrum of companies across Latin America in 2022 —including banks, other large financial institutions like credit card providers, as well as enterprises such as retailers and e-commerce platforms.

And what benefits await for those entering this space? According to Deloitte: “Open banking offers a “plug and play” model wherein financial institutions can offer a full range of services at lower operating costs, thereby increasing profits. Financial institutions can also increase penetration of products and services through effective data utilization.”

This will definitely be a year of growth and consolidation for open banking and open finance in Latin America. At Belvo, we will continue working to empower more financial innovators to build new products and services through technology and data.

If you want to learn more about what’s happening this year, download our latest report with the newest regulatory updates across the region: